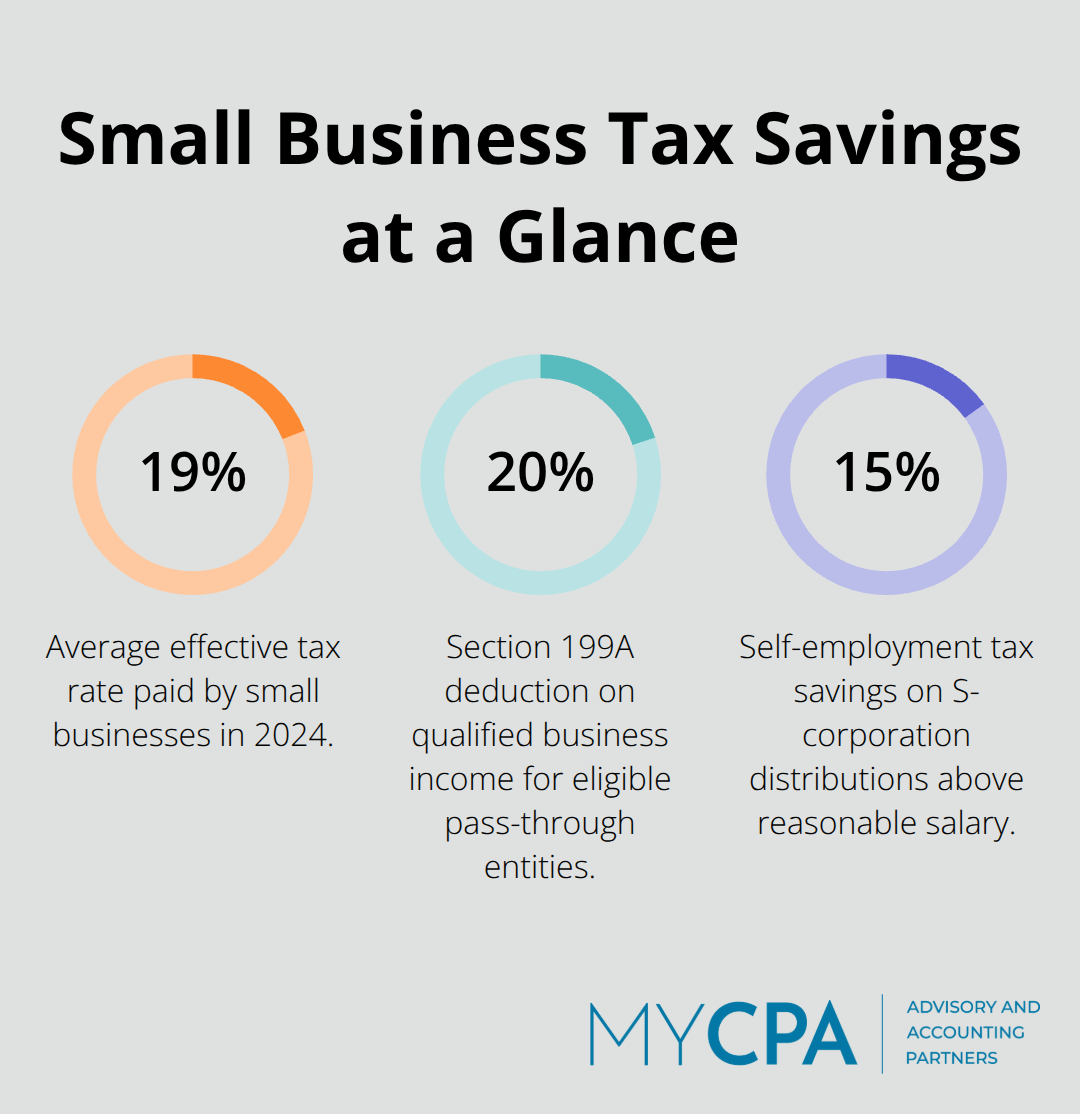

Small businesses paid an average effective tax rate of 19.8% in 2024, but smart planning can significantly reduce this burden. Tax saving for small business requires strategic thinking and proper timing throughout the year.

We at My CPA Advisory and Accounting Partners see countless opportunities that business owners miss simply because they wait until December to think about taxes. The key is implementing proven strategies before year-end deadlines hit.

The Section 199A deduction allows eligible small businesses to deduct 20% of their qualified business income, which saves thousands in taxes each year. Pass-through entities like sole proprietorships, partnerships, LLCs, and S-corporations can claim this deduction if their taxable income stays below $191,950 for single filers or $383,900 for married couples filing jointly in 2025. Service businesses face stricter rules once income exceeds these thresholds, with accounting, law, and consulting firms potentially losing the deduction entirely at higher income levels.

S-corporation election often provides the best outcome because it allows you to split income between salary and distributions, which keeps more income eligible for the 199A deduction. The IRS requires reasonable compensation as salary, but distributions above this amount qualify for the 20% deduction. Manufacturing and retail businesses have more flexibility than service providers, as they can claim the deduction even at higher income levels.

Smart business owners track their income throughout the year and make strategic decisions about equipment purchases or retirement contributions to stay within favorable income ranges. This proactive approach becomes even more important when you consider how equipment depreciation strategies can further optimize your tax position.

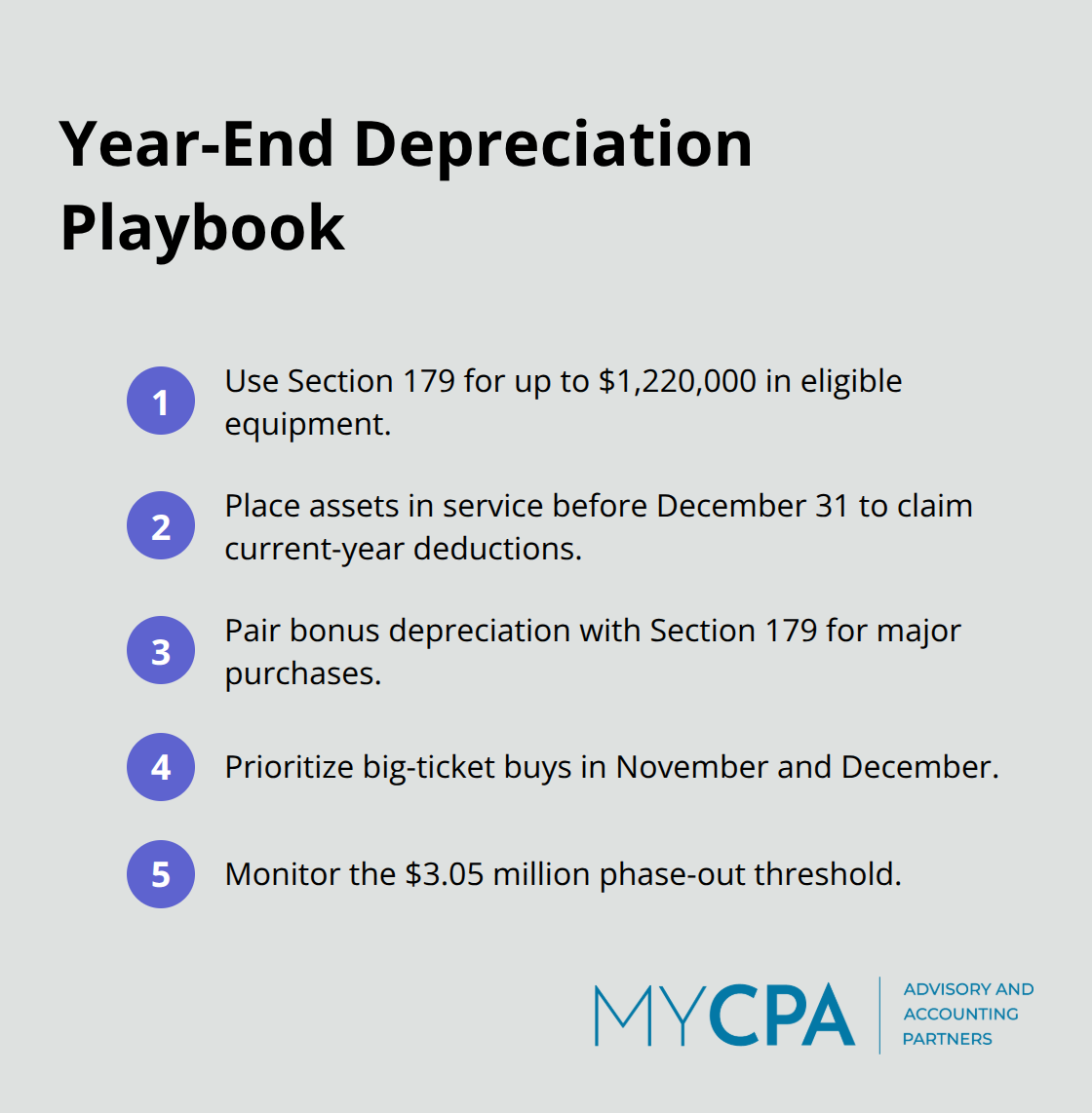

Section 179 deduction allows small businesses to write off up to $1,220,000 in equipment purchases for 2025, making it the most powerful immediate tax reduction tool available. This deduction applies to tangible property like computers, machinery, office furniture, and vehicles used more than 50% for business purposes according to IRS guidelines. The deduction phases out dollar-for-dollar once total equipment purchases exceed $3.05 million annually, which affects larger operations but rarely impacts typical small businesses. Smart business owners purchase equipment before December 31 to claim the full deduction in the current tax year, rather than spread depreciation over multiple years.

Bonus depreciation provides first-year deduction benefits for assets in 2025, which works alongside Section 179 to allow businesses to deduct costs of major purchases. This benefit applies to manufacturing equipment, software, and certain building improvements, creating substantial tax savings for operations. The timing strategy requires assets to be in service before year-end, which means delivery and setup must occur before December 31 to claim current-year benefits. Businesses with strong profit years should prioritize equipment purchases in November and December to maximize immediate tax relief.

Your business structure choice directly impacts how these depreciation benefits work with other tax strategies, particularly when you consider the self-employment tax implications of different entity types.

S-corporation election eliminates self-employment tax on business distributions, which saves owners 15.3% on income above reasonable salary requirements. Single-member LLCs and sole proprietorships pay self-employment tax on all business profits, but S-corp owners only pay this tax on their W-2 wages. A business owner who earns $100,000 annually saves approximately $7,650 in self-employment taxes when they elect S-corp status and take $60,000 as salary plus $40,000 as distributions. The IRS requires reasonable compensation based on industry standards, but distributions above this amount avoid both self-employment tax and the additional Medicare tax of 0.9% on high earners.

LLC structures provide maximum flexibility for tax elections and business operations, which allows owners to choose taxation as sole proprietorship, partnership, S-corp, or C-corp without changing the legal entity. Multi-member LLCs can allocate profits and losses disproportionately to ownership percentages, which benefits partners with different tax situations or investment levels. Professional service providers often benefit from LLC structure because it protects personal assets while it maintains pass-through taxation benefits.

Business owners should evaluate structure changes annually, particularly when they cross the $200,000 income threshold where additional Medicare taxes apply and S-corp elections become more valuable (the savings compound significantly at higher income levels). The next strategy focuses on business expense deductions that many owners overlook, which can add thousands more in tax savings when you streamline your tax planning process and claim them properly.

The home office deduction provides significant tax savings for business owners when they calculate it properly, yet many eligible small business owners fail to claim it. The simplified method allows a $5 per square foot deduction up to 300 square feet, which provides a maximum $1,500 deduction for home offices used exclusively for business. The actual expense method often produces larger deductions for owners with substantial home costs, as it allows deduction of the business percentage of mortgage interest, utilities, repairs, and depreciation. Your home office must serve as your principal place of business or you must use it regularly for administrative tasks when you lack another fixed business location.

Business meals remain partially deductible when they relate directly to business activities, though the deduction percentage varies by tax year. Restaurant meals with clients, business travel meals, and office catered meetings may qualify for deduction, but proper documentation requires receipts that show date, amount, business purpose, and attendees. Professional development expenses including conferences, certifications, business books, and industry training courses remain fully deductible when they maintain or improve skills required for your current business.

The IRS allows deduction of travel costs to educational events, including airfare and lodging, when the primary purpose involves business education rather than personal benefit (documentation proves business purpose). Strategic retirement plan contributions work hand-in-hand with these expense deductions to create comprehensive tax reduction strategies that compound your savings throughout the year.

SEP-IRA contributions for 2025 allow small business owners to deduct up to 25% of compensation or $69,000, whichever is less, which makes it the simplest high-contribution retirement option for self-employed individuals. Solo 401k plans provide even greater flexibility with employee deferrals up to $23,500 plus employer contributions that total up to $69,000 annually for business owners under age 50. Owners over 50 can add catch-up contributions of $7,500 to their Solo 401k deferrals, which brings total potential contributions to $77,500 in employee deferrals alone. Every dollar contributed reduces your current tax liability dollar-for-dollar, so a $50,000 SEP-IRA contribution saves $12,500 in taxes for someone in the 25% tax bracket. These contributions compound tax-free until retirement and create substantial long-term wealth while they provide immediate tax relief.

Solo 401k plans win for business owners who want maximum control and contribution flexibility, as they allow loans up to $50,000 and Roth conversions within the plan. SEP-IRAs work better for businesses with employees because contribution percentages must be equal for all eligible workers, but setup and administration costs remain minimal. SIMPLE IRAs limit contributions to $16,500 for 2025 but require lower administrative burden and allow immediate vesting for all participants (though contribution limits make them less attractive for high earners). Smart business owners establish retirement plans early in the year to maximize contribution periods and cash flow management, rather than scramble to fund accounts before December 31st. Tax credits provide additional incentives for retirement plan implementation, which creates even more value when you combine these strategies with other tax planning opportunities.

Tax credits provide direct reductions to your tax liability rather than reduce taxable income, which makes them significantly more valuable than deductions for small business owners. The research and development tax credit allows businesses to claim credits for qualified research expenses that include software development, product testing, and process improvements. Small businesses with gross receipts under $5 million can claim the R&D credit against payroll taxes, which provides immediate cash flow benefits even when you owe no income tax. Manufacturing companies, software developers, and firms often qualify for substantial R&D credits that many owners overlook because they assume only large corporations benefit from these programs.

The work opportunity tax credit provides up to $2,400 per qualified employee hired from targeted groups that include veterans, ex-felons, and long-term unemployed individuals. Small business health care tax credit reaches 50% of premiums paid for eligible small employers with fewer than 25 full-time employees and average wages below $64,000 in 2025. This health care credit phases out as employee count and average wages increase, but businesses can claim it for two consecutive years (proper documentation remains essential for all credit claims). Smart business owners coordinate their strategies with tax credit opportunities and document eligibility requirements carefully because these credits provide immediate tax savings.

Strategic year-end income and expense management works hand-in-hand with tax credits to maximize your overall tax reduction strategy throughout the year.

Cash-basis small businesses can accelerate deductible expenses into December to create immediate tax savings, while accrual-basis companies benefit when they defer these expenses until January if they expect lower tax rates next year. Business owners can prepay January expenses like insurance premiums, office rent, and professional fees before December 31 to claim current-year deductions when tax rates are higher. Equipment maintenance, office supplies, and software subscriptions purchased in December reduce current-year taxable income dollar-for-dollar, but these purchases must serve legitimate business purposes rather than artificial tax manipulation. The IRS requires economic substance behind expense timing decisions, so you must document business reasons for accelerated purchases and avoid transactions that lack commercial purpose beyond tax benefits.

Business owners can defer income through delayed invoices, extended payment terms, and strategic contract timing to manage tax brackets effectively when they anticipate lower rates in the following year. December invoices can wait until January 2nd for cash-basis businesses, which shifts income to the next tax year and potentially saves thousands when it keeps income below higher tax bracket thresholds. Accounts receivable management becomes particularly powerful when you combine it with inventory strategies, such as delayed year-end sales or postponed completed project deliveries until early January (these timing strategies work best when you track income throughout the year and project your final tax bracket). Smart business owners make strategic decisions in November about which income to defer and which expenses to accelerate based on their projected tax situation, as the timing of income and expenses can significantly impact your tax liability.

Tax-advantaged employee benefits provide another layer of tax reduction opportunities that complement these income and expense timing strategies perfectly.

Health Savings Accounts deliver triple tax advantages for business owners who offer high-deductible health plans. Contributions are deductible, growth remains tax-free, and withdrawals for medical expenses avoid taxation entirely. Small businesses can contribute up to $4,300 for individual coverage in 2025 according to IRS guidelines, with employees over 55 eligible for additional $1,000 catch-up contributions. HSA funds roll over indefinitely and function as retirement accounts after age 65, when withdrawals for non-medical expenses face only ordinary income tax rather than penalties. Business owners save approximately 25% to 37% on HSA contributions through immediate tax deductions, while employees reduce their taxable income through payroll deductions.

Dependent care assistance programs allow businesses to provide up to $5,000 annually per employee for childcare expenses on a pre-tax basis, which reduces both employer and employee payroll taxes significantly. Transportation benefits reach $325 monthly for 2025 according to recent IRS adjustments (covering parking, transit passes, and qualified bicycle commuting costs without creating taxable income for employees). These benefit programs cost businesses less than equivalent salary increases because they avoid payroll taxes, while employees receive greater value than cash compensation due to tax savings. Smart business owners implement multiple benefit programs simultaneously to maximize tax advantages and employee satisfaction, as the combined savings often exceed the administrative costs of program management.

Proper documentation becomes essential when you implement these benefit programs, as the IRS requires detailed records to substantiate tax deductions and employee eligibility requirements.

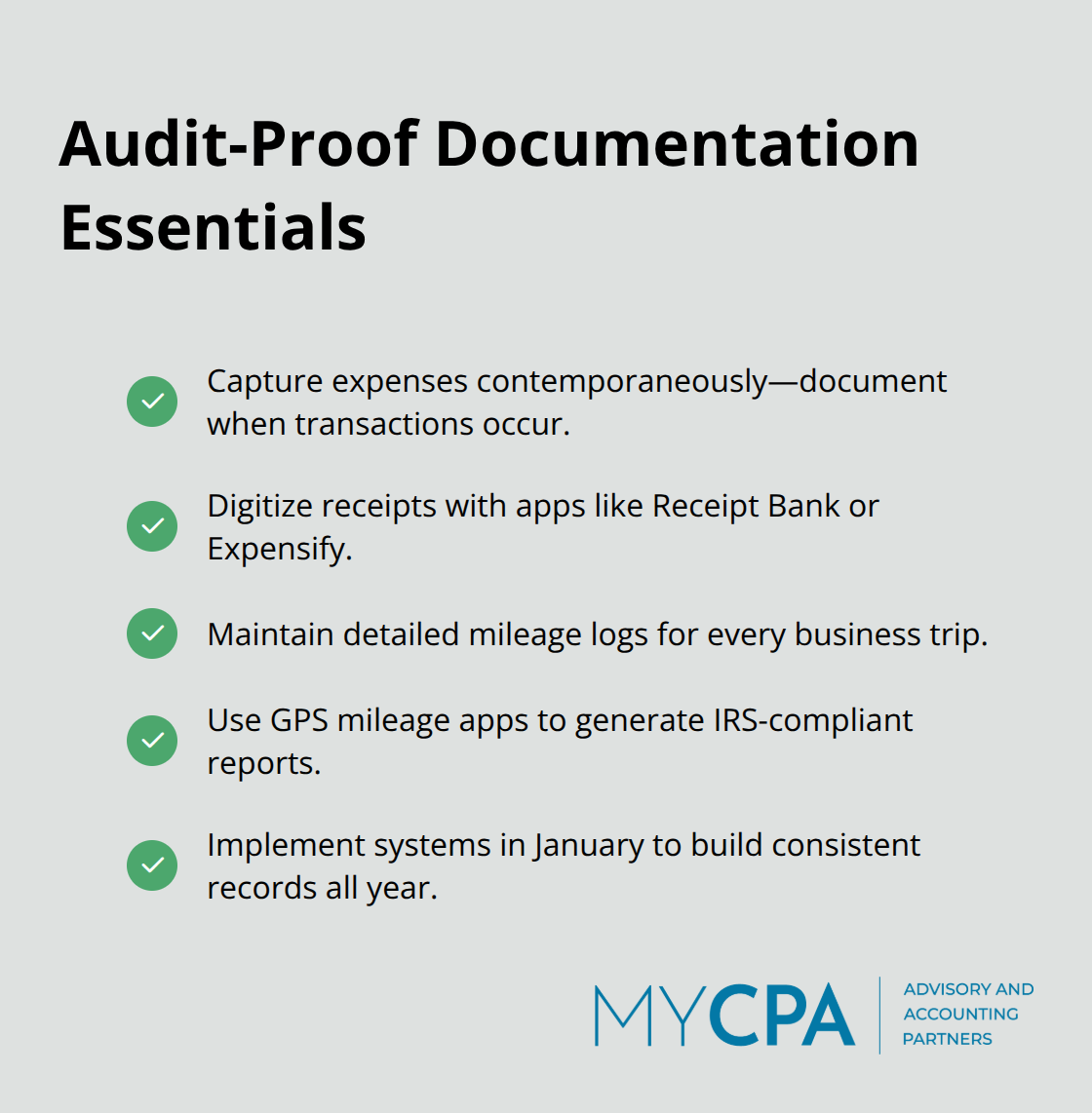

Proper documentation prevents IRS audit disasters and protects every deduction you claim, which makes record-keeping systems essential for tax savings. The IRS requires contemporaneous records for business expenses, which means you must document transactions when they occur rather than reconstruct them later. Receipt apps like Receipt Bank or Expensify capture expense data automatically and store digital copies in cloud systems that survive hardware failures. These digital systems cost $10 to $50 monthly but save hundreds of hours during tax preparation and provide instant access to records during IRS inquiries.

Vehicle deduction claims require detailed mileage logs that include date, destination, business purpose, and odometer readings for every business trip according to IRS Publication 463. MileIQ and TripLog applications track mileage automatically through GPS technology and generate IRS-compliant reports that satisfy audit requirements. Business owners who claim vehicle deductions without proper logs face complete disallowance of these deductions during audits, which costs thousands in additional taxes and penalties (QuickBooks Online and Xero integrate expense tracking with accounting functions to create comprehensive documentation systems that link receipts to specific transactions and tax categories). Smart business owners implement these systems in January rather than scramble for records in March, as consistent documentation throughout the year creates bulletproof audit protection and maximizes deduction opportunities.

Strategic estimated tax payment management works alongside proper documentation to prevent cash flow disruptions and penalty assessments throughout the year.

Quarterly estimated tax payments prevent underpayment penalties that can be assessed when you don’t pay enough tax through withholding and estimated tax payments. The safe harbor rule protects you from penalties when you pay 100% of last year’s tax liability through withholding and estimated payments, or 110% if your prior year adjusted gross income exceeded $150,000. Small businesses with irregular income benefit most from the prior year safe harbor approach because it provides predictable payment amounts regardless of current year profit fluctuations. Calculate your required quarterly payment as 25% of your safe harbor amount, which creates consistent cash flow plans and eliminates penalty risk even when current year income varies significantly from projections. Smart business owners make estimated payments on the 15th of January, April, June, and September to avoid late payment penalties and optimize cash flow around seasonal business cycles.

The fourth quarter payment receives special treatment because you can make it on January 15th instead of December 15th without penalty, which provides additional cash flow flexibility during holiday seasons when many businesses face reduced collections. We recommend automatic estimated tax payment setup through EFTPS to prevent missed deadlines that trigger penalties (even one day late results in penalty assessment regardless of the payment amount). Businesses that experience cash flow challenges should prioritize estimated tax payments over discretionary expenses because IRS penalties compound quarterly and create larger future obligations than most business debts. Professional tax advisors help business owners coordinate these payment strategies with comprehensive year-round tax plans that maximize savings opportunities throughout the entire business cycle.

Tax saving for small business demands consistent action throughout the year rather than last-minute December scrambles. These strategies save thousands annually when business owners implement them systematically and track results monthly. Business owners who wait until tax season miss opportunities worth 15% to 25% of their annual tax liability.

Professional guidance becomes essential as tax laws change and business complexity increases. We at My CPA Advisory and Accounting Partners help minimize tax liabilities while we enhance overall financial health through proactive tax strategies, accurate record maintenance, and strategic business advisory services. Our comprehensive approach addresses the unique challenges that small businesses face in today’s complex tax environment.

Start these strategies immediately through a review of your current business structure, establishment of retirement plan contributions, and setup of proper documentation systems. Schedule quarterly reviews with your tax advisor to adjust strategies based on income projections and new opportunities. The combination of strategic plans, professional guidance, and consistent execution creates substantial tax savings that compound year after year for your business.

Privacy Policy | Terms & Conditions | Powered by Cajabra