Comprehensive accounting is more than just crunching numbers. It’s a holistic approach to managing a company’s financial health, covering everything from daily bookkeeping to strategic financial planning.

At My CPA Advisory and Accounting Partners, we understand the critical role comprehensive accounting plays in business success. This blog post will explore the key components of comprehensive accounting, its benefits for businesses, and how our tailored services can support your financial goals.

Comprehensive accounting encompasses several critical elements that form the foundation of effective financial management. This approach goes beyond basic number crunching to provide a holistic view of a company’s financial health.

Financial statement preparation stands as a cornerstone of comprehensive accounting. These statements (balance sheets, income statements, and cash flow statements) offer a clear snapshot of a business’s financial position. A review engagement, which includes primarily applying analytical procedures to financial data and making inquiries of company management, can provide valuable insights into a company’s financial health.

Tax planning and compliance represent another vital component of comprehensive accounting. The ever-changing landscape of tax laws presents a significant challenge for businesses. The Internal Revenue Service (IRS) reports that small businesses often overpay their taxes due to inadequate planning. Professional accounting services can help navigate these complexities, ensuring compliance while maximizing tax efficiency.

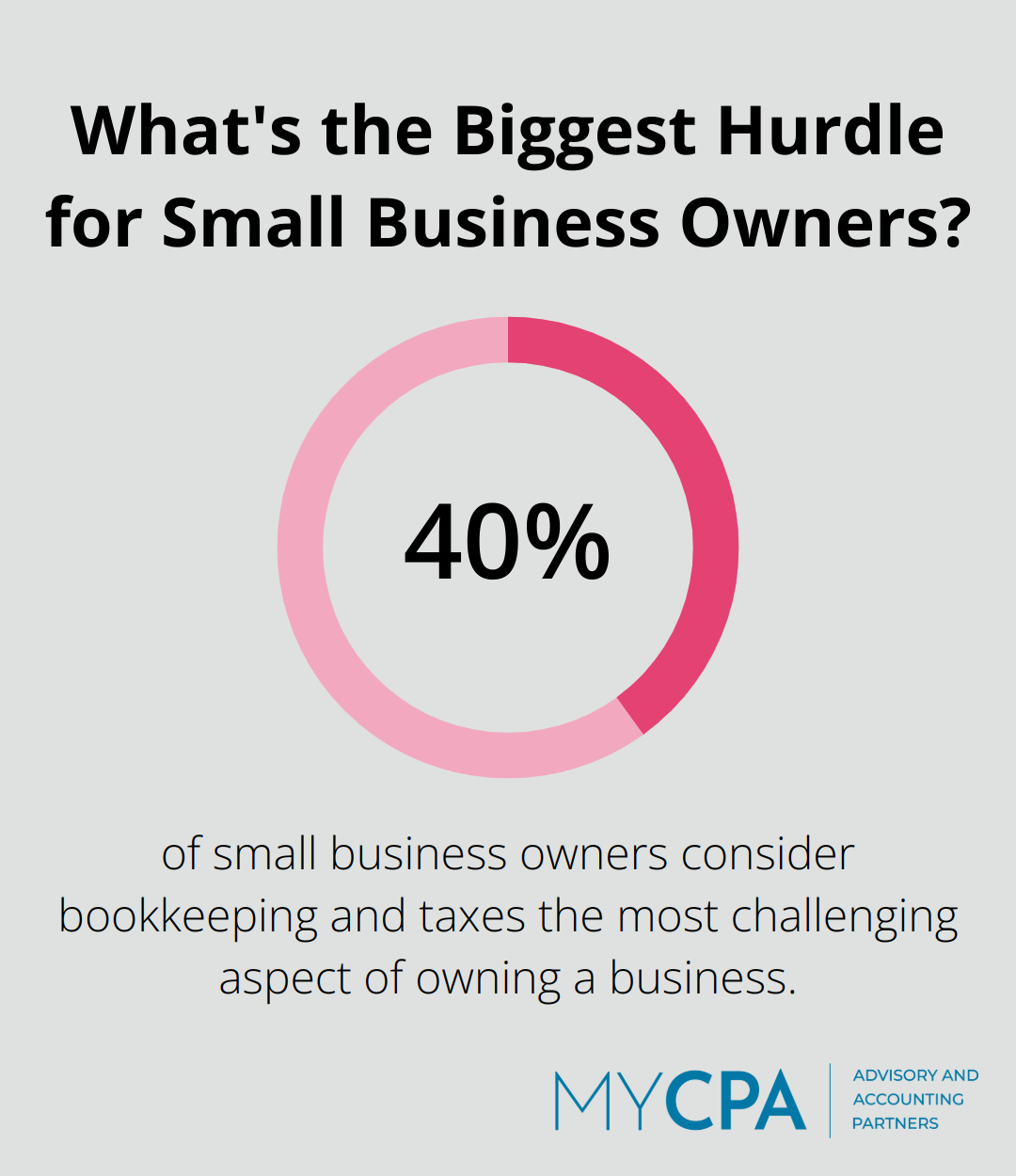

Bookkeeping and record keeping form the bedrock of all accounting functions. Without accurate and up-to-date books, generating reliable financial statements or making informed business decisions becomes impossible. A survey by Wasp Barcode Technologies found that 40% of small business owners consider bookkeeping and taxes the most challenging aspect of owning a business. This highlights the value of professional accounting services in alleviating this burden.

Strong internal controls play a critical role in preventing fraud and ensuring data accuracy. According to the 13th edition of the largest global study on occupational fraud, based on 1,921 real cases from 138 countries and territories, organizations with anti-fraud controls in place experience smaller fraud losses. Additionally, audit support (for both internal reviews and external audits) maintains transparency and credibility. Companies that conduct regular internal audits often find themselves better prepared for external audits, resulting in smoother and less stressful audit processes.

These key components work together to create a comprehensive accounting system that supports informed decision-making and drives business growth. As we move forward, we’ll explore the numerous benefits that this holistic approach brings to businesses of all sizes.

Comprehensive accounting offers numerous benefits that can significantly enhance your business operations and financial health. At My CPA Advisory and Accounting Partners, we’ve observed how this approach transforms businesses of all sizes.

Comprehensive accounting provides a clear, 360-degree view of your financial landscape. This clarity empowers you to make informed decisions quickly. CPAs must use technology to increase speed of analysis and enhance decision-making, as the demand for expanded attest services rises.

The complex world of financial regulations can overwhelm many business owners. Comprehensive accounting ensures you stay compliant and manage risks effectively. The IRS provides information on returns filed, taxes collected, enforcement, taxpayer assistance, and other selected activities in their annual report. This information can help businesses understand the importance of proper accounting practices.

Investing in comprehensive accounting saves you money in the long run. Professional accounting services can help streamline financial management tasks, potentially leading to time and cost savings for businesses.

The improved accuracy from professional accounting reduces costly errors. Strong financial controls can help prevent fraud and minimize related losses, which can significantly impact a company’s bottom line.

Comprehensive accounting provides the tools and insights necessary for effective financial planning and forecasting. With accurate, up-to-date financial information, businesses can create more realistic budgets, set achievable financial goals, and make informed decisions about future investments or expansions.

Comprehensive accounting isn’t just about number crunching – it provides you with the tools and insights to drive your business forward. In the next section, we’ll explore how My CPA Advisory and Accounting Partners delivers these comprehensive accounting services to meet your unique business needs.

At MyCPA Advisory and Accounting Partners, we recognize the uniqueness of each business. Our approach starts with a thorough understanding of your industry, goals, and challenges. This allows us to customize our services to your specific requirements. A startup might need more focus on cash flow management, while an established business could benefit from advanced tax planning strategies.

Our team consists of professionals with diverse backgrounds in accounting, tax, finance, and business advisory. This breadth of knowledge enables us to address complex financial issues from multiple perspectives. When assisting a client with tax planning, we consider not only immediate tax savings but also the impact on long-term business growth, cash flow, and potential exit strategies.

We take a proactive stance in managing your finances. Instead of simply reacting to financial events, we anticipate potential issues and opportunities. This forward-thinking approach helps you stay ahead of financial challenges and capitalize on growth opportunities. We regularly review your financial position and provide timely advice to support your business objectives.

MyCPA utilizes state-of-the-art accounting software and data analytics tools to streamline processes and provide real-time insights. Our proficiency with financial analysis software allows us to set up and manage your books efficiently. We also employ advanced forecasting tools to help you make data-driven decisions about your business’s future.

We believe in maintaining open lines of communication with our clients. Our team is always available to answer questions, provide updates, and discuss financial strategies. This ongoing support ensures that you’re never in the dark about your financial situation and can make informed decisions with confidence.

Comprehensive accounting transforms businesses by integrating various financial disciplines. It provides a solid foundation for informed decision-making and sustainable growth. This holistic approach enhances financial clarity, strengthens compliance, and improves risk management.

My CPA Advisory and Accounting Partners delivers these benefits through tailored comprehensive accounting services. Our team of experts brings knowledge across multiple financial disciplines to meet unique business needs. We use cutting-edge technology and maintain proactive communication to keep clients informed and empowered in their financial journey.

We invite you to partner with My CPA Advisory and Accounting Partners for your financial success. Our personalized approach can help you achieve tax efficiency, confident financial management, and peace of mind. Let us handle your finances while you focus on running and growing your business.

Privacy Policy | Terms & Conditions | Powered by Cajabra