Most business owners leave thousands of dollars on the table each year simply because they don’t have a clear BNA tax planning strategy. The difference between a reactive approach and a proactive one can mean the difference between paying more taxes than necessary and keeping more of what you earn.

At My CPA Advisory and Accounting Partners, we’ve seen firsthand how strategic planning throughout the year beats scrambling in December. This guide walks you through the fundamentals that actually move the needle for your bottom line.

Start with your prior three years of tax returns and pull out the effective tax rate you paid each year. Most business owners have no idea what percentage of their income actually went to taxes, which means they can’t spot patterns or opportunities. Calculate this number yourself: take your total tax paid and divide it by your adjusted gross income. If that rate jumped significantly year-over-year, something changed in your situation that deserves investigation. Income sources shift, deductions disappear, or credits go unclaimed.

Self-employed individuals miss an average of 15 to 20 percent of available deductions annually. That’s money sitting on the table because the deduction wasn’t tracked or wasn’t recognized as deductible in the first place.

Your marginal tax bracket determines whether your next dollar of income gets taxed at 22 percent or 37 percent, yet most business owners only know their effective rate. If you approach a bracket threshold, timing becomes everything. Accelerating expenses into the current year or deferring income into the next could save thousands. For instance, if you’re a sole proprietor earning $180,000 and considering a $30,000 business purchase, the timing of that expense matters more than the purchase itself. Buy it in December and you reduce this year’s taxable income. Wait until January and you reduce next year’s. The tax impact differs substantially depending on your projected income for each year. Use prior returns to forecast where your income will land, then work backward to identify which deductions should happen when. This isn’t guesswork; it’s arithmetic with real consequences for your cash position.

Identify deductions you claimed in prior years but didn’t claim recently. Did you have home office expenses three years ago but not last year? That’s a red flag. The IRS allows home office deductions for self-employed individuals, and they average between $5,000 and $8,000 annually depending on square footage and business use. If you stopped claiming it, you either moved or stopped qualifying. If you still qualify, you’re missing out. The same applies to vehicle expenses, professional development costs, and equipment purchases. Go through each deduction line by line and ask whether your current situation supports it.

Credits are even more commonly missed than deductions. The R&D Tax Credit applies to businesses that develop new products or processes, yet many small manufacturers and software companies don’t claim it because they don’t recognize their work qualifies. The credit can reduce your tax liability directly and sometimes generates a refund. Charitable contributions, education credits, and energy-efficiency credits all require specific documentation and recognition of eligibility. Without reviewing prior returns, you won’t spot the pattern of what you’ve claimed before and what might apply now. This gap between what you claimed and what you could claim represents the starting point for your optimization strategy. Once you understand where you stand today, you can identify which tax planning strategies will move the needle most for your business.

The timing of income and expenses across twelve months matters far more than most business owners realize. A $50,000 expense claimed in December versus January shifts your tax bracket and costs thousands in additional taxes. We at My CPA Advisory and Accounting Partners work with clients to map out their year strategically, treating tax planning as an ongoing process rather than a December scramble.

Start by projecting your income for the full year using your prior three years of returns as a baseline. If you expect to land in a higher tax bracket than last year, accelerate deductible expenses into the current year. Professional development, equipment purchases, vehicle expenses, and prepaid insurance all shift into the current year if you have the cash position to support it. Conversely, if income is unusually high this year due to a one-time project or sale, defer discretionary expenses to next year when your bracket may be lower. This approach requires honest forecasting, not wishful thinking about revenue.

The self-employed face particular timing opportunities through quarterly estimated tax payments. Most pay equally across four quarters, but if your income fluctuates seasonally, you can adjust quarterly payments to reflect actual income. A contractor earning heavily in summer months reduces Q1 and Q2 payments and increases Q3 and Q4, keeping more cash in your business during slower periods while still meeting IRS requirements. This strategy requires tracking your actual income month-to-month rather than assuming a flat distribution.

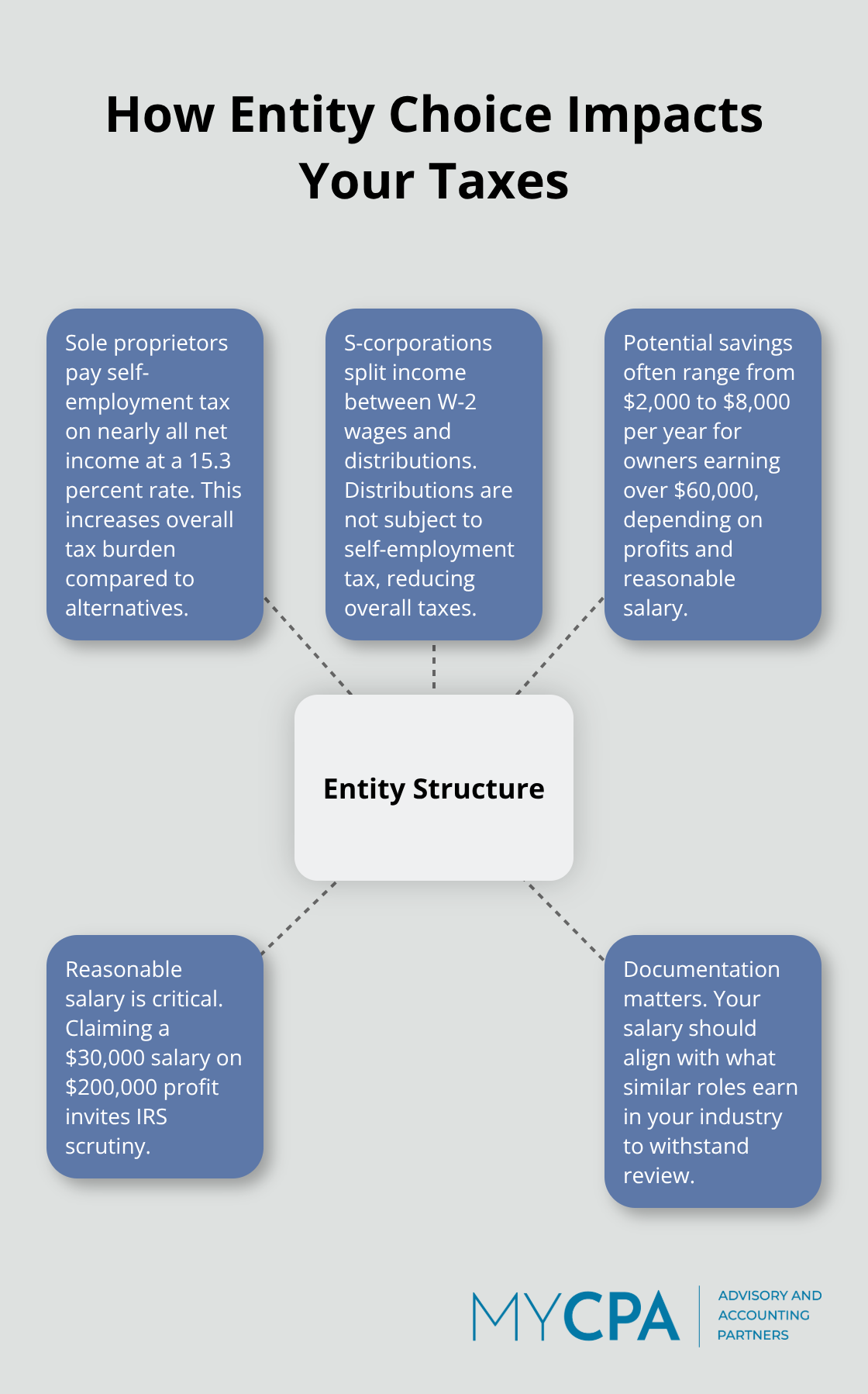

Entity structure determines how much of your income actually gets taxed. A sole proprietor pays self-employment tax on nearly all net income at a 15.3 percent rate, while an S-corporation structure owner splits income between W-2 wages and distributions, avoiding self-employment tax on distributions. For business owners earning over $60,000 annually, the S-corp structure often saves between $2,000 and $8,000 per year depending on profit levels and reasonable salary determination. However, the IRS scrutinizes S-corp wages closely, so claiming a $30,000 salary on a $200,000 profit invites audit risk. You need documentation showing your salary aligns with what similar roles earn in your industry.

Retirement contributions represent the most straightforward tax reduction available. A Solo 401(k) allows business owners to contribute up to $23,500 pre-tax or Roth dollars as an employee, with additional employer contributions available. An SEP-IRA permits contributions up to 25 percent of net self-employment income. Health Savings Accounts paired with high-deductible health plans let you contribute $4,150 individually or $8,300 for families in 2024, with the funds growing tax-free and available for qualified medical expenses forever. The key is establishing these accounts before year-end if you want to claim contributions on your current-year return. Most business owners underutilize these accounts because they assume contributions happen automatically, when in reality you must make affirmative elections and actual transfers to claim the deduction.

These structural decisions and timing strategies form the foundation of tax efficiency, but they only work when paired with accurate tracking and documentation throughout the year. The next section addresses the mistakes that undermine even the best-laid plans.

December planning amounts to reactive firefighting, not strategy. Most business owners file their returns in March or April after scrambling to gather receipts and calculate deductions in a compressed timeframe. The IRS data shows that businesses filing returns in the final weeks of tax season claim significantly fewer deductions than those who planned throughout the year, suggesting both rushed accuracy and missed opportunities. When you wait until year-end, you’ve already made spending decisions without tax consideration. A $15,000 equipment purchase made in November with no knowledge of your tax bracket costs substantially more than the same purchase made in August when you had time to evaluate its impact.

State and local tax obligations compound this mistake. Most business owners focus exclusively on federal taxes and overlook that 43 states plus the District of Columbia impose income taxes, and many require quarterly estimated payments separate from federal deadlines. Missing a state deadline costs penalties and interest that federal planning wouldn’t have prevented. A business owner in California earning $200,000 faces a 9.3 percent state income tax rate, meaning a $30,000 deduction saves $2,790 in state taxes alone. Without state-specific planning, that opportunity disappears. If you operate in multiple states, you need to coordinate estimated payment schedules across jurisdictions so you don’t underpay one state while overpaying another.

Documentation failures create a third category of expensive mistakes. The IRS challenges business expense deductions at higher rates than wage earners claim them, and without contemporaneous records showing what the expense was, when it occurred, and why it was business-related, the deduction gets disallowed entirely. A contractor who spent $8,000 on professional development but failed to keep course receipts and attendance records loses the deduction in an audit, even though the expense genuinely qualified. Inadequate record keeping costs thousands in missed deductions and audit penalties that proper documentation would have prevented.

The solution requires shifting from December scrambling to month-by-month tracking and decision-making. Establish a system now where every business expense gets recorded with a description, date, and business purpose the moment it occurs. Use accounting software or a simple spreadsheet that categorizes expenses by type, making year-end reconciliation straightforward rather than chaotic.

Project your income quarterly and adjust your tax strategy based on actual results rather than assumptions. If your third quarter earnings landed 40 percent higher than expected, you have time to accelerate deductible expenses or increase retirement contributions before December 31.

State tax planning requires the same attention as federal planning. Review your entity structure annually to confirm it still minimizes state taxes where you operate. An S-corp structure that saves federal taxes might increase state compliance costs in a particular state, making a different structure more efficient overall. Proactive planning throughout the year allows you to catch these issues before they become expensive problems. The difference between proactive planning and reactive filing isn’t just a better tax outcome; it’s the difference between controlling your tax situation and letting your tax situation control you.

Tax planning fundamentals rest on three core principles: understanding where you stand today, making strategic decisions throughout the year, and documenting everything properly. Your effective tax rate tells you whether you pay too much, your marginal bracket determines whether your next dollar gets taxed at 22 percent or 37 percent, and your deductions and credits reveal gaps between what you claim and what you could claim. Once you see these patterns, the path forward becomes clear.

Implementing your BNA tax planning strategy requires you to shift from December scrambling to ongoing tracking throughout the year. Project your income quarterly, adjust your expenses based on actual results, and establish systems that capture business expenses the moment they occur. Review your entity structure annually to confirm it still minimizes both federal and state taxes, and maximize retirement contributions and tax-advantaged accounts before year-end.

The complexity of multi-state compliance and tax optimization makes professional guidance valuable, and we at My CPA Advisory and Accounting Partners offer tax services designed to minimize your liabilities while providing accurate financial reporting and personalized business advisory. Our cross-disciplinary expertise means your tax strategy integrates with your overall financial plan rather than existing in isolation, and we handle the technical details so you can focus on running your business. If you’re ready to move beyond reactive filing and implement a strategy that actually moves your bottom line, contact us to discuss your situation.

Privacy Policy | Terms & Conditions | Powered by Cajabra