Income tax minimization strategies can significantly impact your financial well-being. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how effective tax planning can lead to substantial savings for individuals and businesses alike.

This blog post will explore proven methods to reduce your tax burden legally and ethically. From maximizing deductions to optimizing investment structures, we’ll cover practical steps you can take to keep more money in your pocket.

Tax deductions and credits are powerful tools to reduce your tax bill. The key difference lies in how they affect your taxes. Deductions lower your taxable income, while credits directly reduce the amount of tax you owe.

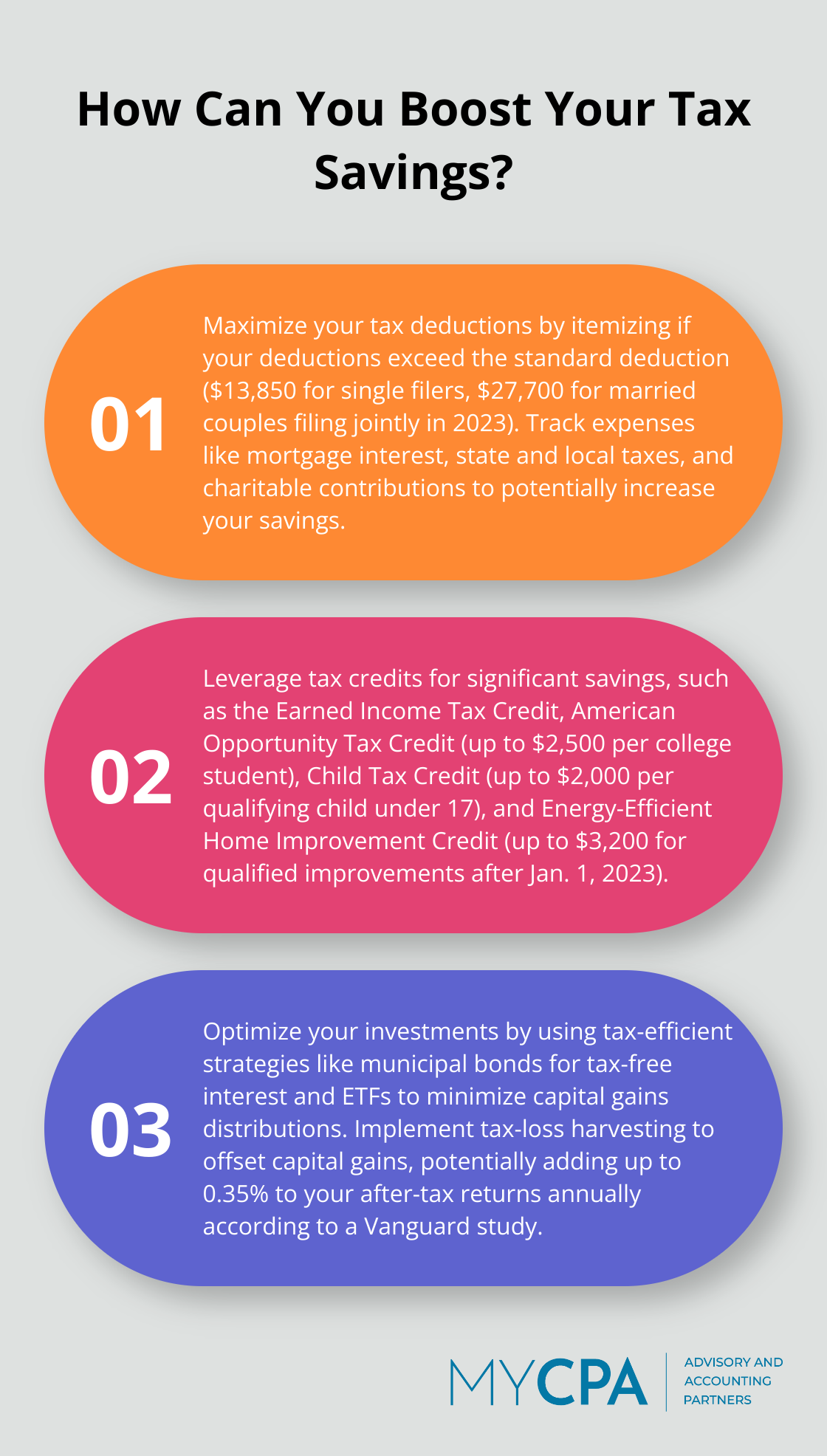

For 2023, the standard deduction is $13,850 for single filers and $27,700 for married couples filing jointly. If your itemized deductions exceed these amounts, itemizing could lead to greater tax savings.

Common itemized deductions include:

Tax credits offer a dollar-for-dollar reduction in your tax bill. Some popular credits include:

Business owners and self-employed individuals have numerous opportunities to reduce taxable income. Some key deductions include:

Self-employed individuals can deduct 50% of their self-employment taxes from their taxable income. Additionally, contributions to a SEP IRA or Solo 401(k) can significantly reduce your tax bill while boosting your retirement savings.

Accurate record-keeping is essential for maximizing deductions and credits. Use expense tracking apps and high-quality accounting software to streamline financial record-keeping. This not only aids in tax preparation but also helps prevent audits.

Tax laws change frequently. Working with tax professionals (such as those at My CPA Advisory and Accounting Partners) ensures you take advantage of all available deductions and credits while staying compliant with current regulations.

As we move forward, let’s explore how strategic income timing and deferral can further optimize your tax situation.

Strategic income timing can reduce your tax burden significantly. The key to this strategy is to understand your current and future tax brackets. If you expect to be in a lower tax bracket next year, defer income to that year for substantial savings. If you anticipate being in a higher bracket, accelerate income into the current year.

Business owners can delay invoices or prepay expenses. Employees might negotiate year-end bonuses to be paid in January instead of December. The IRS reports that timing strategies can save taxpayers an average of $1,500 to $2,000 annually.

Retirement accounts serve as powerful tax-saving tools. For 2024, the IRS increased 401(k) contribution limits to $23,000. These contributions reduce your taxable income dollar-for-dollar.

A study by Vanguard shows that maxing out your 401(k) can save you up to $5,700 in taxes annually (assuming a 25% tax bracket). If you’re over 50, catch-up contributions allow you to save even more.

Health Savings Accounts (HSAs) offer a triple tax advantage: account contributions are pre-tax, earnings are tax-free, and withdrawals for qualified medical expenses are tax-free.

The Employee Benefit Research Institute found that a family contributing the maximum to an HSA for 20 years could accumulate over $200,000 (assuming a 5% annual return).

Charitable donations can provide significant tax benefits while supporting causes you care about. Consider bunching donations in alternating years to exceed the standard deduction threshold.

Donor-advised funds (DAFs) allow you to make a large contribution in one year for an immediate tax deduction, then distribute the funds to charities over time. Fidelity Charitable reports that their average DAF account grew from $16,097 in 2010 to $27,864 in 2020.

These strategies require careful planning and execution. Professional guidance can help you implement these tactics effectively, ensuring you maximize your tax savings while staying compliant with IRS regulations. As we move forward, we’ll explore how optimizing your investments and business structure can further enhance your tax-saving efforts.

Investors who structure their portfolios strategically can reduce their tax burden significantly. Municipal bonds offer tax-free interest at the federal level (and potentially at the state level). The Investment Company Institute reports that municipal bond funds held $969 billion in assets as of 2023, which underscores their popularity among tax-conscious investors.

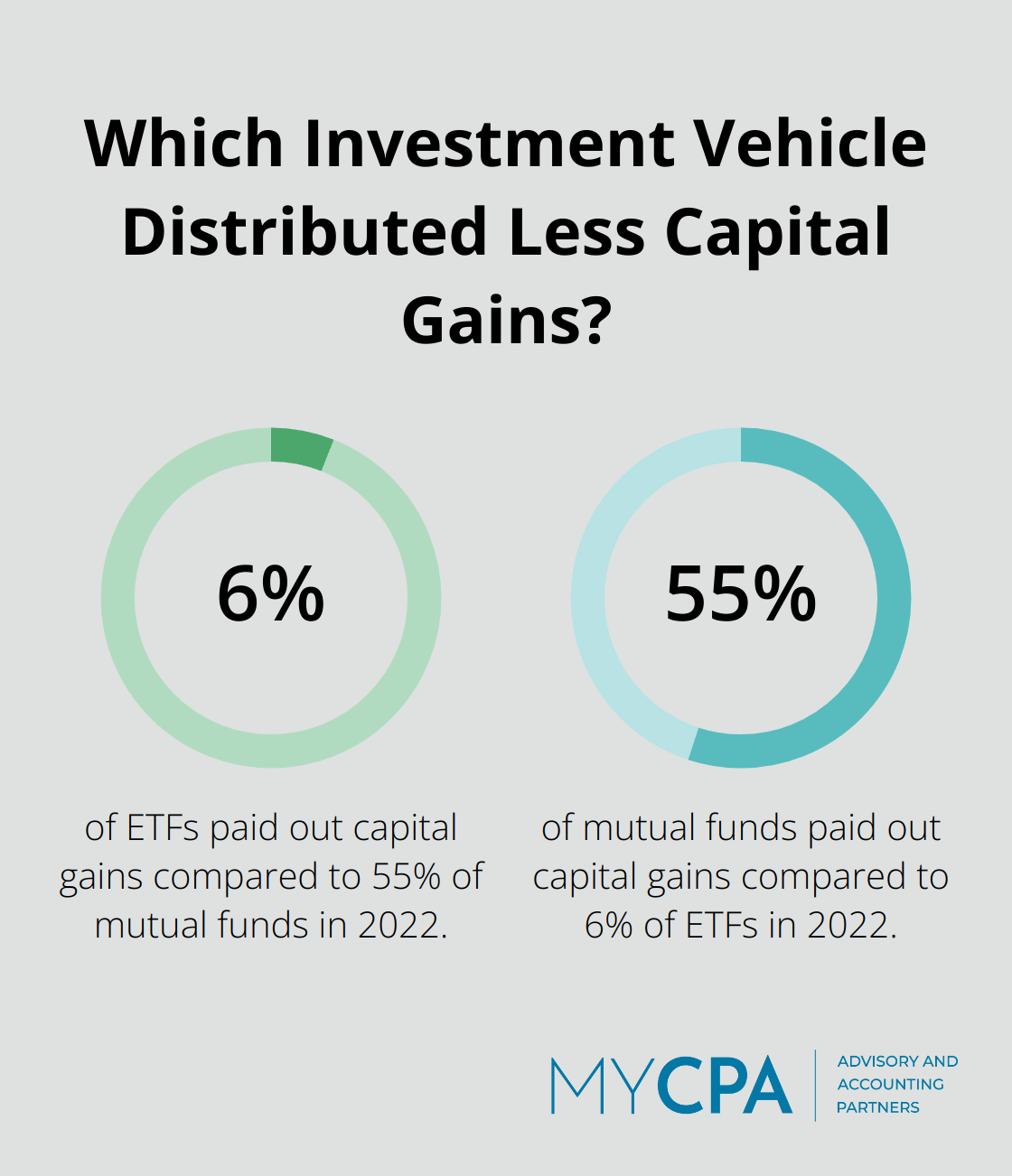

Exchange-traded funds (ETFs) typically generate fewer capital gains distributions than actively managed mutual funds. Morningstar’s data shows that in 2022, only 6% of ETFs paid out capital gains compared to 55% of mutual funds. This difference translates to substantial tax savings over time.

Tax-loss harvesting involves selling investments at a loss to offset capital gains. This strategy reduces tax liability while maintaining overall investment strategy. A Vanguard study found that tax-loss harvesting can add up to 0.35% of after-tax return annually. This figure assumes a 30% tax rate when losses are harvested and a 20% tax rate when the position is liquidated.

Many robo-advisors now offer automated tax-loss harvesting. Betterment claims their tax-loss harvesting service adds an estimated 0.77% to after-tax returns annually. However, working with a qualified tax professional (such as those at My CPA Advisory and Accounting Partners) ensures proper execution and avoids potential pitfalls like wash sale rules.

Business entity structure significantly impacts tax obligations. S Corporations can help reduce self-employment taxes. The National Federation of Independent Business reports that S Corporations are the most common form of corporation in the U.S. (with over 4.7 million in existence).

Limited Liability Companies (LLCs) offer flexibility in taxation. Unlike sole proprietors, partnerships, and LLCs, corporations pay income tax on their profits. It’s possible for an LLC to be taxed as a C corp, S corp, or a different entity type. This flexibility allows business owners to choose the most tax-advantageous option for their specific situation.

Real estate investments offer numerous tax advantages. The depreciation deduction allows investors to write off the cost of investment property over time, even as the property potentially appreciates in value. The National Association of Realtors reports that the median existing-home price rose 4.3% in 2023, which showcases the potential for both appreciation and tax benefits.

1031 exchanges allow investors to defer capital gains taxes by reinvesting proceeds from a property sale into a like-kind property. The Federation of Exchange Accommodators estimates that 1031 exchanges support 568,000 jobs and generate $55.3 billion in economic impact annually.

Income tax minimization strategies offer powerful tools for individuals and businesses to retain more of their earnings. These approaches encompass maximizing deductions and credits, strategic income timing, and investment optimization, all of which can lead to substantial savings. Tax laws are complex and ever-changing, making it challenging for most people to stay informed and compliant while maximizing their tax savings.

Professional guidance becomes invaluable in navigating the intricate world of tax planning. My CPA Advisory and Accounting Partners specializes in developing tailored income tax minimization strategies for our clients. Our team of experts stays current with the latest tax regulations and utilizes cross-disciplinary expertise to provide comprehensive financial solutions.

We work proactively to identify opportunities for tax savings, ensure accurate financial reporting, and offer personalized advice to help you achieve your financial goals. Our personalized approach means we take the time to understand your unique situation and develop strategies that align with your specific needs and objectives (whether you’re an individual or a business owner). With the right professional support, you can navigate the complex world of taxes with confidence, knowing you’re making informed decisions that support your long-term financial well-being.

Privacy Policy | Terms & Conditions | Powered by Cajabra