Other Comprehensive Income (OCI) is a crucial component of financial reporting that often goes overlooked. At My CPA Advisory and Accounting Partners, we recognize the importance of understanding OCI for accurate financial analysis and decision-making.

This blog post will explore the essentials of Other Comprehensive Income accounting, its impact on financial statements, and why it matters for businesses and investors alike.

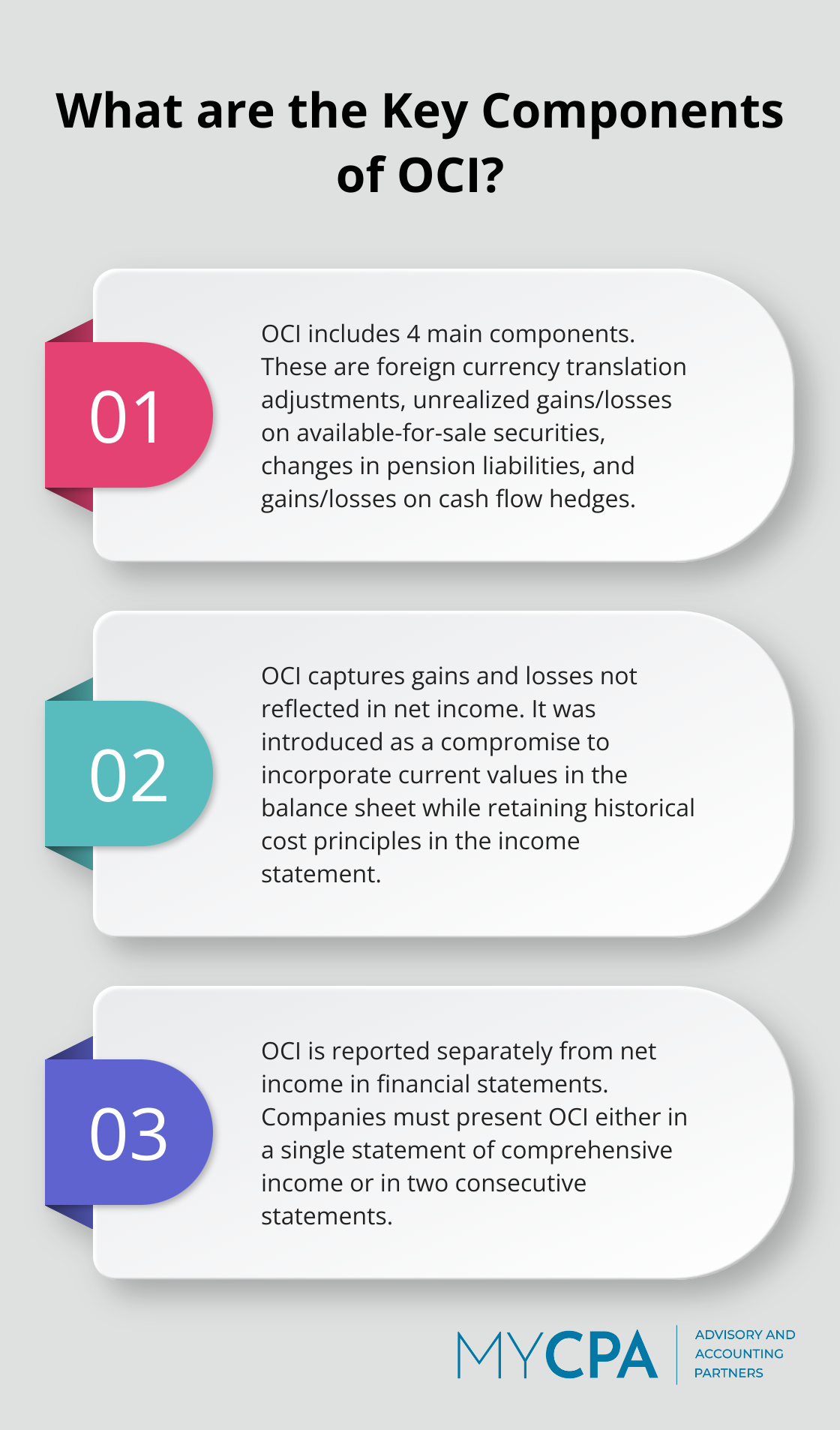

Other Comprehensive Income (OCI) represents a vital aspect of financial reporting that captures gains and losses not reflected in a company’s net income. It was introduced as a compromise to incorporate current values in the balance sheet while retaining historical cost principles in the income statement. This approach allows for a more nuanced representation of a company’s financial position, especially in the face of market volatility.

For instance, when a company holds investments in foreign currencies, exchange rate fluctuations can alter the value of these assets. Instead of immediately impacting net income, these changes appear in OCI until the assets are sold or the gains/losses become realized.

Net income represents a company’s profitability from its core operations, while OCI captures broader economic factors affecting a company’s value. Net income appears as the bottom line on the income statement, whereas OCI resides in the equity section of the balance sheet.

This distinction plays a significant role in financial analysis. During the 2008 financial crisis, many banks reported positive net income but substantial losses in OCI due to declining values of mortgage-backed securities. This discrepancy highlighted the importance of considering both figures for a comprehensive financial assessment.

Typical components of OCI include:

For multinational corporations, foreign currency translation can significantly impact OCI. A U.S. company with substantial operations in Europe (for example) might see its OCI fluctuate with changes in the Euro-Dollar exchange rate.

OCI provides a more comprehensive view of a company’s financial health beyond traditional profit measures. It allows stakeholders to assess potential future impacts on the company’s financial position, which may not be immediately apparent from net income alone.

Companies must report OCI separately from net income, either in a single statement of comprehensive income or in two consecutive statements. This separation helps users of financial statements distinguish between realized and unrealized gains and losses, providing a clearer picture of the company’s overall financial performance.

Understanding OCI is not just about compliance; it’s about gaining a fuller picture of a company’s financial position and potential future performance. As we move forward, we’ll explore how companies account for and present OCI in their financial statements, shedding light on the practical aspects of this important financial concept.

Accounting for Other Comprehensive Income (OCI) demands precision and adherence to specific guidelines. The proper treatment of OCI items often challenges many businesses. Let’s examine the key aspects of OCI accounting to help you navigate this complex area.

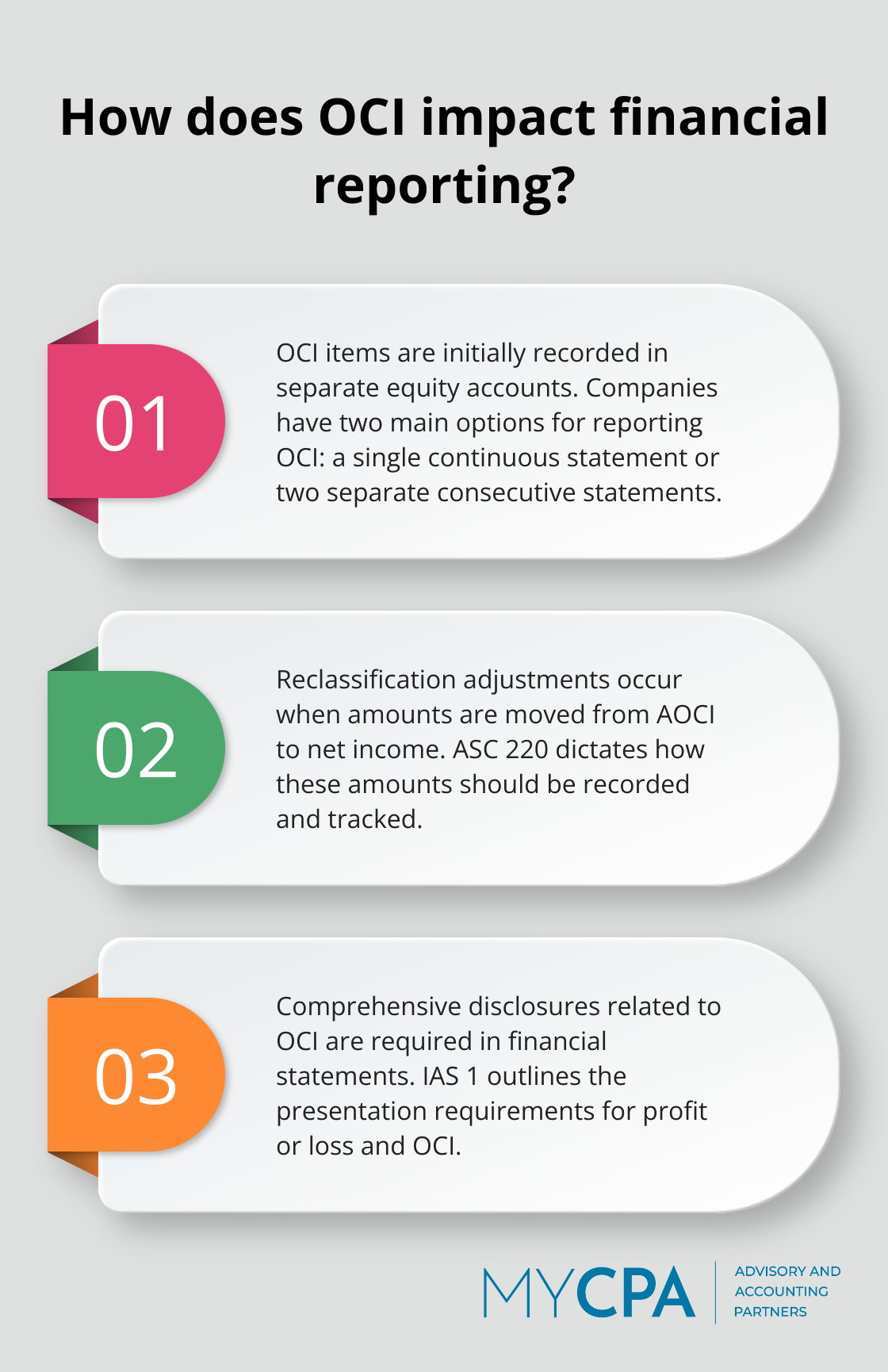

Timing plays a critical role in recording OCI items. Unlike regular income statement entries, companies initially record OCI transactions in separate equity accounts. For instance, when a company experiences unrealized gains on available-for-sale securities, it doesn’t immediately recognize these gains in net income. Instead, it records them in a specific OCI account within the equity section of the balance sheet.

A practical tip: Create dedicated general ledger accounts for each type of OCI item. This approach simplifies tracking and reporting, which makes it easier to generate accurate financial statements and respond to auditor inquiries.

The presentation of OCI on financial statements has evolved over time. Currently, companies have two main options for reporting OCI:

The choice between these options can impact how investors and analysts perceive a company’s performance. The two-statement approach often provides clearer differentiation between core operational results and other economic factors affecting the company’s value.

Reclassification adjustments represent a critical aspect of OCI accounting. These adjustments occur when amounts are reclassified out of Accumulated Other Comprehensive Income (AOCI) and into net income. This process is sometimes referred to as recycling AOCI. ASC 220 dictates how these amounts should be recorded.

To manage this process effectively, implement a robust system for tracking OCI items from initial recognition through to realization. This approach not only ensures accurate financial reporting but also provides valuable insights into the timing and impact of these transactions on your company’s overall financial position.

Companies must provide comprehensive disclosures related to OCI in their financial statements. Disclosure requirements for presenting profit or loss and OCI are outlined in IAS 1 Presentation of Financial Statements. Entities currently have choices in how they present this information.

Clear and detailed disclosures help stakeholders understand the nature and potential impact of OCI items on the company’s financial health.

Modern accounting software can significantly streamline OCI accounting processes. Many platforms (such as QuickBooks, which MyCPA Advisory and Accounting Partners specializes in) offer features specifically designed to handle OCI transactions and reporting. These tools can automate much of the recording and reclassification process, reducing the risk of errors and saving valuable time.

As we move forward, it’s essential to understand how OCI impacts financial analysis and decision-making. The next section will explore the broader implications of OCI on a company’s financial picture and its importance for investors and analysts.

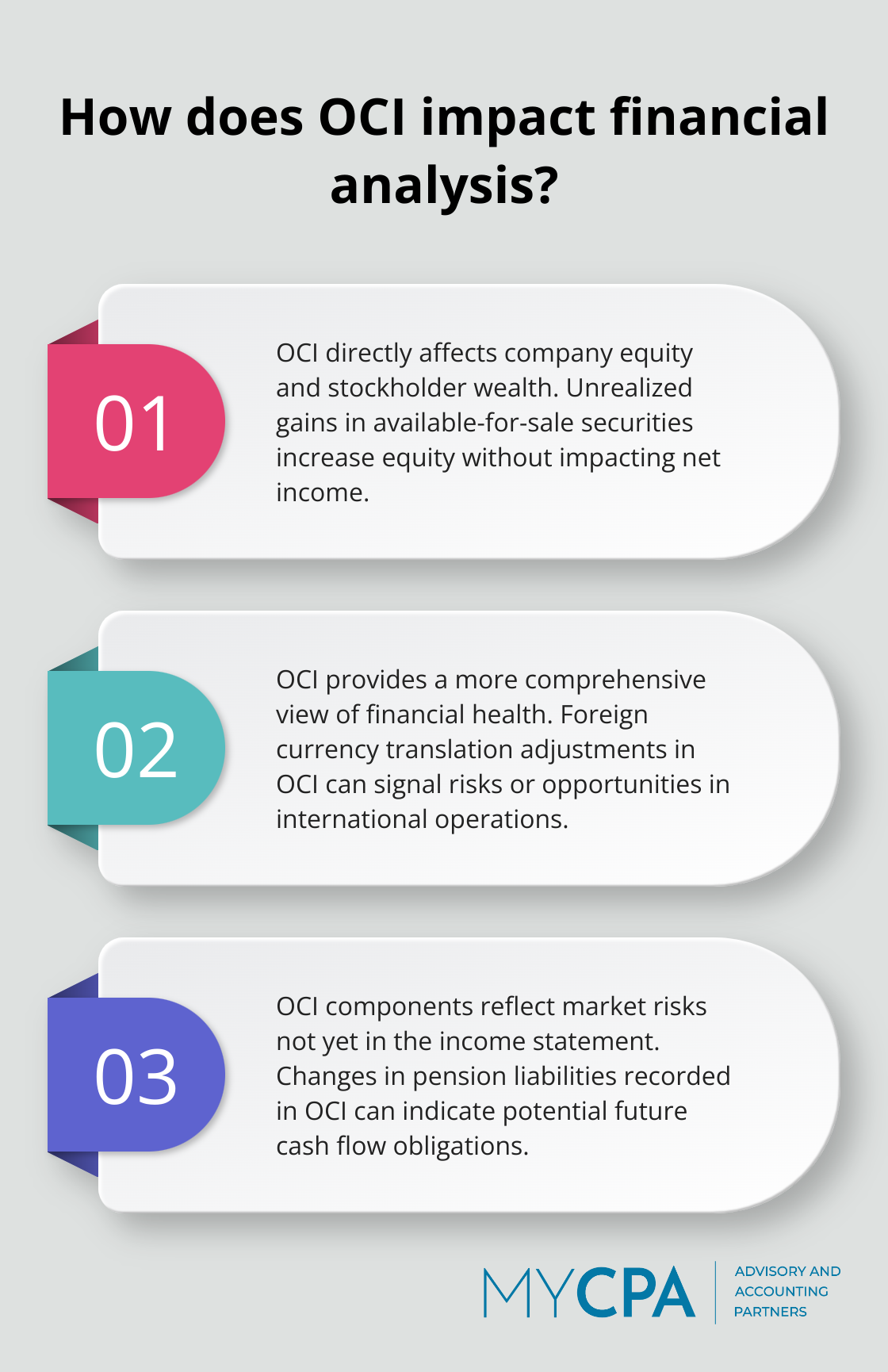

Other Comprehensive Income (OCI) directly affects a company’s equity, which influences stockholder wealth. Unrealized gains in available-for-sale securities increase equity without impacting net income. This can create situations where a company’s book value grows faster than its reported earnings might suggest.

In 2020, many tech companies experienced significant increases in their equity due to unrealized gains in their investment portfolios (despite facing operational challenges during the pandemic). This example highlights the importance of considering OCI when assessing a company’s true financial position.

Net income remains a key metric, but incorporating OCI provides a more comprehensive view of a company’s financial health. Foreign currency translation adjustments in OCI can signal potential risks or opportunities in a company’s international operations.

Financial analysts often use a metric called “Return on equity” (ROE) which is calculated by dividing net income by shareholders’ equity. This provides a view of how effectively a company uses its equity to generate returns.

OCI components often reflect market risks that haven’t yet materialized in the income statement. Changes in pension liabilities recorded in OCI can indicate potential future cash flow obligations. This information proves essential for assessing a company’s long-term financial stability.

During the 2008 financial crisis, banks with significant unrealized losses in their available-for-sale securities (recorded in OCI) were more likely to face liquidity issues in the following years. This underscores the predictive power of OCI in risk assessment.

OCI plays a significant role in company valuation. Analysts and investors consider OCI when determining a company’s intrinsic value. For example, unrealized gains on available-for-sale securities might indicate potential future income streams, while foreign currency translation adjustments could signal exposure to currency risks.

Understanding and analyzing OCI components allows for a more accurate assessment of a company’s true financial position and potential future performance. This comprehensive approach to financial analysis (which includes OCI) helps investors and analysts make more informed decisions about a company’s value and investment potential.

Other Comprehensive Income (OCI) plays a vital role in modern financial reporting and analysis. OCI captures important financial information that doesn’t immediately impact net income but significantly affects a company’s overall financial position. From foreign currency translation adjustments to unrealized gains on investments, OCI provides a more comprehensive view of a company’s financial health.

Other comprehensive income accounting will continue to be a critical skill for financial professionals. As global markets become increasingly interconnected, the importance of OCI in reflecting the impact of international operations and investments will likely grow. We may see new categories of OCI emerge to capture non-financial metrics that impact a company’s overall value.

At My CPA Advisory and Accounting Partners, we stay informed about these developments to provide our clients with accurate and insightful financial analysis. Our expertise in tax services, accounting, QuickBooks, and business advisory ensures that you have a comprehensive understanding of your financial position (including the nuances of OCI). The financial landscape continues to evolve, and staying informed about OCI and its implications will help maintain a competitive edge in today’s complex business environment.

Privacy Policy | Terms & Conditions | Powered by Cajabra