Is your QuickBooks data a mess? You’re not alone. Many businesses struggle with disorganized financial records, leading to headaches during tax season and potential compliance issues.

At My CPA Advisory and Accounting Partners, we offer QuickBooks cleanup services to help you regain control of your finances. In this post, we’ll guide you through common QuickBooks issues and provide practical steps to clean up your books effectively.

QuickBooks is a powerful tool, but it’s not immune to errors. Several recurring issues often surface when cleaning up QuickBooks accounts.

Unreconciled bank accounts create major headaches for businesses. This issue occurs when transactions in QuickBooks don’t match bank statements. A bank reconciliation is a process of matching the balances in a business’s accounting records to the corresponding information on a bank statement.

To address this, compare your QuickBooks balance with your bank statement balance. Look for discrepancies like missing transactions or incorrect amounts. QuickBooks offers a built-in reconciliation tool to streamline this process.

Duplicate transactions can inflate income or expenses, distorting your financial picture. The Association of Certified Fraud Examiners reports that 5% of businesses suffer from duplicate payments, leading to significant financial losses.

To fix this, run a report of all transactions and sort by amount. Look for identical amounts on the same or close dates. QuickBooks includes a “find duplicates” feature to identify these issues quickly.

Misclassified transactions throw off entire financial reporting systems. For example, classifying an expense as an asset overstates a company’s value. The IRS provides information on returns filed and taxes collected, enforcement, taxpayer assistance, the IRS budget and workforce, and other selected activities.

Review your chart of accounts and ensure each transaction falls into the correct category. Pay special attention to areas like capital expenses vs. operating expenses, or personal vs. business expenses (if you’re a sole proprietor).

Inaccurate customer and vendor data leads to payment delays and communication issues. Experian reports that up to 92% of businesses have some form of inaccurate data in their systems.

Review and update your customer and vendor lists regularly. Remove duplicates, update contact information, and ensure all relevant details (like tax IDs) remain current and accurate.

Addressing these common QuickBooks issues proves essential for maintaining accurate financial records. While time-consuming, the benefits of clean books far outweigh the effort involved. Professional services (like MyCPA Advisory and Accounting Partners) offer expertise to efficiently clean up QuickBooks and set businesses on the path to better financial management.

Now that we’ve identified common QuickBooks cleanup issues, let’s explore a step-by-step process to tackle these problems effectively.

Cleaning up QuickBooks requires a systematic approach. A comprehensive review of your financial reports helps identify discrepancies and sets the stage for targeted cleanup efforts.

Bank and credit card reconciliations form the backbone of accurate financial records. A study used the fraud triangle to understand why employees commit fraudulent acts and how small businesses can prevent this sort of activity in their organization. Start by comparing your QuickBooks balance with your bank statements. Address any discrepancies immediately, whether they’re missing transactions or incorrect amounts.

QuickBooks offers a built-in reconciliation tool that streamlines this process. Use it to match transactions and identify outliers. Take your time with this step – thorough reconciliation sets the foundation for clean books.

A well-organized chart of accounts is essential for accurate financial reporting. Review each account carefully, merge duplicates and remove unused accounts. Pay special attention to expense categorizations – misclassifications can lead to significant tax implications.

The IRS provides guidance on using electronic accounting software records in small business examinations. Ensure each transaction is properly categorized. If you’re unsure about proper classifications, consult with a professional accountant or tax advisor (like those at My CPA Advisory and Accounting Partners).

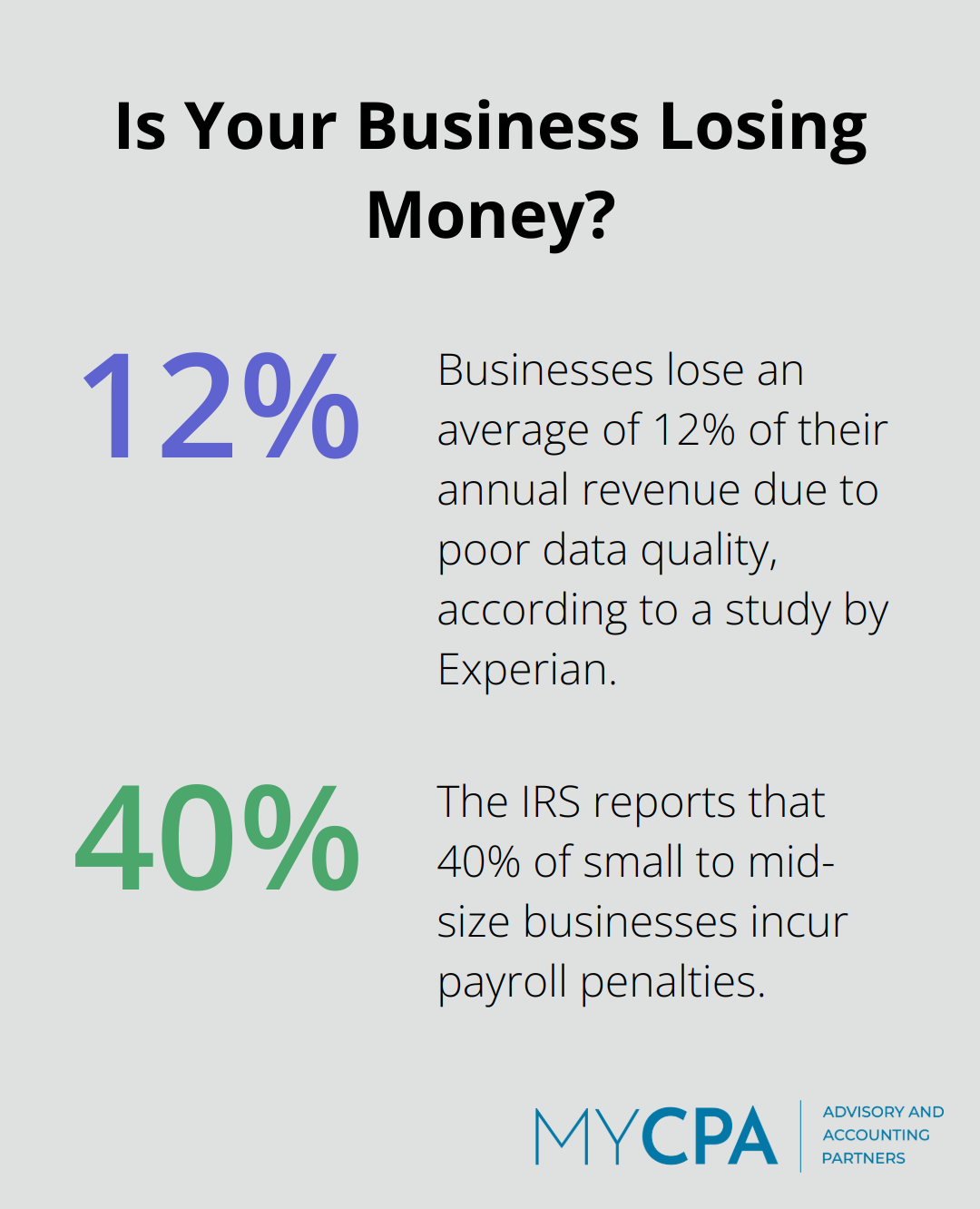

Outdated customer and vendor data can lead to payment delays and communication breakdowns. A study by Experian found that businesses lose an average of 12% of their annual revenue due to poor data quality.

Review your customer and vendor lists thoroughly. Remove duplicates, update contact information, and verify tax IDs. This not only improves your record-keeping but also enhances your business relationships.

The IRS reports that 40% of small to mid-size businesses incur an average of $845 per year in payroll penalties. Carefully review your payroll records, ensuring all employee information is up-to-date and tax withholdings are accurate.

A thorough QuickBooks cleanup is not a one-time event. Establish regular maintenance routines to prevent future disorganization and keep your financial records in top shape. If you find the process overwhelming, consider seeking professional help from experts who specialize in QuickBooks cleanup (such as My CPA Advisory and Accounting Partners).

Now that we’ve covered the step-by-step process for cleaning up your QuickBooks, let’s explore some practical tips for maintaining clean records going forward.

Consistency proves key for QuickBooks maintenance. Set up a weekly or bi-weekly schedule to reconcile your accounts. This frequent review helps catch discrepancies early and prevents small issues from becoming major problems. Regular reconciliations provide a clear picture of your financial health, allowing you to make informed decisions. Best practices for effective bank reconciliation include using accounting tools, reconciling regularly, keeping detailed records, and separating duties between employees.

Strong internal controls prevent errors and fraud. Assign different financial tasks to multiple employees to create a system of checks and balances. For example, have one person enter bills and another approve payments. Regardless of the nature of the fraudulent activity, the propensity for loss is tremendous. Fraud can threaten the stability of a business by resulting in significant financial losses.

QuickBooks offers many built-in tools and reports to streamline your financial management. Take advantage of features like automated invoicing, expense tracking, and financial reporting. The QuickBooks Audit Log monitors user activity and identifies potential issues.

Technology and financial regulations evolve constantly. Keep your team up-to-date by investing in regular QuickBooks training. The American Institute of CPAs (AICPA) offers various courses and certifications specifically for QuickBooks users.

For complex financial matters or when you need expert guidance, consider professional assistance. Firms like My CPA Advisory and Accounting Partners provide additional expertise and support in managing your financial data effectively. Their specialized knowledge can help you navigate intricate financial situations and ensure your QuickBooks records remain accurate and compliant.

QuickBooks cleanup is essential for accurate financial records and smooth business operations. We addressed common issues like unreconciled accounts, duplicate transactions, and incorrect classifications. Our systematic approach tackles these problems effectively and sets businesses on the path to financial clarity. Regular maintenance prevents future disorganization, and consistent reconciliation routines support clean books.

QuickBooks cleanup services offer expert guidance for businesses overwhelmed by the process. At My CPA Advisory and Accounting Partners, we specialize in helping businesses regain control of their finances. Our team provides tailored solutions to address specific QuickBooks challenges and establish systems for long-term success.

Take the first step towards cleaner books and better financial management. Visit our website to learn more about our QuickBooks cleanup services and overall financial strategy. With the right approach and support, you can transform your messy books into a powerful tool for business growth.

Privacy Policy | Terms & Conditions | Powered by Cajabra