Fiduciary tax planning is a complex yet essential aspect of managing trusts, estates, and other fiduciary relationships. At My CPA Advisory and Accounting Partners, we understand the critical role it plays in preserving wealth and minimizing tax liabilities.

Effective strategies can significantly impact the financial outcomes for both fiduciaries and beneficiaries. This blog post will explore key approaches to optimize fiduciary tax planning and avoid common pitfalls that could lead to costly mistakes.

Fiduciary relationships form the foundation of trust and estate management. These relationships involve a fiduciary who holds a position of trust and responsibility to act in the best interests of another party, known as the beneficiary. Various types of fiduciaries exist, each with unique responsibilities and tax implications.

Trustees manage assets held in a trust for the benefit of beneficiaries. Executors administer the estate of a deceased person. Guardians act as fiduciaries when they manage assets for minors or incapacitated individuals.

Each role carries significant tax planning responsibilities. For example, trustees must make decisions about income distributions that can have substantial tax consequences for both the trust and its beneficiaries. A 2024 study by the American College of Trust and Estate Counsel revealed that trusts with income over $14,450 face a top tax rate of 37%, emphasizing the need for strategic distribution planning.

Effective tax planning is not just beneficial – it’s essential for fiduciaries. The Internal Revenue Service (IRS) reported in 2023 that fiduciaries who failed to properly manage tax obligations faced an average penalty of $9,800. This fact underscores the financial risks of neglecting tax planning in fiduciary roles.

Tax planning for fiduciaries extends beyond mere compliance. It involves strategic decision-making to maximize the value of assets for beneficiaries. For instance, timing distributions to coincide with beneficiaries’ lower-income years can result in significant tax savings.

Fiduciaries must navigate a labyrinth of tax rules that often differ from individual or corporate tax regulations. The “65-day rule” (which allows trustees to elect to treat distributions made within 65 days after the end of the tax year as if they were made on the last day of that tax year) exemplifies the complexity of these regulations. This flexibility can serve as a powerful tool for tax optimization when used correctly.

Understanding these nuances is critical. Fiduciaries who actively engage in tax planning typically reduce overall tax burdens by 15-20% compared to those who take a passive approach.

As we move forward, we will explore key strategies that fiduciaries can employ to optimize their tax planning efforts and maximize benefits for their beneficiaries.

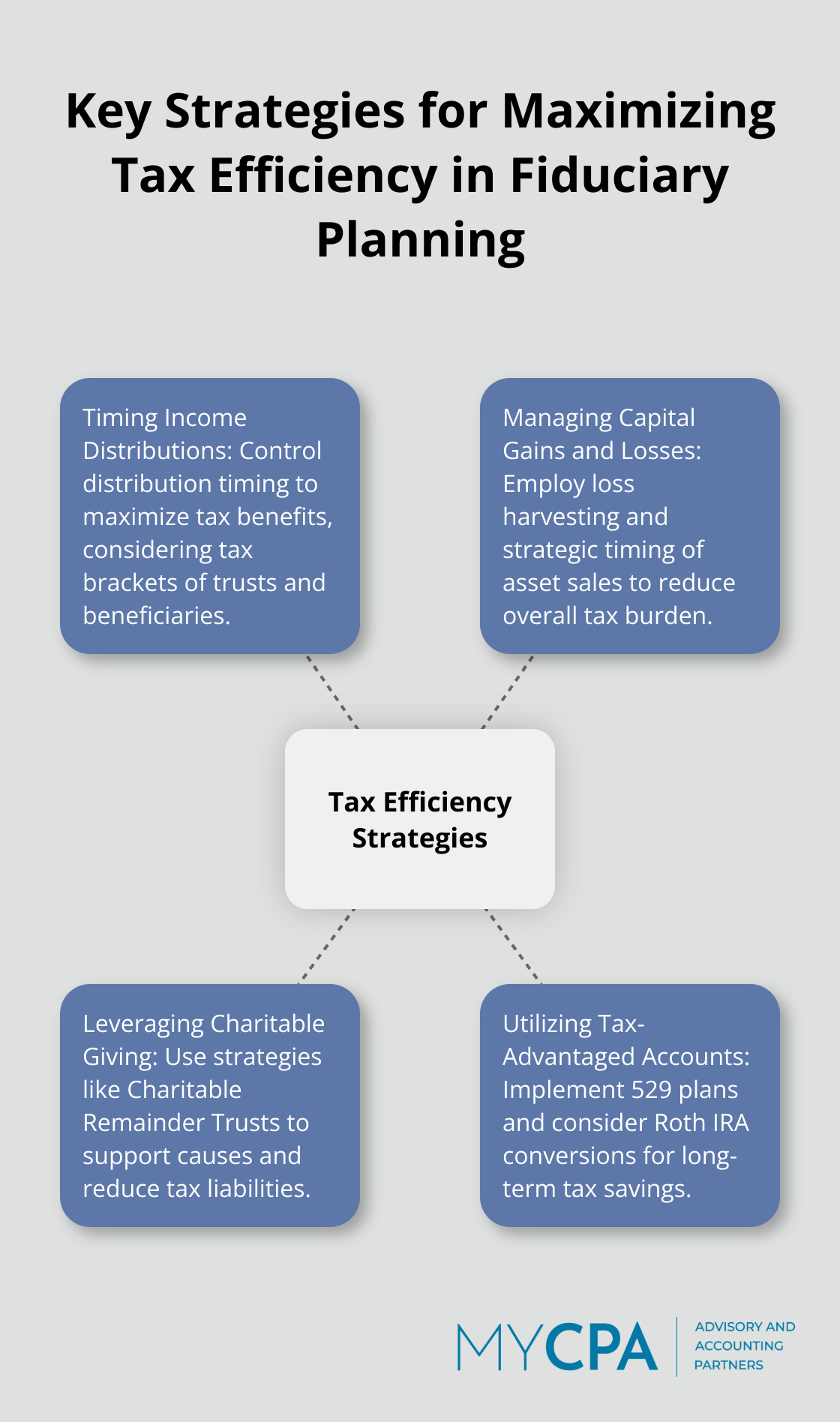

Fiduciaries can control the timing of income distributions to maximize tax benefits. Analysis of tax brackets for both trusts and beneficiaries informs these decisions. For instance, if a trust falls into the highest tax bracket (37% for income over $14,450 in 2025), but a beneficiary occupies a lower bracket, income distribution to the beneficiary can yield substantial tax savings.

The 65-day rule provides additional flexibility. This rule allows trustees to elect distributions made within 65 days after the tax year-end as if made on the last day of that year. It proves particularly useful for year-end tax planning when the full financial picture becomes clearer.

Effective management of capital gains and losses can reduce the overall tax burden of a trust or estate. Fiduciaries should consider loss harvesting to offset gains.

Timing plays a critical role when selling appreciated assets. If possible, spreading sales over multiple tax years helps avoid pushing the trust into higher tax brackets. Consideration of the step-up in basis for inherited assets can provide substantial tax savings when planning asset sales.

Charitable giving strategies offer dual benefits: support for worthy causes and reduced tax liabilities. Charitable remainder trusts (CRTs) have gained popularity among fiduciaries.

CRTs allow for the donation of appreciated assets to charity while providing income to beneficiaries and generating a tax deduction. This strategy proves particularly effective for highly appreciated assets that would otherwise trigger significant capital gains taxes if sold.

Tax-advantaged accounts play a crucial role in fiduciary tax planning. For example, 529 plans for education expenses offer tax-free growth and withdrawals for qualified expenses. According to the College Savings Plans Network, the average 529 plan balance hit a record $27,741 as of June 30, 2023, highlighting the potential for significant tax savings over time.

For retirement planning, Roth IRA conversions for beneficiaries in lower tax brackets should be considered. This strategy can provide tax-free growth and distributions in the future, potentially saving beneficiaries thousands in taxes over their lifetimes.

Implementation of these strategies requires a deep understanding of tax law and careful consideration of each beneficiary’s unique situation. Professional guidance from experienced advisors can help navigate the complexities of fiduciary tax planning and ensure compliance with all relevant regulations.

As we move forward, we will explore common pitfalls in fiduciary tax planning and how to avoid them, ensuring a comprehensive approach to wealth preservation and tax optimization.

Fiduciary tax planning contains potential pitfalls that can lead to significant financial consequences. One of the most frequent oversights involves the failure to consider the tax situations of individual beneficiaries. Each beneficiary may have a unique tax profile, and distributions that seem beneficial for the trust might create unfavorable tax consequences for the recipient.

A distribution could push the beneficiary into a higher tax bracket if it’s made from the trust income rather than the trust principal. This could result in a larger overall tax burden for the beneficiary.

Fiduciaries should conduct a comprehensive analysis of each beneficiary’s tax situation before making distribution decisions. This analysis must include consideration of their income from other sources, deductions, and potential future financial changes.

While federal taxes often take center stage, state tax implications can be equally detrimental. State tax laws vary widely and can significantly affect the overall tax liability of a trust or estate.

Some states tax trusts based on the residence of the trustee, while others consider the location of the trust’s administration or the domicile of the settlor. In 2024, 34 states have implemented state tax changes, including modifications to state income tax and business tax regulations.

Fiduciaries must know these state-specific rules and consider them in their planning. This consideration might involve the strategic selection of trustees or trust situs to minimize state tax burdens. Fiduciaries must also track beneficiary relocations, as a move to a different state can alter the tax landscape dramatically.

Improper documentation and record-keeping can lead to serious issues during audits and legal challenges. The IRS requires fiduciaries to maintain detailed records of all transactions, distributions, and tax-related decisions.

To mitigate this risk, fiduciaries should implement robust systems for tracking all financial activities, maintaining clear communication logs with beneficiaries, and documenting the rationale behind key decisions. Regular reviews and audits of these records can help identify and address any gaps before they become problematic.

The intricacies of tax law can confound even experienced fiduciaries. Misinterpretation of complex rules can result in costly errors and potential penalties. For instance, the “65-day rule” allows trustees to elect distributions made within 65 days after the tax year-end as if made on the last day of that year. Misapplication of this rule could lead to unintended tax consequences.

Fiduciaries must stay current with tax law changes and seek professional advice when necessary. Continuous education and consultation with tax experts can prevent misunderstandings and ensure compliance with evolving regulations.

Fiduciary tax planning requires a strategic approach to manage trusts and estates effectively. Fiduciaries must implement key strategies such as timing income distributions, managing capital gains and losses, and leveraging charitable giving to reduce tax liabilities. They also need to avoid common pitfalls like overlooking beneficiary tax situations, neglecting state tax implications, and misunderstanding complex tax rules.

Professional guidance proves invaluable in navigating the intricacies of fiduciary tax planning. Experts can develop tailored strategies that maximize tax efficiency while ensuring compliance with relevant regulations. They also stay informed about evolving tax laws and consider the unique circumstances of each beneficiary.

At My CPA Advisory and Accounting Partners, we offer comprehensive fiduciary tax planning services. Our team can help fiduciaries fulfill their responsibilities, minimize tax burdens, and optimize financial outcomes for the trusts and estates they manage (while maintaining compliance with all applicable laws). Partnering with experienced professionals allows fiduciaries to navigate complex tax landscapes with confidence.

Privacy Policy | Terms & Conditions | Powered by Cajabra