At My CPA Advisory and Accounting Partners, we often encounter businesses seeking alternatives to traditional accounting methods. The Other Comprehensive Basis of Accounting (OCBOA) offers a compelling option for many organizations.

This approach provides flexibility and simplicity, particularly for small businesses and specific industries. In this post, we’ll explore OCBOA’s definition, benefits, and implementation strategies to help you determine if it’s the right fit for your financial reporting needs.

OCBOA represents an alternative financial reporting framework that differs from Generally Accepted Accounting Principles (GAAP). OCBOA simplifies financial reporting for certain businesses and organizations. This method often proves more straightforward and less costly to implement than GAAP, making it attractive for smaller entities or those with specific reporting needs.

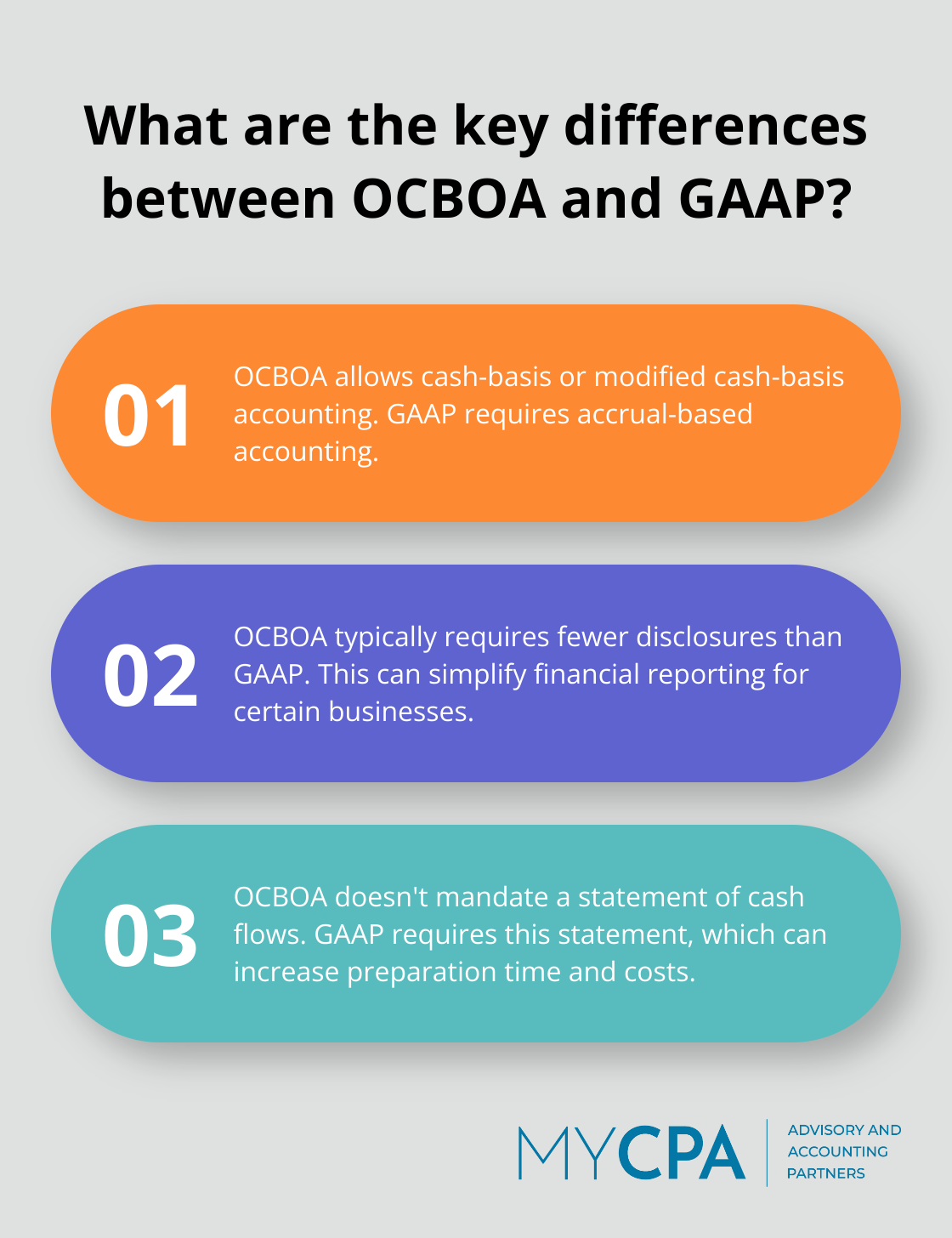

OCBOA diverges from GAAP in several important ways:

The most frequently used OCBOA methods include:

When deciding whether to adopt OCBOA, businesses should consider their stakeholders’ needs. For example, if a company seeks external financing, lenders might require GAAP-compliant statements. However, for many small businesses, OCBOA can provide sufficient financial insight without the complexity of GAAP.

It’s important to note that while OCBOA can simplify reporting, it’s not a universal solution. The choice between OCBOA and GAAP should involve careful consideration of factors like industry norms, growth plans, and regulatory requirements. Professional guidance often proves invaluable in making this decision and implementing the chosen method effectively.

As we move forward, let’s explore the benefits and limitations of OCBOA to help you determine if this accounting method aligns with your business needs.

OCBOA offers significant benefits to small businesses. The simplified reporting process aligns well with their operational needs. For example, a local bakery using cash-basis accounting under OCBOA can easily track daily sales and expenses without the complexity of accrual accounting. This straightforward approach provides clear insights into cash flow, which is often a primary concern for small business owners.

Certain industries benefit significantly from OCBOA. Non-profit organizations often use modified cash-basis accounting to better reflect their financial activities. This method allows them to easily track donations received and expenses paid, providing a clear picture of their financial health to donors and board members.

OCBOA typically requires less time and resources to implement and maintain compared to GAAP. These savings stem from reduced complexity in financial statement preparation and fewer required disclosures.

While OCBOA offers many benefits, it also has limitations. Businesses considering international expansion or seeking external investment might find OCBOA restrictive. GAAP-based statements are often preferred (or required) in these scenarios.

Moreover, the simplicity of OCBOA can sometimes lead to a less comprehensive financial picture. Cash-basis accounting, for instance, might not accurately reflect a company’s long-term financial obligations or future revenue from contracts.

The decision to use OCBOA should follow careful consideration of your business’s current needs and future goals. It’s advisable to consult with a financial professional (such as those at MyCPA Advisory and Accounting Partners) to determine if OCBOA aligns with your specific situation and to ensure proper implementation if you choose this path.

As we move forward, let’s explore the practical steps involved in implementing OCBOA in your business and how to choose the right method for your specific needs.

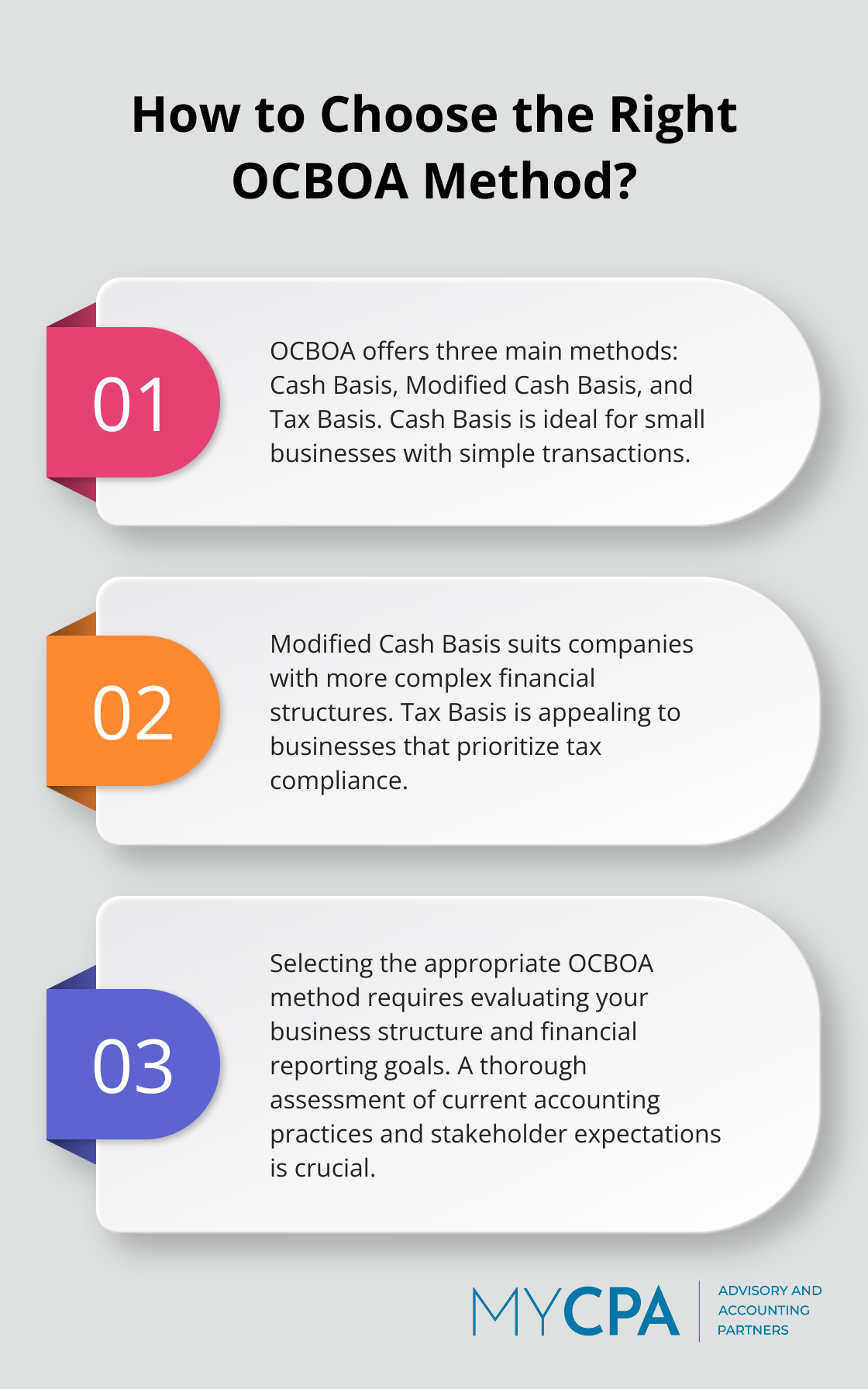

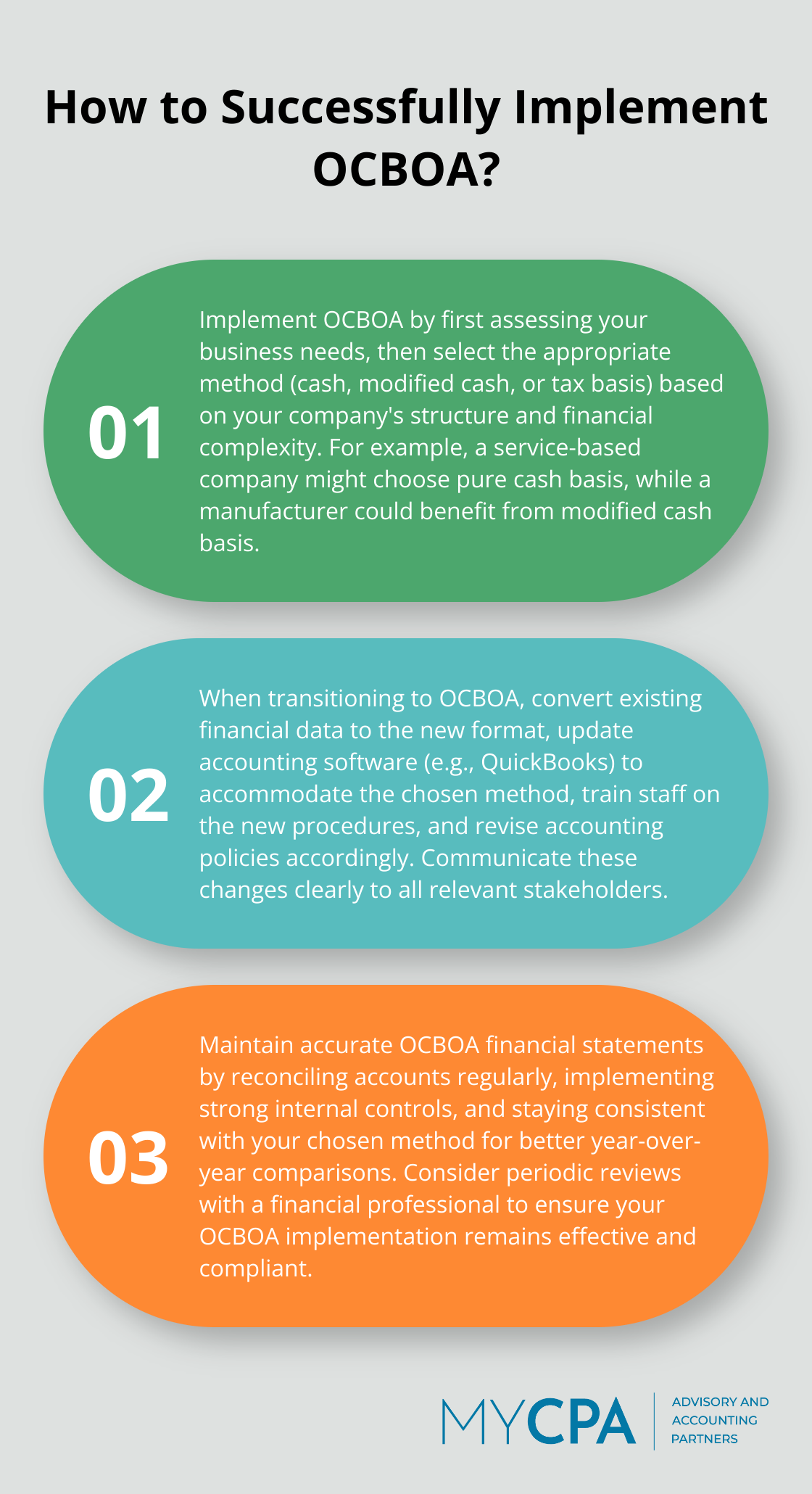

The implementation of Other Comprehensive Basis of Accounting (OCBOA) starts with a thorough evaluation of your business requirements. Review your current accounting practices and stakeholder expectations to determine if OCBOA aligns with your financial reporting goals.

Choose the OCBOA method that best suits your business structure:

For instance, a service-based company might find pure cash basis accounting sufficient, while a manufacturing firm with significant inventory and equipment could benefit from a modified cash basis approach (which accounts for depreciation).

Follow these key steps to transition to OCBOA:

To ensure accurate OCBOA financial statements:

Consider periodic reviews with a financial professional to ensure your OCBOA implementation remains effective and aligned with your business goals. MyCPA Advisory and Accounting Partners offers ongoing support to help businesses navigate OCBOA complexities and optimize their financial reporting processes.

Other Comprehensive Basis of Accounting (OCBOA) provides a viable alternative to GAAP for many businesses. It offers a simplified approach to financial reporting, which can lead to cost savings and easier implementation. The flexibility of OCBOA allows businesses to select a method that aligns with their operational needs, such as cash basis, modified cash basis, or tax basis accounting.

Companies must evaluate their current and future needs before adopting OCBOA. Factors to consider include growth plans, stakeholder expectations, and industry standards. While OCBOA can provide clear financial insights with less complexity, it may not suit companies seeking external investment or planning international expansion.

OCBOA implementation requires a thoughtful approach, from method selection to system updates and staff training. At My CPA Advisory and Accounting Partners, we help businesses navigate these decisions and implement appropriate accounting methods. Our team provides expert advice on OCBOA adoption, ensuring a smooth transition and ongoing compliance.

Privacy Policy | Terms & Conditions | Powered by Cajabra