Tax season can be daunting, but it doesn’t have to be. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how effective tax minimization strategies for individuals can lead to significant savings.

This guide will walk you through key tactics to reduce your tax burden, from maximizing deductions to leveraging tax credits and utilizing tax-advantaged accounts. By implementing these strategies, you’ll be better equipped to keep more of your hard-earned money in your pocket.

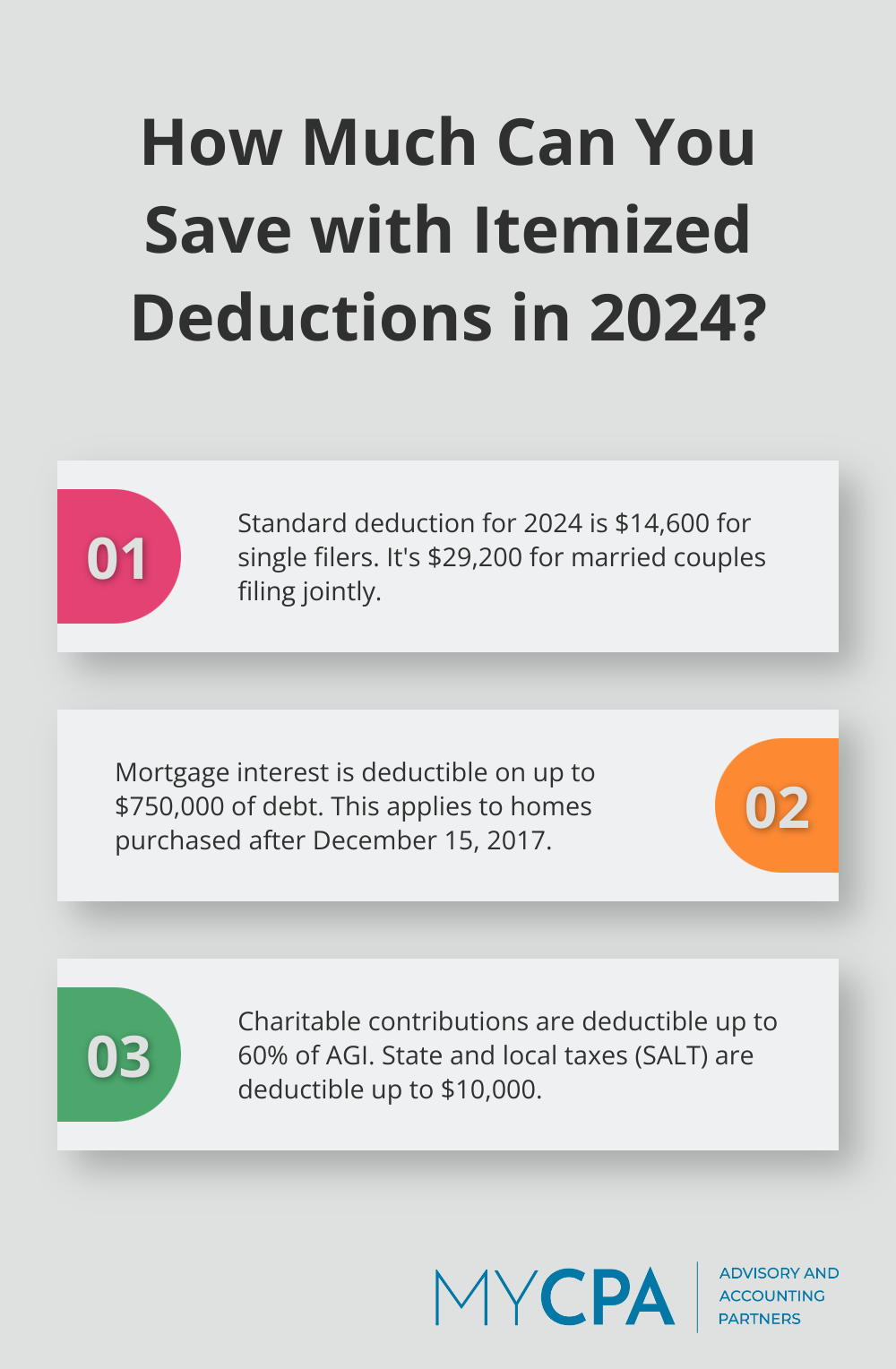

The first step to reduce your taxable income is to decide between the standard deduction and itemizing. For the 2024 tax year, the standard deduction stands at $14,600 for single filers and $29,200 for married couples filing jointly. If your itemized deductions exceed these amounts, itemizing could result in greater tax savings.

Itemizing could be more beneficial, especially for high-income earners with large, deductible expenses like mortgage interest, state and local taxes:

Above-the-line deductions reduce your AGI, potentially qualifying you for other tax benefits. Key above-the-line deductions include:

Self-employed individuals can also deduct half of their self-employment tax and health insurance premiums.

To maximize your deductions, keep detailed records throughout the year. Use a dedicated credit card for deductible expenses or a mobile app to track receipts. This organization will streamline tax preparation and ensure you don’t miss any potential deductions.

Tax laws change frequently, and what worked last year might not be the best strategy this year. Working with a professional can provide invaluable insights. They stay up-to-date on the latest tax code changes and can help you develop a personalized strategy to maximize your deductions and minimize your tax liability.

Now that we’ve explored ways to maximize deductions, let’s move on to another powerful tool in your tax-saving arsenal: tax credits. These dollar-for-dollar reductions in your tax bill can lead to substantial savings when used strategically.

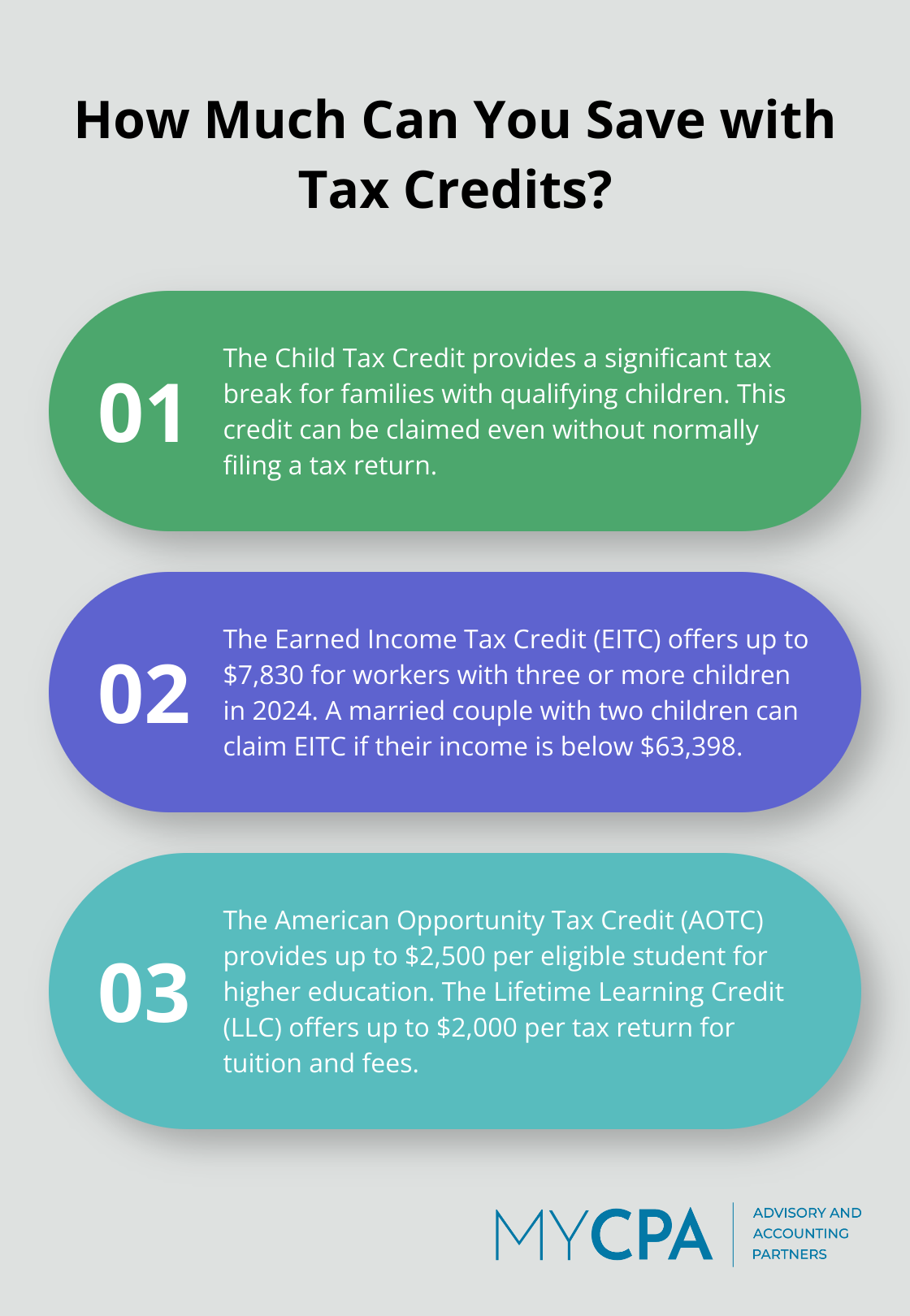

Tax credits offer a powerful way to reduce your tax liability. Unlike deductions that lower your taxable income, credits directly reduce the amount of tax you owe. Let’s explore some key tax credits that can lead to substantial savings when used strategically.

The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return.

The Earned Income Tax Credit (EITC) benefits low to moderate-income workers. For the 2024 tax year, the maximum credit ranges from $632 for workers with no children to $7,830 for those with three or more children.

The income thresholds and credit amounts vary based on filing status and number of children. For instance, a married couple with two children can claim the EITC if their income falls below $63,398. This refundable credit can potentially result in a tax refund even if you don’t owe any taxes.

Two main education credits can help reduce the rising costs of higher education:

The Residential Clean Energy Credit allows homeowners to claim 30% of the cost of installing certain renewable energy systems (such as solar panels or wind turbines). This credit remains available through 2032.

The Energy Efficient Home Improvement Credit offers up to $1,200 annually for energy-efficient improvements like new windows, doors, or insulation. An additional $2,000 credit is available for heat pumps and biomass stoves.

Maximizing these credits requires careful planning and documentation. Professional guidance can help you navigate these complex rules to ensure you claim every credit you’re entitled to. These tax credits can translate into significant savings, putting more money back in your pocket.

Now that we’ve covered how tax credits can reduce your tax bill, let’s explore another powerful strategy for minimizing your tax burden: tax-advantaged accounts and investments.

Tax-advantaged accounts offer powerful tools for minimizing your tax burden while saving for important life goals. These accounts provide various tax benefits, from immediate tax deductions to tax-free growth and withdrawals. Let’s explore how you can leverage these accounts to optimize your financial strategy.

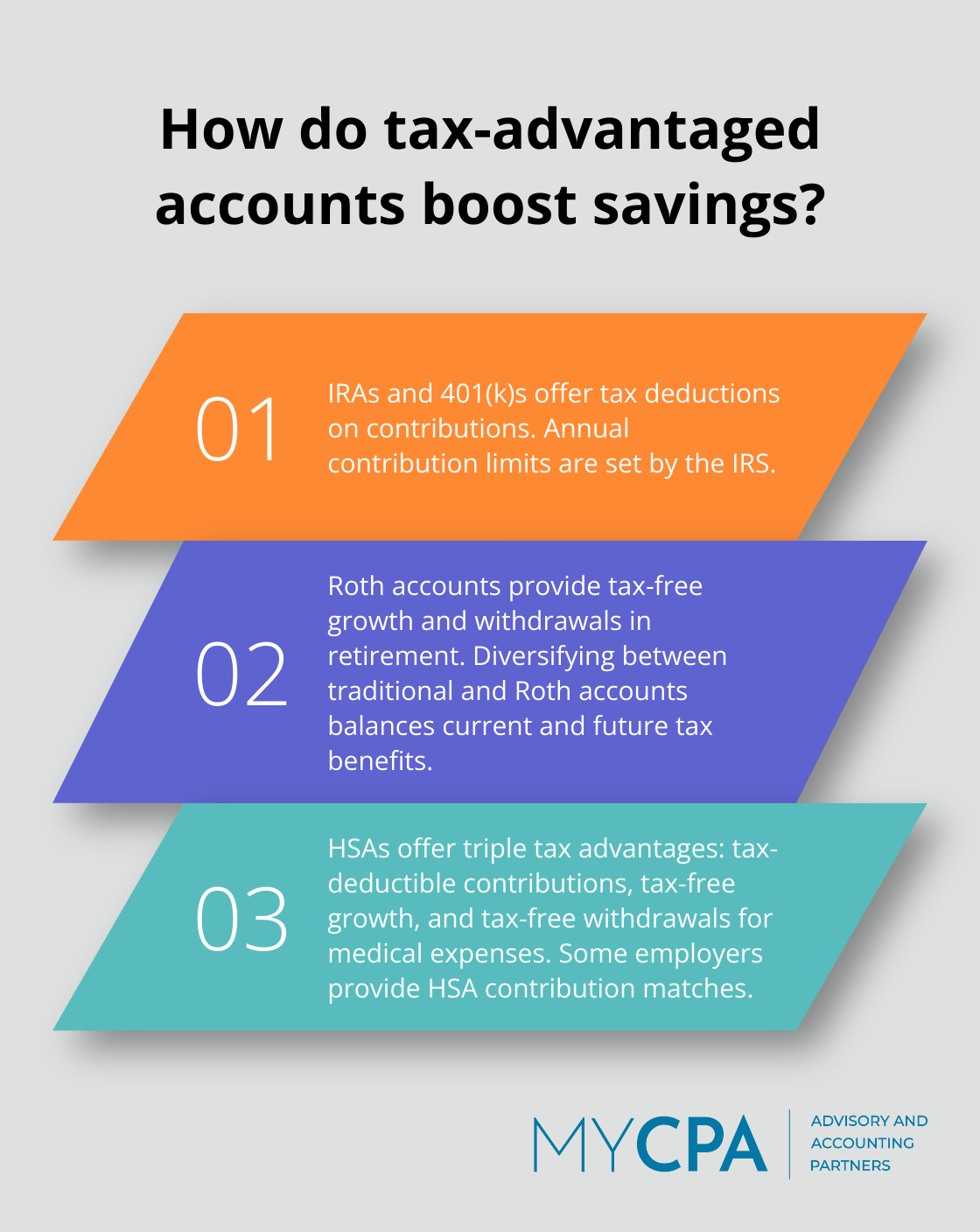

Individual Retirement Accounts (IRAs) and 401(k)s form the cornerstone of retirement savings vehicles. Traditional IRAs and 401(k)s offer immediate tax deductions on contributions, which reduce your current taxable income. These accounts have annual contribution limits set by the IRS.

Roth versions of these accounts don’t provide immediate tax benefits but offer tax-free growth and withdrawals in retirement. This can prove particularly advantageous if you expect to be in a higher tax bracket in retirement.

A smart strategy involves diversifying your retirement savings across both traditional and Roth accounts. This allows you to balance current tax benefits with future tax-free income.

Health Savings Accounts (HSAs) offer a unique triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

HSAs aren’t limited to current medical expenses. You can invest the funds and allow them to grow tax-free for future healthcare costs (including in retirement). This makes HSAs a powerful tool for both healthcare planning and retirement savings.

To maximize your HSA benefits, consider paying current medical expenses out-of-pocket if you can afford it, allowing your HSA balance to grow tax-free for future use. Some employers even offer HSA contribution matches, which essentially provides free money you shouldn’t ignore.

529 plans offer tax-free growth and withdrawals for qualified education expenses. While contributions aren’t federally tax-deductible, many states offer tax deductions or credits for 529 contributions.

A lesser-known benefit of 529 plans is the ability to change beneficiaries. This flexibility allows you to transfer unused funds to another family member without tax penalties, making 529 plans a versatile tool for family education planning.

Try to front-load 529 contributions to maximize tax-free growth. You can contribute up to five years’ worth of gift tax exclusions in a single year without triggering gift taxes.

Navigating the complexities of tax-advantaged accounts requires careful planning and consideration of your overall financial picture. Professional guidance can help create personalized strategies that optimize these accounts for your unique situation, ensuring you make the most of every tax-saving opportunity available to you.

Effective tax minimization strategies for individuals can lead to substantial savings and improved financial well-being. You can significantly reduce your tax burden by carefully considering deductions, leveraging available tax credits, and utilizing tax-advantaged accounts. Your unique financial situation, income level, family structure, and long-term goals all play important roles in determining the most effective tax minimization strategies for you.

At My CPA Advisory and Accounting Partners, we understand the complexities of tax planning and the importance of tailored solutions. Our team of experts stays up-to-date with the latest tax laws and regulations to help you benefit from every available opportunity to minimize your tax liability. We offer comprehensive tax services designed to optimize your financial health, providing peace of mind and allowing you to focus on what matters most to you.

Don’t leave money on the table when it comes to your taxes. You can navigate the intricate world of tax planning with confidence by partnering with experienced professionals. We’re here to help you develop a personalized tax strategy that aligns with your financial goals and maximizes your savings potential.

Privacy Policy | Terms & Conditions | Powered by Cajabra