Tax planning is a topic that often raises questions about legality. At My CPA Advisory and Accounting Partners, we frequently encounter clients wondering: Is tax planning legal or illegal?

The answer isn’t always straightforward, as the line between legal tax planning and illegal tax evasion can sometimes appear blurry. This blog post will clarify the boundaries of legal tax planning and provide insights into strategies that can help you minimize your tax burden while staying compliant with the law.

Tax planning is a strategic approach to manage finances and minimize tax liabilities within legal boundaries. It involves understanding and utilizing the tax code to optimize your financial situation. This practice differs from tax evasion, as it operates within the confines of the law.

The Internal Revenue Service (IRS) recognizes tax planning as a legitimate practice. The U.S. Tax Court has affirmed that taxpayers have the right to arrange their affairs to keep taxes as low as possible. This principle, known as the doctrine of tax avoidance, is based on strict or literal interpretation of the law and is nurtured by the ideology of liberty. It stands in stark contrast to tax evasion, which employs illegal methods to reduce tax liabilities.

Transparency forms the foundation of legal tax planning. All financial transactions and decisions must be reported accurately to tax authorities. Maintaining detailed records to support your tax positions is essential (and often required by law).

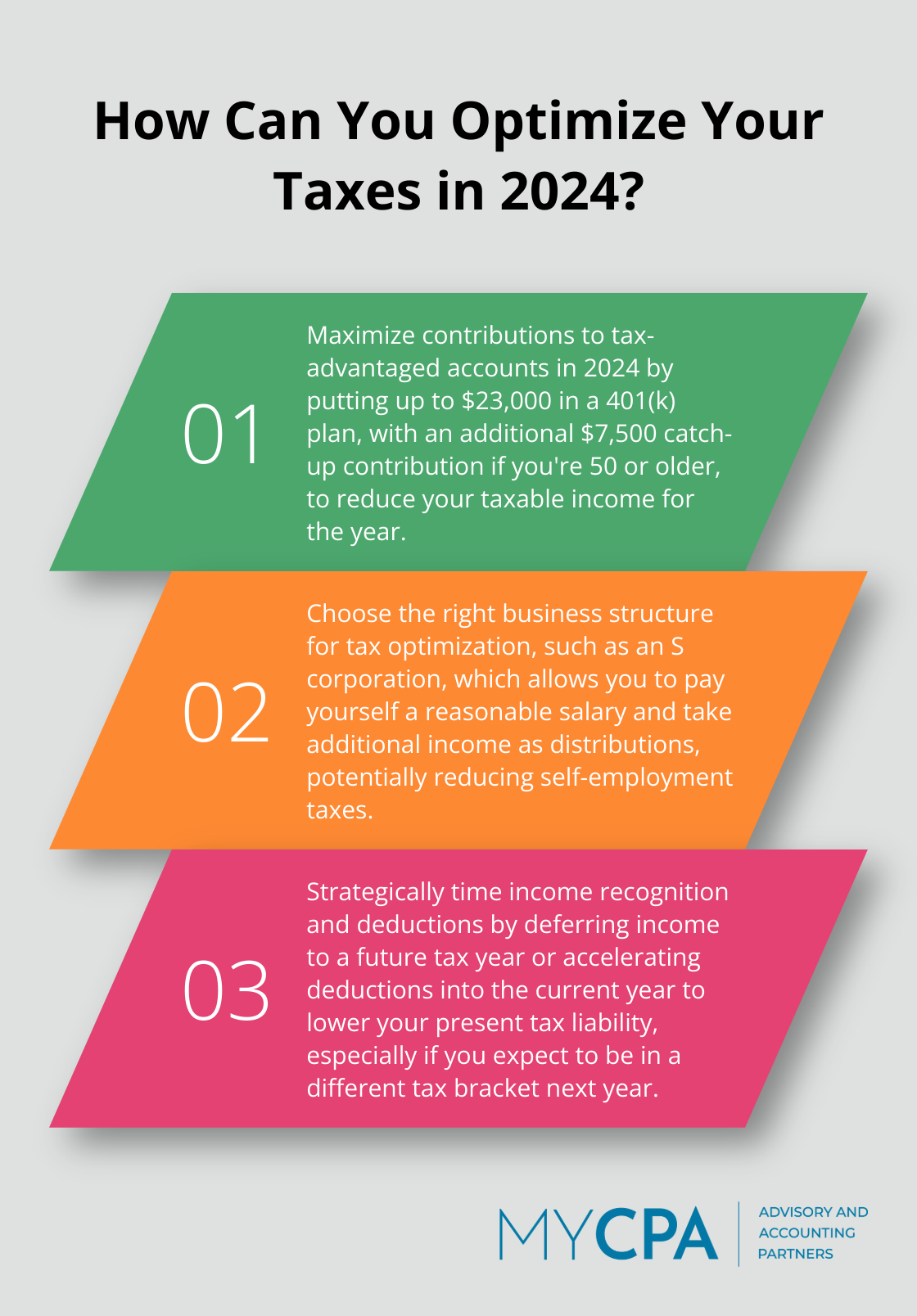

The timing of income recognition and deductions can significantly impact your tax bill. For example, deferring income to a future tax year or accelerating deductions into the current year can lower your present tax liability.

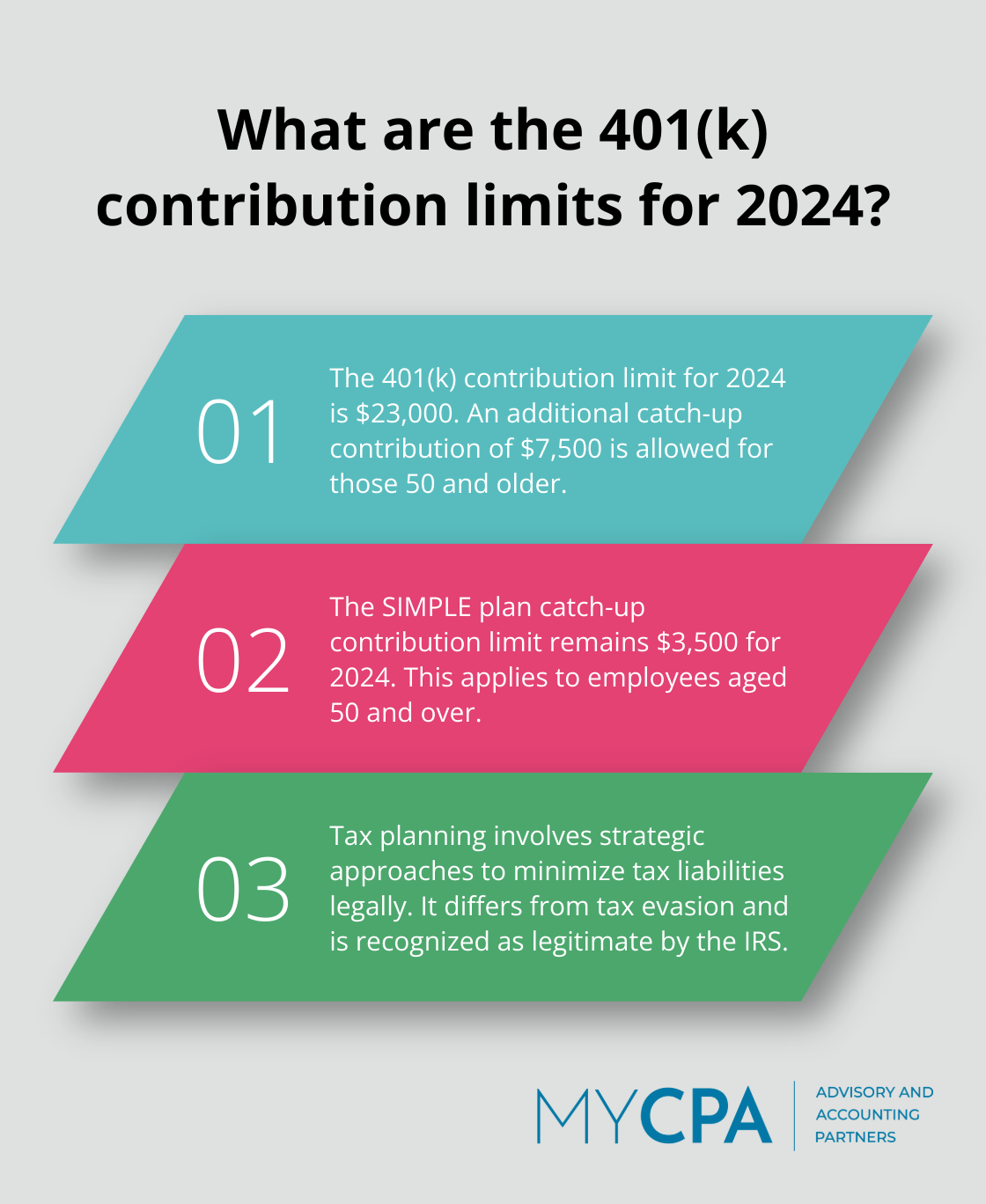

One effective strategy involves maximizing contributions to tax-advantaged accounts. For 2024, you can contribute up to $23,000 to a 401(k) plan (with an additional $7,500 catch-up contribution if you’re 50 or older). These contributions reduce your taxable income for the year. Additionally, for SIMPLE plans, the catch-up contribution limit for employees 50 and over remains $3,500 for 2024.

Business owners have additional opportunities for tax planning. Choosing the right business structure can have significant tax implications. For instance, S corporations can provide tax advantages through the ability to pay yourself a reasonable salary and take additional income as distributions (potentially reducing self-employment taxes).

Tax laws are complex and constantly changing. What was a valid strategy last year might not apply this year. Working with qualified tax professionals is vital for effective and compliant tax planning. These experts can help navigate the intricacies of the tax code and ensure your strategies align with current regulations.

As we move forward, let’s explore some common tax planning strategies in more detail and how they can be implemented effectively within legal boundaries.

Tax planning requires constant updates with the latest tax laws and regulations. Several key strategies can help minimize your tax burden while maintaining compliance with IRS guidelines.

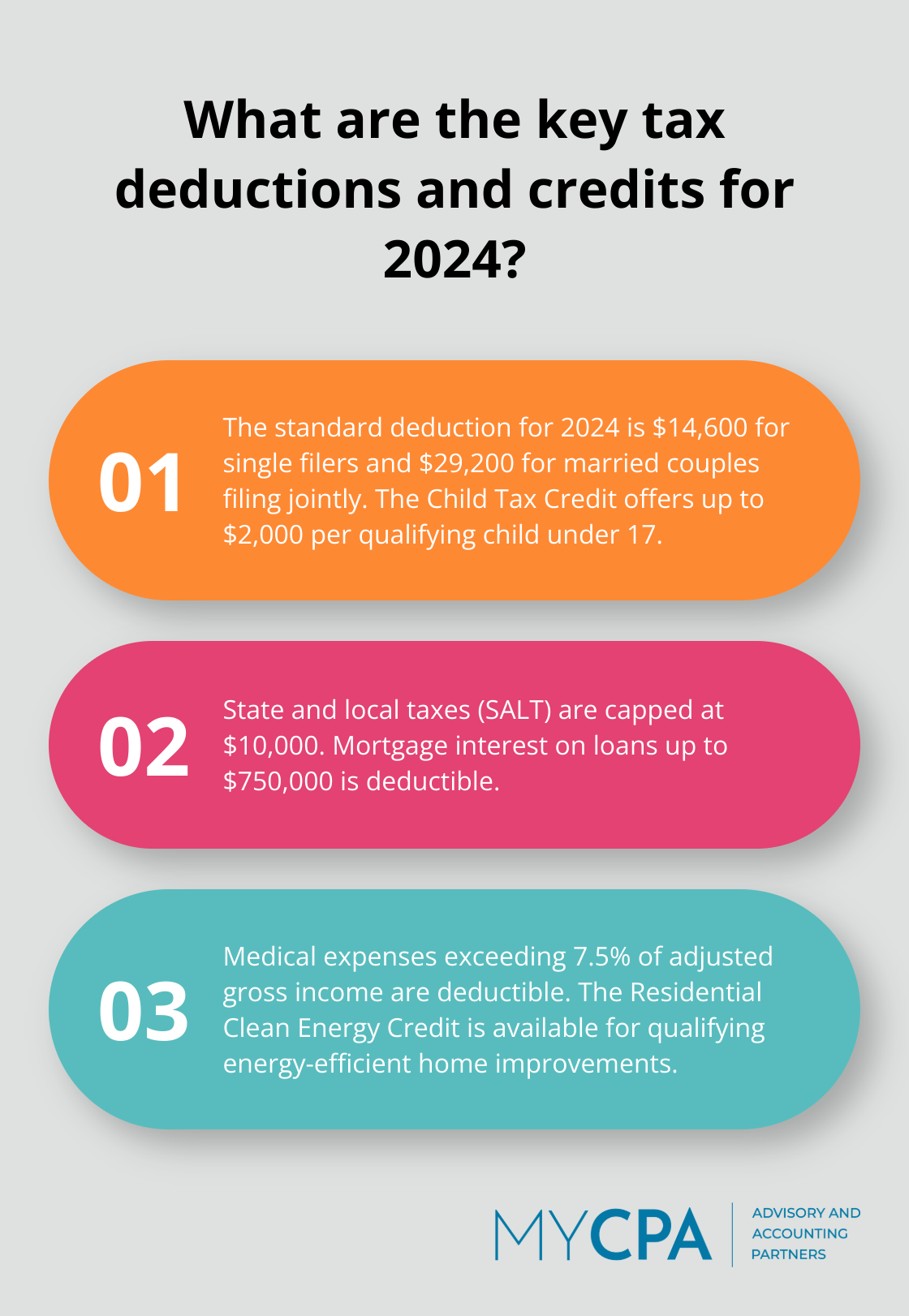

Reducing tax liability often involves taking full advantage of available deductions and credits. For the 2024 tax year, the standard deduction has increased to $14,600 for single filers and $29,200 for married couples filing jointly. However, itemizing deductions might prove more beneficial if qualifying expenses exceed these amounts.

Some frequently overlooked deductions include:

Tax credits provide a dollar-for-dollar reduction in your tax bill. The Child Tax Credit offers up to $2,000 per qualifying child under 17. For energy-conscious homeowners, the Residential Clean Energy Credit allows a credit for qualifying improvements made to increase energy efficiency.

Timing income and expenses can significantly impact tax liability. Self-employed individuals or those with control over income receipt should consider deferring income to the following year if they expect to be in a lower tax bracket. Conversely, accelerating income into the current year might benefit those anticipating a higher bracket next year.

Retirees must carefully manage Required Minimum Distributions (RMDs) from retirement accounts. The SECURE 2.0 Act has changed the RMD age to 73 for those who reach age 72 in 2023. Careful planning of these distributions can help minimize their tax impact.

Maximizing contributions to tax-advantaged retirement accounts remains a powerful tax planning strategy. For 2024, the contribution limits for 401(k) plans have increased to $23,000 (with an additional $7,500 catch-up contribution for those 50 and older). IRA contribution limits have also risen to $7,000 (with a $1,000 catch-up contribution for those 50 and above).

Consider diversifying retirement savings between traditional and Roth accounts. While traditional accounts offer immediate tax deductions, Roth accounts provide tax-free withdrawals in retirement. This strategy, known as tax diversification, can provide flexibility in managing tax liability during retirement years.

Business owners have additional opportunities for tax planning. Choosing the right business structure can have significant tax implications. For instance, S corporations can provide tax advantages through the ability to pay a reasonable salary and take additional income as distributions (potentially reducing self-employment taxes).

As tax laws continue to evolve, it becomes increasingly important to stay informed and adapt strategies accordingly. The next section will explore the legal boundaries of tax planning and the importance of compliance in implementing these strategies.

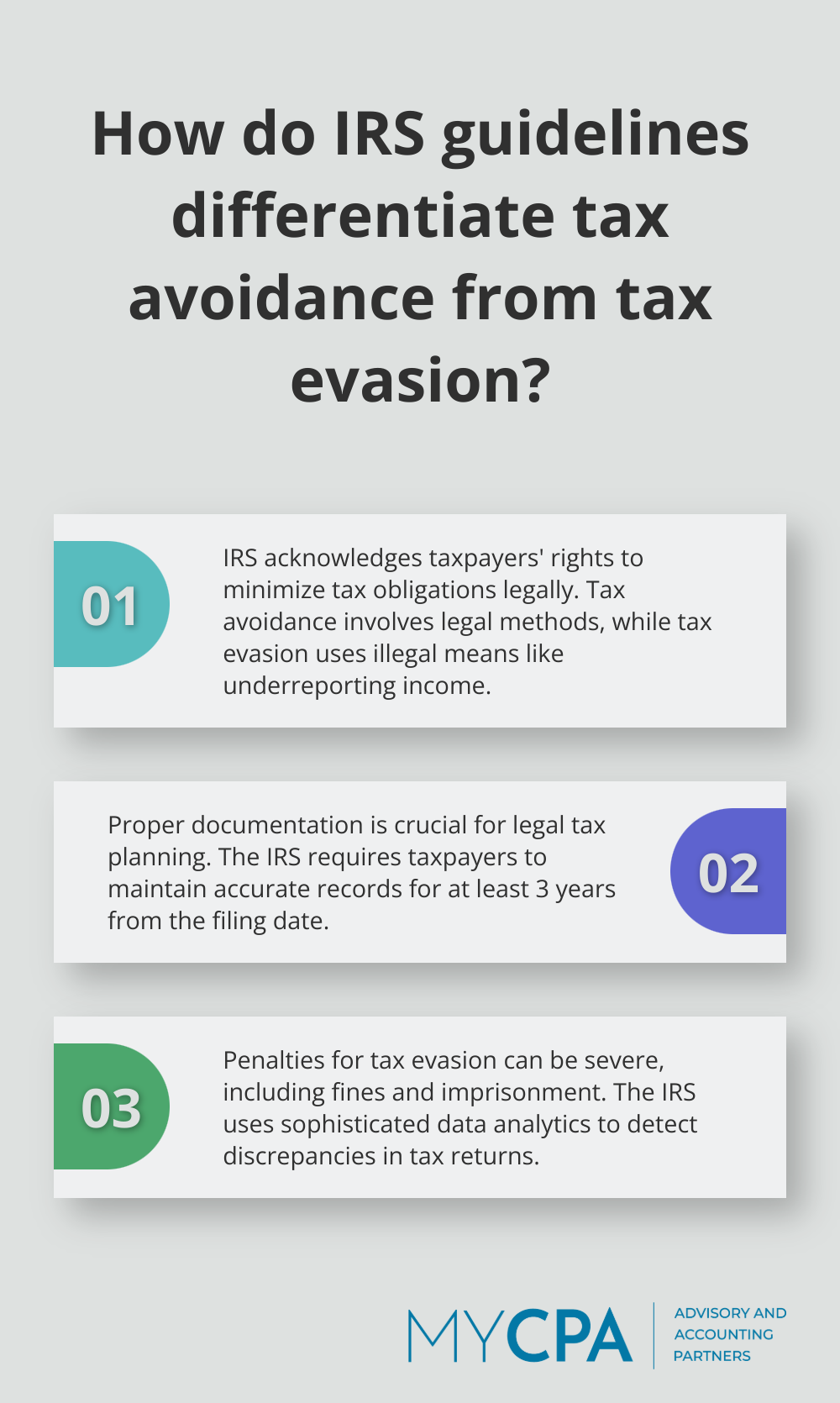

The Internal Revenue Service (IRS) acknowledges taxpayers’ rights to minimize tax obligations through legal means. This practice, known as tax avoidance, is perfectly legal. IRS regulations allow eligible taxpayers to claim certain deductions, credits, and adjustments to income. The IRS draws a clear line between tax avoidance and tax evasion. Tax avoidance involves legal methods to reduce taxes, while tax evasion uses illegal means such as underreporting income or inflating deductions.

Proper documentation serves as a shield against scrutiny in tax planning. The IRS requires taxpayers to maintain accurate records to support their tax positions. These records should include receipts, bank statements, and other financial documents. Taxpayers should keep these records for at least three years from the date of filing their return (in some cases, such as property transactions, even longer).

The penalties for crossing into illegal territory can be severe. Tax evasion can result in hefty fines, imprisonment, and damage to personal and professional reputations. If convicted of tax evasion, the penalties can include many years in prison. The IRS employs sophisticated data analytics tools to detect discrepancies and inconsistencies in tax returns, making it difficult to hide income or fabricate deductions.

The complexities of tax law often necessitate expert guidance. Qualified tax professionals stay informed about frequent changes in tax legislation and provide tailored advice based on specific financial situations. They can identify legitimate deductions and credits that might otherwise be overlooked, ensuring maximum legal tax benefits while maintaining compliance.

Transparency forms a cornerstone of legal tax planning. This principle involves full disclosure of all relevant information to tax authorities and avoidance of any attempts to conceal income or assets. The IRS offers voluntary disclosure programs for taxpayers with previously undisclosed income from legal sources. These programs can help mitigate penalties and bring tax affairs into compliance.

Tax planning is legal and essential for individuals and businesses who want to optimize their financial positions. The question “Is tax planning legal or illegal?” has a clear answer: when executed correctly, tax planning is entirely legal and encouraged by tax authorities. It involves the use of existing tax laws to minimize liabilities while maintaining full compliance with regulations.

Tax codes change frequently, and strategies that were once beneficial may become obsolete or problematic. We at My CPA Advisory and Accounting Partners specialize in providing tailored tax planning strategies that align with your financial goals while ensuring full compliance with tax laws. Our expertise helps you navigate tax regulations, identify opportunities for tax savings, and implement strategies that enhance your overall financial health.

The key to successful tax planning lies in transparency, accurate documentation, and a proactive approach to managing your finances. Working with qualified professionals and staying informed about tax laws will help you implement strategies that reduce your tax burden while maintaining peace of mind about your compliance with legal requirements.

Privacy Policy | Terms & Conditions | Powered by Cajabra