Most taxpayers miss significant savings opportunities by treating taxes as a year-end scramble rather than a strategic process. Poor financial tax planning costs Americans billions in unnecessary payments annually.

We at My CPA Advisory and Accounting Partners see clients reduce their tax burden by 15-30% through proper planning strategies. The difference lies in understanding when and how to implement specific techniques throughout the year.

Tax preparation focuses on past events and compliance, while tax planning shapes future financial outcomes. Tax preparation involves the completion of returns based on transactions from the previous year. Tax planning involves strategic decisions throughout the current year to minimize future tax obligations. The IRS reports that taxpayers who engage in proactive tax planning reduce their annual tax burden by an average of 12-18% compared to those who only prepare returns reactively.

The standard deduction increased to $14,600 for single filers and $29,200 for married couples who file jointly in 2024. For 2025, 401k contribution limits rose to $23,500 with catch-up contributions of $11,250 for those aged 50 or older. Traditional IRA contribution limits reached $7,000 with an additional $1,000 catch-up for older taxpayers.

Starting in 2026, high earners who make over $145,000 must make catch-up contributions to Roth 401ks with after-tax dollars. Required minimum distributions now begin at age 73 (rather than the previous age 72), which gives retirees additional time for tax-deferred growth.

The biggest mistake involves the decision to wait until December to implement tax strategies. Effective tax planning requires year-round attention to maximize deductions and timing opportunities. Another costly error involves the failure to understand the wash-sale rule when you harvest tax losses, which disallows loss deductions if substantially identical securities are repurchased within 30 days.

High earners frequently miss the mega-backdoor Roth strategy, which allows after-tax 401k contributions up to $70,000 annually when employer plans permit. The failure to coordinate retirement account contributions with tax brackets results in missed opportunities to optimize current versus future tax rates.

These fundamental concepts set the foundation for specific optimization strategies that can significantly reduce your tax burden throughout the year.

The 2025 retirement contribution limits offer substantial tax reduction opportunities that most taxpayers underutilize. Someone in the 25% bracket saves $5,750 in taxes when they contribute the full $23,000 to a 401k, while the additional catch-up contribution for those 50 or older provides significant additional savings. Traditional IRA contributions of $7,000 reduce taxable income dollar-for-dollar, though income limits apply for tax deductibility when you have employer-sponsored plans.

The mega-backdoor Roth strategy represents the most powerful wealth-building tool for high earners. This approach allows high-earning investors, who otherwise couldn’t put money in a Roth account because of income restrictions, to move funds through after-tax 401k contributions. You make after-tax contributions to your 401k beyond the standard limit, then convert those funds to a Roth account for tax-free growth. Health Savings Accounts provide triple tax benefits with $4,300 individual contribution limits for 2025 (plus an additional $1,000 for those over 55).

Business owners who fail to document expenses properly leave thousands in tax savings on the table each year. The IRS allows deductions for ordinary and necessary business expenses, which include 100% of business meals when you travel, home office expenses at $5 per square foot up to 300 square feet, and vehicle expenses at 67 cents per business mile for 2025. Technology purchases qualify for Section 179 expensing up to $1.22 million, which allows immediate deduction rather than depreciation over several years.

Professional development costs qualify as fully deductible business expenses. These include conferences, training programs, and business books. You can expense equipment purchases under $2,500 immediately rather than depreciate them, while larger purchases benefit from bonus depreciation rules that allow 80% first-year deductions for qualified property placed in service during 2025.

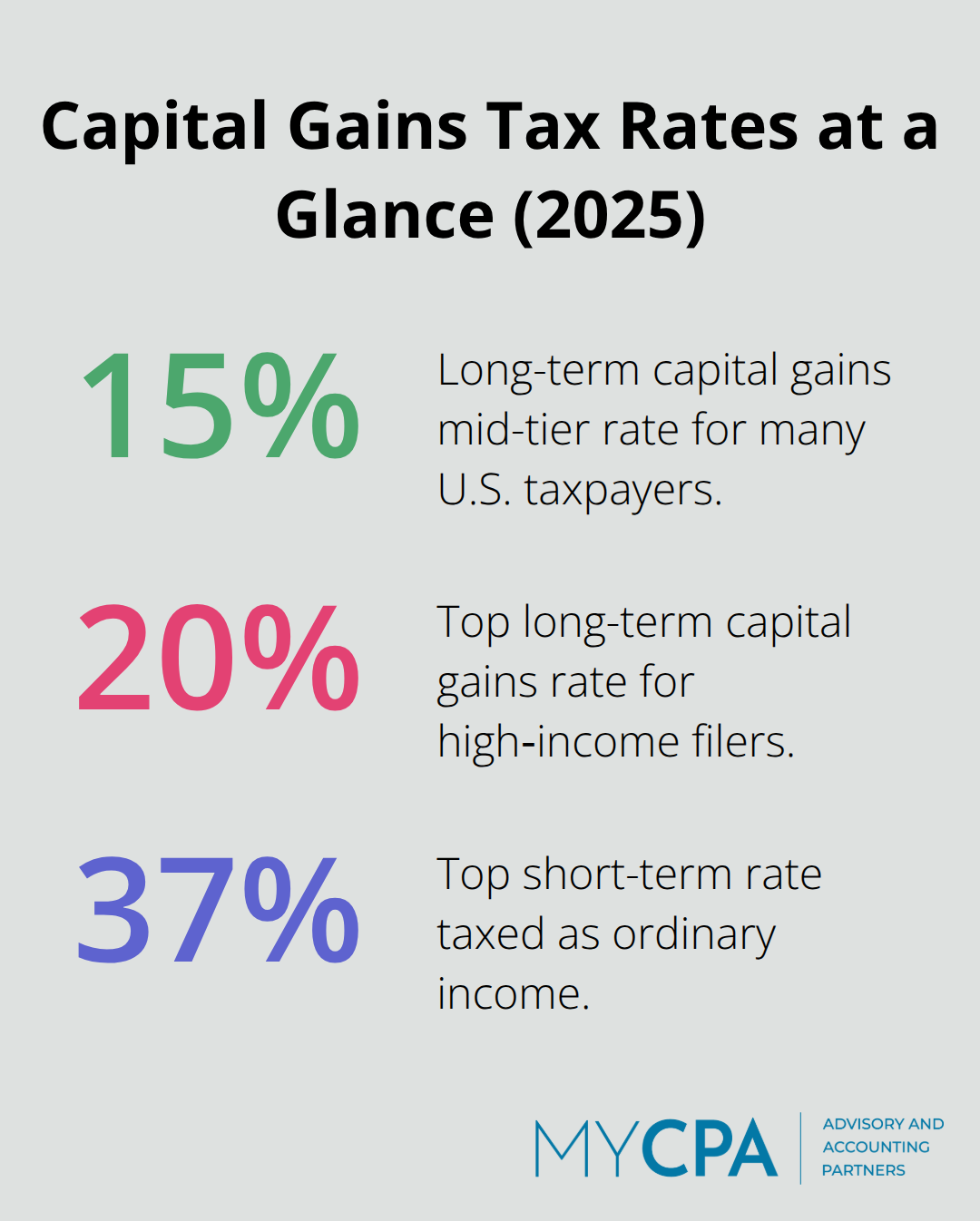

Tax loss harvesting reduces capital gains taxes when you sell losing investments to offset gains. You can deduct up to $3,000 against ordinary income when losses exceed gains. The wash-sale rule prohibits you from claiming losses if you repurchase substantially identical securities within 30 days, which makes strategic replacement investments necessary. Long-term capital gains face preferential tax rates of 0%, 15%, or 20% depending on income levels, while short-term gains get taxed as ordinary income at rates up to 37%.

Systematic harvesting throughout the year proves more effective than year-end scrambles. Market volatility creates ongoing opportunities to realize losses while you maintain desired asset allocation. You can carry forward unused losses indefinitely, which makes harvesting valuable even when current-year gains are minimal.

These optimization strategies work best when you implement them as part of a comprehensive year-round approach to tax management.

The IRS requires estimated quarterly payments when you expect to owe $1,000 or more in taxes. Self-employed individuals and business owners who miss these deadlines face penalties of 0.5% per month on unpaid amounts. The safe harbor rule protects you from penalties when you pay 100% of last year’s tax liability (110% if your prior year adjusted gross income exceeded $150,000).

We calculate quarterly payments based on current year projections rather than prior year amounts. This approach prevents overpayment and improves cash flow management. Fourth quarter payments receive special treatment – you can make the January 15th payment instead of December 31st and still avoid penalties for the previous tax year.

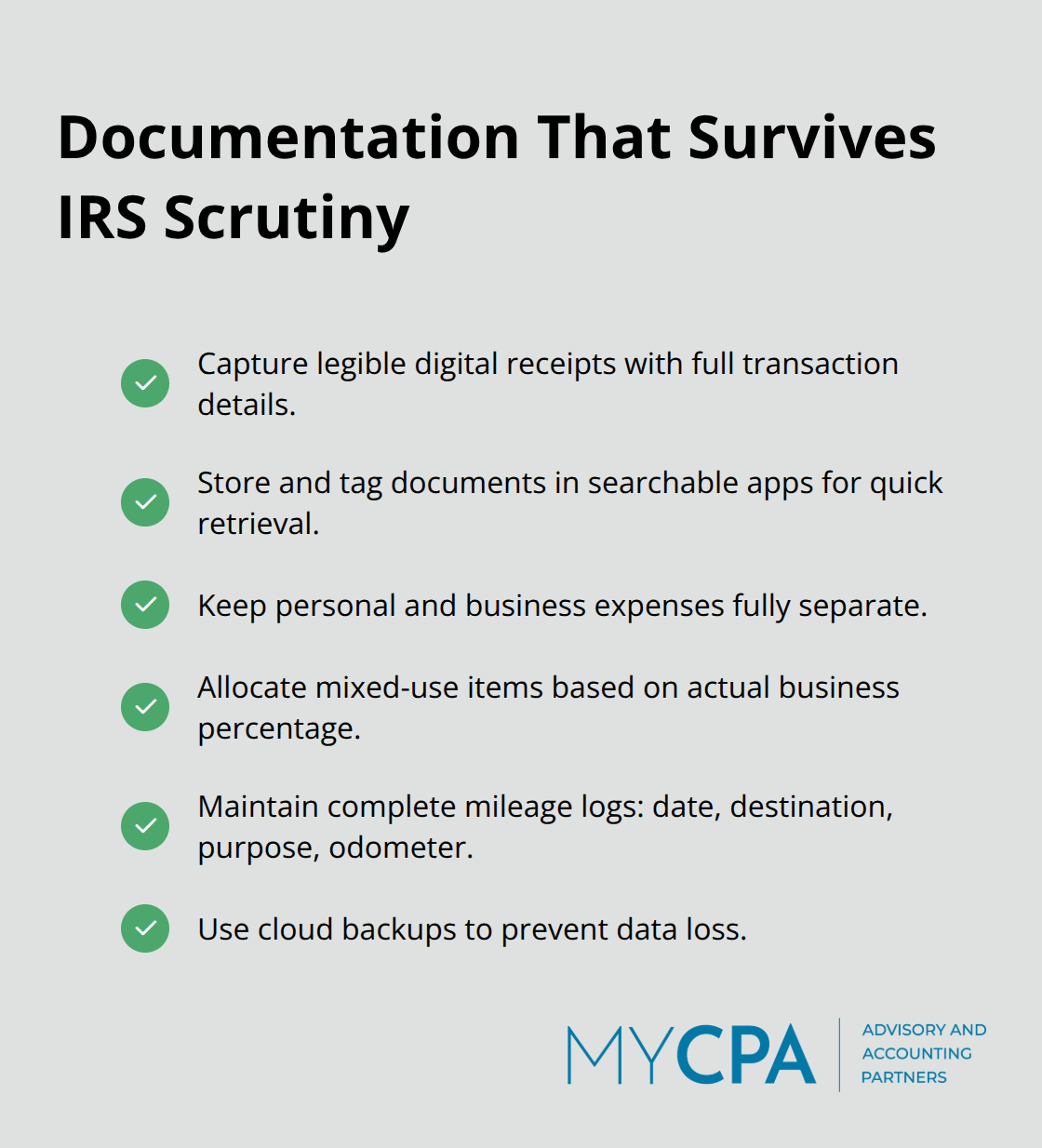

Digital receipt management through apps like Receipt Bank or Shoeboxed reduces audit risk through organized, searchable records. The IRS accepts digital copies of receipts and documents, but requires legible images that show all transaction details. Business owners must separate personal and business expenses completely – mixed-use items require allocation based on actual business percentage.

Mileage logs need specific details: date, destination, business purpose, and odometer readings for each trip. The IRS audits returns with poor documentation at rates 3-5 times higher than those with complete records. Cloud storage systems provide automatic backup and prevent document loss that could cost thousands in disallowed deductions.

Tax professionals become cost-effective when your situation involves multiple income sources, business ownership, or complex investments. Professional tax services charge an average fee of $2,351 per year, per client for comprehensive planning and advisory services. Enrolled agents, CPAs, and tax attorneys offer different expertise levels – enrolled agents specialize in tax issues, while CPAs provide broader financial guidance.

Professional fees range from $300-$1,500 for individual returns, but business owners often see 5-10 times return on investment through strategic planning. Year-round advisory relationships prove more valuable than seasonal preparation services because ongoing planning captures time-sensitive opportunities that December consultations miss.

Effective financial tax planning transforms your annual tax burden from a costly obligation into a strategic advantage. The combination of maximized retirement contributions, implemented tax-loss harvesting, and maintained proper documentation creates measurable savings that compound over time. Proactive planning delivers results that reactive preparation cannot match.

Taxpayers who implement year-round strategies reduce their tax liability by 15-30% compared to those who wait until December. The key lies in timed contributions, strategically managed investment gains and losses, and work with qualified professionals who understand complex tax regulations. Business owners, high earners, and investors with multiple income sources benefit most from professional tax advisory services.

We at My CPA Advisory and Accounting Partners provide comprehensive tax planning services that minimize tax liabilities while enhance overall financial health through personalized strategies. Start implementation of these strategies immediately rather than wait for year-end deadlines. The sooner you begin, the greater your potential savings become (and the more time you have to optimize your approach).

Privacy Policy | Terms & Conditions | Powered by Cajabra