Tax efficiency ratio is a critical metric for savvy investors looking to maximize their returns. At My CPA Advisory and Accounting Partners, we often see clients overlook this important aspect of their investment strategy.

This blog post will explore the ins and outs of tax efficiency ratio, its impact on your portfolio, and practical strategies to improve it. We’ll also discuss how to navigate the complex interplay between different types of investments and tax implications.

Tax efficiency ratio measures the percentage of an investment’s return retained after taxes. This metric provides investors with a clear picture of how taxes impact their overall returns. A higher ratio indicates greater tax efficiency, meaning more of the investment’s return remains in the investor’s pocket.

To calculate the tax efficiency ratio, investors divide the after-tax return by the pre-tax return. For example, if a fund has a 10% pre-tax return and an 8% after-tax return, its tax efficiency ratio would be 0.8 (or 80%). This simple calculation offers valuable insights into an investment’s tax impact.

Consider two funds: Fund A with a tax efficiency ratio of 0.9 and Fund B with a ratio of 0.7. Fund A proves more tax-efficient, retaining a larger portion of its returns after taxes. This difference can significantly affect long-term investment performance.

Understanding tax efficiency ratios can reshape investment strategies. To compute the TWR, you find the rate of return from each period and add one to it. Once you have gotten the rate of return for each period, you multiply all the numbers together and subtract one from the result.

While tax efficiency is important, it shouldn’t be the sole driver of investment decisions. Investors must balance tax considerations with other financial goals, risk tolerance, and overall portfolio strategy. Professional guidance can help navigate these complex decisions, ensuring a well-rounded approach to investment management.

As we move forward, we’ll explore the various factors that affect tax efficiency ratio and how investors can leverage this knowledge to optimize their portfolios.

Tax efficiency ratio varies based on different investment income types. Qualified dividends and long-term capital gains typically incur lower tax rates compared to ordinary income or short-term capital gains. The IRS (as of 2025) applies long-term capital gains tax rates of 0%, 15%, or 20%, depending on taxable income and filing status. This tax advantage makes stocks held for over a year more tax-efficient than frequently traded ones.

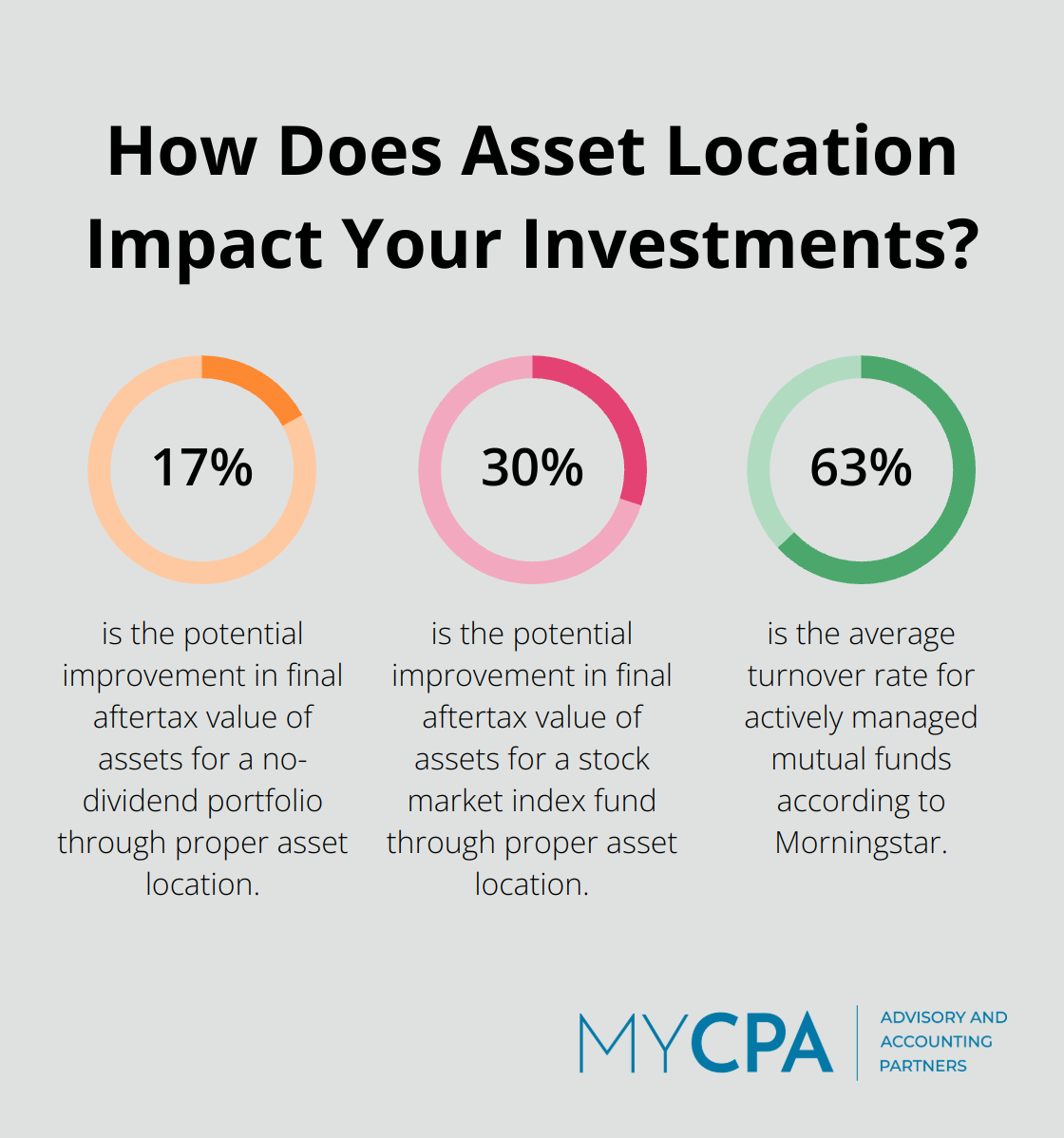

The placement of investments significantly affects tax efficiency ratio. Tax-advantaged accounts (401(k)s and IRAs) allow tax-deferred or tax-free growth. It’s often beneficial to place high-yield bonds or actively managed funds (which generate significant short-term capital gains) in these accounts. Conversely, tax-efficient investments like index funds or municipal bonds suit taxable accounts better. Proper asset location can improve the final aftertax value of assets by 17% for a no-dividend portfolio, 30% for a stock market index fund, and 44% for a high-dividend stock portfolio.

Tax-loss harvesting improves tax efficiency by selling investments at a loss to offset capital gains. The IRS permits investors to deduct up to $3,000 of net capital losses against ordinary income annually (with excess carried forward). However, investors must avoid wash sale rules, which prohibit claiming a loss on a security if the same or a similar security is purchased within 30 days before or after the sale.

The frequency of buying and selling within a portfolio affects its tax efficiency. High turnover rates often lead to more taxable events and potentially higher short-term capital gains taxes. Actively managed mutual funds have an average turnover rate of around 63%, while index funds have just 8% (according to Morningstar). This difference in turnover can result in a substantial variance in tax efficiency ratios between these two investment types.

Market conditions play a role in tax efficiency. In bull markets, funds may realize more capital gains, potentially leading to higher distributions and lower tax efficiency. Conversely, bear markets might offer more tax-loss harvesting opportunities. Investors should consider these cyclical effects when evaluating their portfolio’s tax efficiency over time.

Understanding these factors allows investors to make informed decisions about their portfolios. The next section will explore strategies to improve tax efficiency ratio, helping you keep more of your investment returns.

One of the most effective ways to improve tax efficiency is to fully utilize tax-advantaged accounts. In 2025, the combined employer and employee contribution limit for 401(k) plans is increasing to $70,000, up from $69,000 in 2024. These accounts allow your investments to grow tax-deferred or tax-free, depending on the account type.

For high-income earners, a backdoor Roth IRA strategy can be beneficial. This involves making non-deductible contributions to a traditional IRA and then converting it to a Roth IRA. While this strategy requires careful execution to avoid tax pitfalls, it can serve as a powerful tool for tax-efficient investing.

Adopting a buy-and-hold strategy can significantly improve your tax efficiency ratio. Long-term capital gains (from assets held for more than a year) are taxed at preferential rates of 0%, 15%, or 20%, depending on your income level. In contrast, short-term gains are taxed as ordinary income, which can be as high as 37% for high earners.

A study by Vanguard found that over a 15-year period, a buy-and-hold strategy in a taxable account outperformed a high-turnover strategy by an average of 1.8% annually, purely due to tax efficiency.

Municipal bonds can be an excellent choice for improving tax efficiency, especially for investors in high tax brackets. The interest from these bonds is typically exempt from federal taxes (and often from state and local taxes if you live in the issuing state).

For example, if you’re in the 35% federal tax bracket, a municipal bond yielding 3% would be equivalent to a taxable bond yielding 4.62% on an after-tax basis. This tax advantage can significantly boost your overall tax efficiency ratio.

Timing your capital gains and losses can be a powerful tool for improving tax efficiency. Tax-loss harvesting involves selling investments at a loss to offset capital gains. The IRS allows you to deduct up to $3,000 of net capital losses against ordinary income each year, with any excess carried forward to future years.

A study by Betterment found that tax-loss harvesting can add up to 0.77% to after-tax returns annually. However, it’s important to avoid wash sale rules, which prohibit claiming a loss on a security if you buy the same or a substantially identical security within 30 days before or after the sale.

Implementing these strategies requires careful planning and execution. Professional guidance can help you navigate complex tax rules and maximize your after-tax returns. My CPA Advisory and Accounting Partners specializes in creating personalized tax-efficient investment strategies tailored to your unique financial situation. Our expertise can help ensure that you keep more of what you earn.

Tax efficiency ratio provides valuable insights into how taxes impact portfolio performance. Investors can maximize returns by utilizing tax-advantaged accounts, embracing long-term strategies, and considering tax-exempt investments. Strategic tax-loss harvesting also plays a crucial role in boosting after-tax returns over time.

Navigating tax-efficient investing requires expertise. At My CPA Advisory and Accounting Partners, we specialize in creating personalized strategies tailored to unique financial situations. Our team offers comprehensive services to enhance financial health and minimize tax liabilities (including tax planning, accounting, and business advisory).

Don’t let taxes erode your investment gains. Let us help you build a more tax-efficient portfolio that aligns with your financial goals and risk tolerance. With our guidance, you can focus on growing your wealth for the future while optimizing your tax efficiency ratio.

Privacy Policy | Terms & Conditions | Powered by Cajabra