Comprehensive accounting problems are the ultimate test of a student’s financial acumen. At My CPA Advisory and Accounting Partners, we’ve seen how mastering these complex exercises can significantly boost career prospects.

These problems simulate real-world scenarios, requiring a deep understanding of accounting principles and practices. By tackling comprehensive problem accounting challenges, you’ll develop critical skills that are invaluable in today’s fast-paced business environment.

Comprehensive accounting problems are complex, multi-step exercises that test a student’s ability to apply various accounting principles in a simulated business scenario. These problems typically cover an entire accounting cycle, from initial journal entries to the preparation of financial statements.

A typical comprehensive accounting problem starts with a set of transactions for a fictional company. Students must record these transactions, post them to ledger accounts, and prepare a trial balance. The problem then introduces adjusting entries, requiring students to update their records accordingly.

After making adjustments, students prepare financial statements (including an income statement, balance sheet, and statement of cash flows). The final steps involve closing temporary accounts and creating a post-closing trial balance.

Mastering comprehensive accounting problems translates directly to real-world success. These exercises mirror the complexities of actual business operations, preparing students for the challenges they’ll face in their careers.

Comprehensive problems force students to think critically about how different accounting concepts interact. This holistic approach is vital in today’s business world, where accountants must understand the broader implications of financial decisions.

A survey by Robert Half found that 41% of CFOs cite critical thinking as the most in-demand skill for accounting and finance professionals. Working through comprehensive problems helps students develop this ability, setting them apart in a competitive job market.

To excel in comprehensive accounting problems, create a systematic approach. Break down the problem into manageable sections, and tackle each part methodically. Use T-accounts to visualize transactions and double-check your work at each stage.

Time management is important. Allocate specific time frames for each section of the problem, ensuring you can complete all steps within the given timeframe. This skill is particularly valuable in real-world scenarios where deadlines are tight and accuracy is paramount.

Practice regularly with diverse problem sets. The more exposure you have to different scenarios, the better equipped you’ll be to handle any accounting challenge that comes your way in your future career.

As we move forward, let’s explore the specific steps involved in solving a comprehensive accounting problem, providing you with a roadmap to tackle these complex exercises effectively.

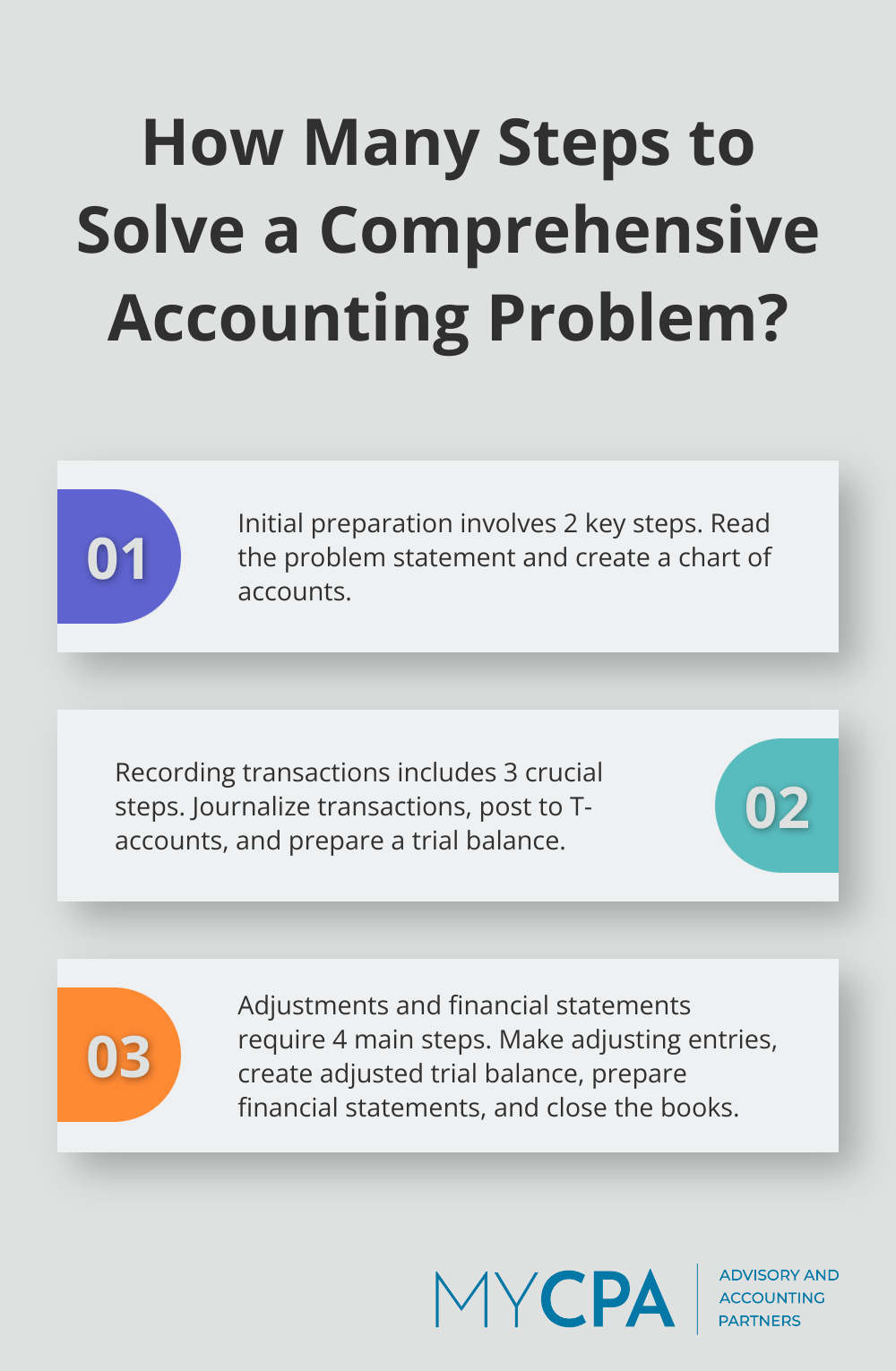

A systematic approach is essential to solve comprehensive accounting problems efficiently. Start by reading the problem statement thoroughly. Identify the company name, accounting period, and specific instructions. This initial step sets the context and helps avoid mistakes later.

Next, organize the given information. Create a chart of accounts, listing all accounts mentioned in the problem. This step helps visualize the company’s financial structure and ensures no important details are missed.

Begin by journalizing each transaction. Use a two-column journal entry format, clearly stating the date, accounts affected, and amounts. Apply the double-entry bookkeeping principle – for every financial transaction, there must be equal and opposite effects in at least two different accounts.

After journalizing, post these entries to T-accounts. This step helps track the running balance of each account and serves as a visual aid for subsequent steps.

Once all transactions are recorded, prepare a trial balance. This step ensures that debits and credits are equal, catching any arithmetic errors early in the process.

Adjusting entries are vital for accurate financial reporting. Common adjustments include accruals, deferrals, and depreciation. Analyze the problem for any information about prepaid expenses, unearned revenues, or asset depreciation.

After making adjustments, create an adjusted trial balance. This step verifies that accounts are still in balance and provides the basis for preparing financial statements.

Use the adjusted trial balance to prepare the income statement, balance sheet, and statement of cash flows. The income statement shows revenues and expenses for the period. The balance sheet presents assets, liabilities, and equity at a specific point in time. The cash flow statement categorizes cash inflows and outflows into operating, investing, and financing activities.

The final step involves closing temporary accounts (revenues, expenses, and dividends) to retained earnings. This process resets these accounts for the next accounting period.

After closing entries, prepare a post-closing trial balance. This final check ensures all temporary accounts are closed and permanent accounts are correctly carried forward.

While understanding the manual process is important, modern accounting often utilizes software to streamline these steps. Familiarize yourself with popular accounting software like QuickBooks or Xero (MyCPA Advisory and Accounting Partners offers expert QuickBooks services). These tools can significantly reduce calculation time and allow more focus on analysis and interpretation of financial data.

Practice is key to mastering these problems. Many accounting professionals seek comprehensive training programs to hone these skills. Such programs often emphasize hands-on experience with real-world scenarios, preparing accountants for the complexities of modern accounting.

Now that we’ve covered the steps to tackle a comprehensive accounting problem, let’s explore common challenges you might face and strategies to overcome them.

Effective time management is a key factor when you tackle comprehensive accounting problems. Allocate specific time blocks for each section of the problem. For example, dedicate 30 minutes to initial journal entries, 45 minutes to adjusting entries, and so on. This approach prevents you from getting stuck on one part and ensures you address all aspects of the problem.

Implementing time management strategies could potentially reclaim 20% of work hours, enhancing overall productivity. To implement this strategy, use a timer or time-tracking app to stay on schedule. Build in short breaks to maintain focus and prevent burnout.

Complex transactions often challenge even experienced accountants. When you face a challenging entry, break it down into its component parts. Identify the accounts affected and the underlying economic event. Sketch out T-accounts to visualize the transaction’s impact before you commit it to your formal solution.

For particularly tricky scenarios, consider using a decision tree. This visual tool can help you systematically work through the accounting treatment options. The Big Four accounting firms often use this technique to train new hires on complex accounting standards (like revenue recognition under ASC 606).

One of the most frequent mistakes in comprehensive accounting problems is misclassification of transactions. To avoid this, create a cheat sheet of account classifications at the start of your problem-solving process. This quick reference can save valuable time and prevent errors.

Another common issue is failure to recognize all necessary adjusting entries. Develop a checklist of potential adjustments (e.g., depreciation, prepaid expenses, accrued revenues) and systematically review it before you finalize your adjusted trial balance.

While manual problem-solving builds foundational skills, proficiency with accounting software is essential in today’s digital landscape. Familiarize yourself with popular platforms like QuickBooks or Xero. MyCPA Advisory and Accounting Partners offers expert QuickBooks services to help businesses streamline their accounting processes.

When you use software for comprehensive problems, input your initial data carefully. Take advantage of features like automated journal entry creation and financial statement generation, but always review the output critically. Software is a tool to enhance your efficiency, not a replacement for your accounting judgment.

A survey by Sage found that 90% of accountants believe that technology has improved their efficiency. However, it’s important to balance software usage with manual calculations to maintain your core accounting skills.

Mastering comprehensive problem accounting challenges prepares you for real-world financial management complexities. These exercises simulate multifaceted business operations, sharpening your critical thinking, time management, and attention to detail. The skills you develop through these problems extend far beyond academic success, boosting your confidence in handling diverse financial scenarios.

Your ability to spot and correct errors will improve, along with your financial analysis capabilities. These highly sought-after skills will set you apart in the job market and open doors to exciting career opportunities. You’ll find yourself better equipped to make informed financial decisions, provide valuable insights to stakeholders, and contribute meaningfully to your organization’s success.

At My CPA Advisory and Accounting Partners, we understand the importance of these fundamental skills. Our team applies this knowledge to provide tailored financial services, ensuring our clients receive accurate and insightful financial guidance. Practice and refine your approach to comprehensive accounting problems to build a strong foundation for a successful finance and accounting career.

Privacy Policy | Terms & Conditions | Powered by Cajabra