As we approach 2025, significant tax changes are on the horizon. Our 2025 tax planning guide is designed to help you navigate these updates and optimize your financial strategy.

At My CPA Advisory and Accounting Partners, we’ve compiled essential information on new tax brackets, deductions, and credits. We’ll also share effective planning strategies and common pitfalls to avoid.

The tax landscape will shift significantly in 2025, with several key changes that will impact both individuals and businesses. These updates present new opportunities and challenges for taxpayers.

The IRS has adjusted the tax brackets for 2025 to account for inflation. The top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). However, the income thresholds for other brackets have increased.

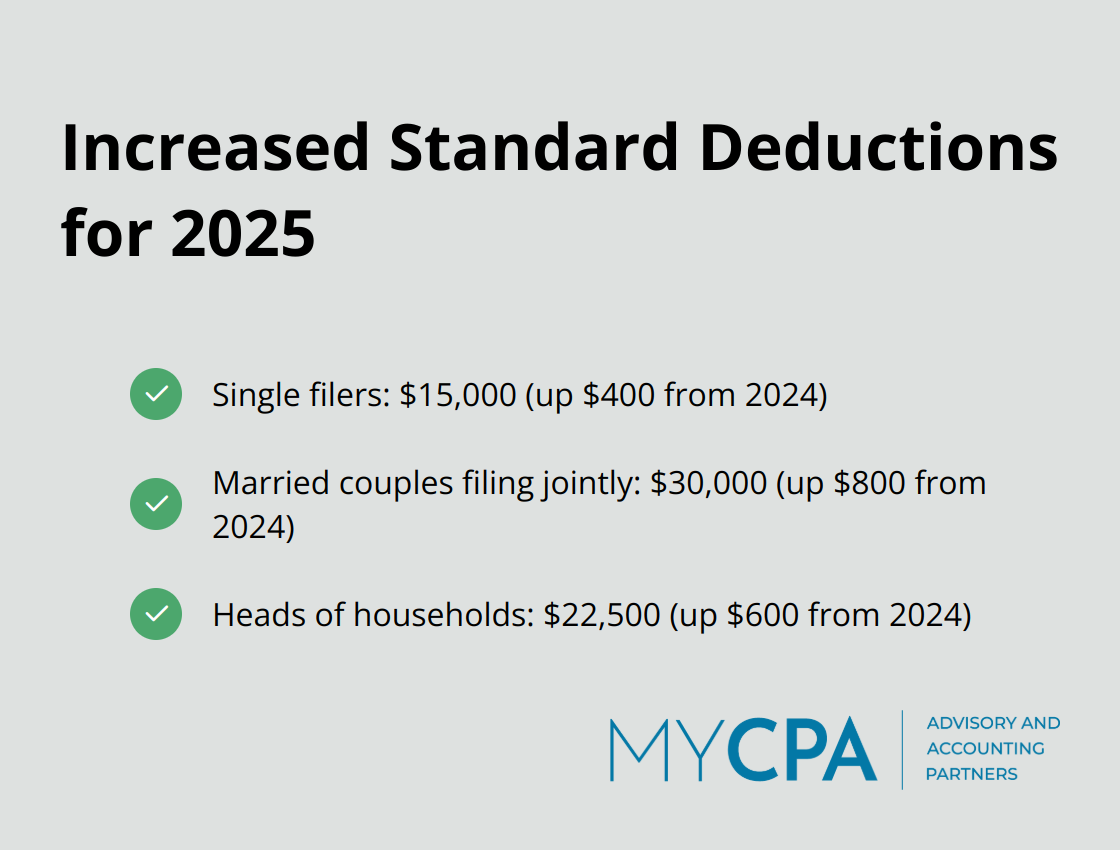

Taxpayers who don’t itemize will benefit from increased standard deductions. Single filers will see their standard deduction rise to $15,000 (a $400 increase from 2024). Married couples filing jointly will have a standard deduction of $30,000 (up $800 from the previous year). Heads of households will enjoy a $22,500 standard deduction (a $600 increase).

2025 introduces several new deductions and credits. A notable addition is the $6,000 deduction for taxpayers aged 65 and older, which doubles to $12,000 for married couples filing jointly. For instance, a 65-year-old single taxpayer who qualifies for the full $6,000 deduction would be able to deduct a total of $23,750 from these provisions.

The Earned Income Tax Credit (EITC) also gets a boost. Taxpayers with three or more qualifying children can now receive a maximum credit of $8,046 (up from $7,830 in 2024).

Businesses will see updates to various benefits and limits:

The estate tax landscape also changes in 2025:

These tax changes will require careful planning and strategy. To navigate these updates effectively and optimize your tax position for 2025 and beyond, it’s essential to work with experienced tax professionals. The next section will explore strategies for effective tax planning in light of these new provisions.

The IRS has increased contribution limits for various retirement plans in 2025. For 401(k) plans, the contribution limit is set to $23,000, with an additional $7,500 catch-up contribution for those 50 and older. IRA contribution limits are also expected to increase.

Full funding of these accounts not only secures your financial future but also potentially lowers your current tax bill. For example, if you’re in the 24% tax bracket and contribute the full $23,000 to your 401(k), you could save $5,520 in taxes for the year.

Health Savings Accounts offer a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. For 2025, the contribution limit for HSAs is expected to increase to $4,300 for individual coverage and $8,300 for family coverage.

If you have a high-deductible health plan, maximizing your HSA contributions can significantly reduce your taxable income while providing a cushion for future medical expenses. Unlike Flexible Spending Accounts (FSAs), HSAs have no “use it or lose it” rule, allowing your balance to grow over time.

With the increased standard deduction, many taxpayers find it challenging to itemize deductions. However, strategic charitable giving can still provide tax benefits. Try to “bunch” your charitable donations into a single year to exceed the standard deduction threshold.

Another effective strategy involves using a Donor-Advised Fund (DAF). You can contribute a lump sum to a DAF in one year, claim the tax deduction, and then distribute the funds to charities over several years. This approach allows you to maintain your giving schedule while maximizing tax benefits.

For those aged 70½ or older, Qualified Charitable Distributions (QCDs) from IRAs can satisfy Required Minimum Distributions (RMDs) without increasing taxable income. This strategy allows eligible IRA owners to make up to $100,000 in tax-free gifts to charity.

Tax-loss harvesting involves selling investments that have declined in value to offset capital gains. This strategy can help reduce your overall tax liability. In 2025, with potential changes in capital gains tax rates, this approach may become even more important.

You can use tax-loss harvesting to offset up to $3,000 of ordinary income per year (after netting against capital gains). Any unused losses can be carried forward to future tax years, providing ongoing tax benefits.

As we move into the next section, we’ll explore common tax mistakes to avoid in 2025. Understanding these pitfalls will help you further refine your tax strategy and ensure you’re making the most of the new tax landscape.

As tax laws evolve, it’s crucial to stay informed and avoid common mistakes that could cost you money or lead to compliance issues. Here are some key pitfalls to watch out for in 2025:

Tax credits can significantly reduce your tax bill, but many taxpayers miss these opportunities. The Earned Income Tax Credit (EITC) often goes unclaimed, despite its potential for substantial tax relief. In 2025, families with three or more qualifying children could receive up to $7,830 through the EITC.

The Saver’s Credit is another frequently overlooked benefit. This credit rewards low- and moderate-income taxpayers for contributing to retirement accounts. Depending on income and contribution levels, it can be worth up to $1,000 for individuals (or $2,000 for married couples filing jointly).

Missing tax deadlines can result in penalties and interest charges. While most people know about the April 15 deadline, other important dates often slip through the cracks. Self-employed individuals must make estimated tax payments quarterly. Failure to meet these deadlines can lead to underpayment penalties.

The deadline for Individual Retirement Account (IRA) contributions for the previous tax year typically falls on April 15 of the following year. Many taxpayers miss this chance to reduce their taxable income for the prior year.

Inadequate record-keeping can lead to missed deductions and difficulties during audits. The IRS requires taxpayers to keep records supporting income, deductions, and credits for at least three years from the filing date (and even longer for certain items like property records).

Digital tools can simplify this process. Many banks and credit card companies offer year-end summaries that categorize expenses, which can help identify deductible items. Apps like Expensify or Shoeboxed can track receipts and categorize expenses throughout the year.

Many people view taxes as a once-a-year event, but effective tax planning requires year-round attention. Waiting until the last minute to consider tax implications can result in missed opportunities for deductions and credits.

Regular check-ins with a tax professional (such as those at My CPA Advisory and Accounting Partners) can help you stay on track and take advantage of all available tax-saving opportunities. These professionals can provide guidance on strategies like tax-loss harvesting, which involves selling investments that have declined in value to offset capital gains.

Tax laws change frequently, and 2025 brings several significant updates. Failing to understand these changes can lead to costly mistakes. For example, the standard deduction for single filers increases to $15,000 in 2025 (a $400 increase from 2024). Married couples filing jointly will see their standard deduction rise to $30,000 (up $800 from the previous year).

Try to stay informed about these changes or work with a knowledgeable tax professional who can explain how new laws affect your specific situation.

The 2025 tax planning guide outlines significant changes in the tax landscape. These updates present new opportunities and challenges for taxpayers. Proactive tax planning will become more important than ever to optimize your tax position and avoid common pitfalls.

My CPA Advisory and Accounting Partners understands the complexities of tax planning. Our team of experts stands ready to help you navigate these changes and develop a personalized strategy. We offer comprehensive services including tax planning, accounting, QuickBooks management, and business advisory.

Don’t leave your financial future to chance. Let us help you create an effective tax strategy that aligns with your goals and takes full advantage of the new tax provisions. With our personalized approach and expertise, you can face the 2025 tax year with confidence and peace of mind.

Privacy Policy | Terms & Conditions | Powered by Cajabra