The final quarter presents the most powerful window for reducing your tax burden. Strategic year end tax planning can save thousands of dollars when executed properly.

We at My CPA Advisory and Accounting Partners see clients reduce their tax liability by 15-30% through well-timed moves before December 31st. The key lies in understanding which strategies work best for your specific financial situation.

Tax rates will increase significantly starting in 2026 when the Tax Cuts and Jobs Act provisions expire. The top marginal rate jumps from 37% to 39.6%, which makes 2025 your last opportunity to take advantage of lower rates. This creates a compelling case for acceleration of income into 2025 and deferral of deductions to future years when rates climb higher.

Smart taxpayers manipulate the timing of income and expenses to minimize their overall tax burden. If you expect to be in a higher bracket next year, accelerate deductible expenses like medical bills, charitable contributions, and business purchases into 2025. Conversely, if you anticipate lower income next year, defer income through delayed invoices or bonus deferrals. The standard deduction rises to $15,750 for single filers and $31,500 for married couples in 2025, which makes itemization beneficial only when deductions exceed these thresholds.

Business owners possess far more flexibility than individual taxpayers. You can defer revenue recognition when you delay December invoices until January or accelerate expenses through equipment purchases that qualify for Section 179 deductions up to $1,220,000. The 20% qualified business income deduction expires after 2025 (making this year critical for maximization of pass-through entity benefits). Business structures also allow retirement plan contributions that provide immediate deductions while they build tax-deferred wealth. Personal taxpayers lack these income-shifting opportunities and must focus primarily on investment timing and retirement contributions to optimize their tax position.

These fundamental strategies set the foundation for more specific tactics that target both individual and business tax planning situations.

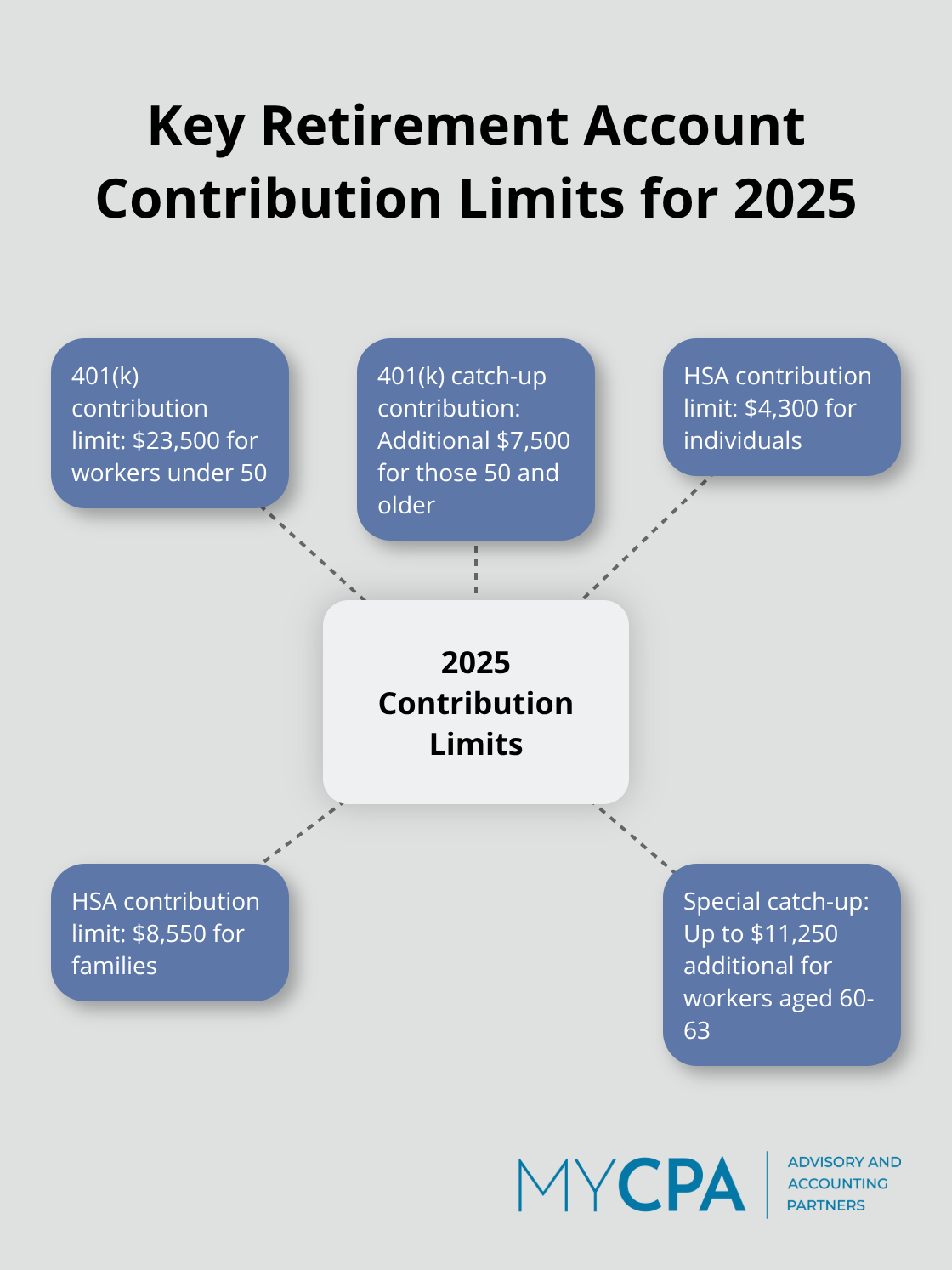

Retirement contributions provide the most direct path to substantial tax reduction. Workers under 50 can contribute $23,500 to 401(k) plans in 2025, while those 50 and older add an extra $7,500 catch-up contribution. The new catch-up rules allow workers aged 60-63 to contribute up to $11,250 additional if their employer permits it.

High earners blocked from direct Roth IRA contributions should execute backdoor Roth conversions before year-end. Health Savings Account contributions reach $4,300 for individuals and $8,550 for families, which provide triple tax benefits through deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

Health Savings Accounts outperform traditional retirement accounts because medical expenses in retirement are guaranteed. These accounts allow you to deduct contributions today, grow investments tax-free, and withdraw funds without taxes for qualified medical expenses. After age 65, you can withdraw HSA funds for any purpose (paying ordinary income tax like a traditional IRA).

Tax-loss harvesting generates immediate tax savings when you offset capital gains with realized losses. You can deduct up to $3,000 in net losses against ordinary income annually, with unlimited carryforward of excess losses. December represents the final opportunity to realize losses that offset gains from earlier in the year.

The wash sale rule prevents repurchase of identical securities within 30 days, but you can buy similar assets to maintain market exposure while you capture tax losses. This strategy works particularly well in volatile markets where temporary declines create tax opportunities.

Income acceleration makes sense when you expect higher tax rates in 2026, while deferral works when you anticipate lower future income. Business owners control this through delayed invoices or accelerated equipment purchases that qualify for Section 179 deductions (up to $1,250,000).

These foundational strategies prepare you for more sophisticated techniques that can multiply your tax savings through advanced planning methods.

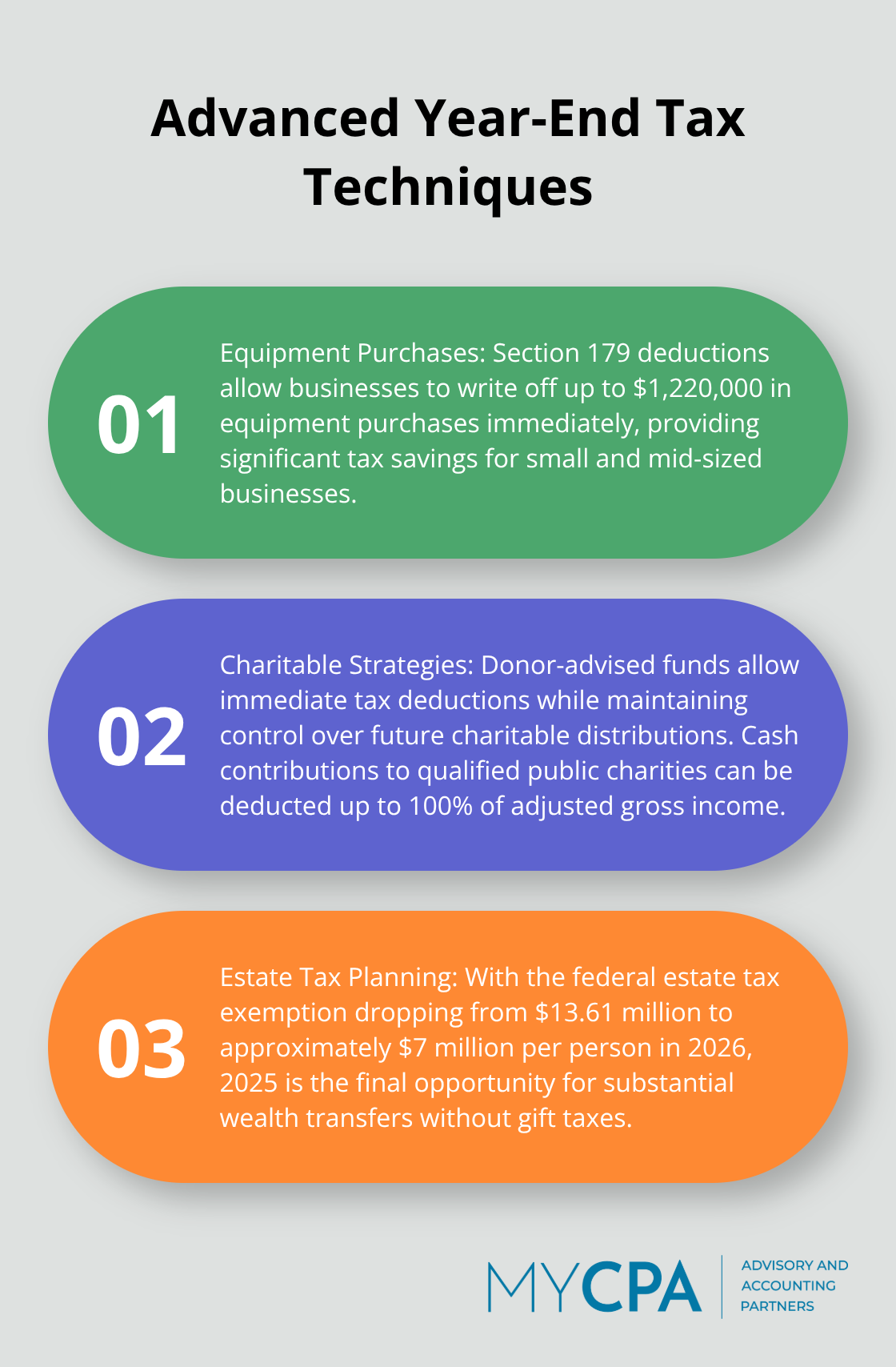

Section 179 deductions allow businesses to write off up to $1,220,000 in equipment purchases immediately rather than depreciate them over years. This deduction phases out once equipment purchases exceed $3,050,000, which makes it perfect for small and mid-sized businesses. Manufacturing equipment, office furniture, computers, and vehicles under 6,000 pounds qualify for this treatment.

Bonus depreciation rules let you deduct 60% of equipment costs in the first year after Section 179 limits are reached. Smart business owners time major equipment purchases for December delivery to capture full deductions in the current tax year. Software purchases also qualify when they control machinery or have a determinable useful life of one year or less.

Donor-advised funds allow you to claim immediate tax deductions while you maintain control over future charitable distributions. You contribute appreciated stock to the fund, receive a deduction for the full market value, and avoid capital gains taxes entirely. The fund grows tax-free while you recommend grants to qualified charities over time.

Cash contributions can be deducted up to 100% of adjusted gross income when made to qualified public charities. Contributions to private foundations face limits of 30% of AGI. You can bunch charitable contributions into alternating years to maximize itemized deductions when they exceed standard deduction thresholds.

The federal estate tax exemption drops from $13.61 million per person to approximately $7 million in 2026 when Tax Cuts and Jobs Act provisions expire. Married couples lose over $13 million in combined exemptions, which makes 2025 the final opportunity for substantial wealth transfers without gift taxes.

Annual gift exclusions remain at $19,000 per recipient (but five-year front-loading of 529 contributions allows $95,000 gifts per beneficiary without using lifetime exemptions). Grantor trusts let you transfer assets while you pay income taxes on trust earnings, which provides additional tax-free benefits to beneficiaries. These advanced tax strategies require immediate action since legislative changes cannot be reversed once implemented.

The most effective year-end tax planning strategies focus on retirement contributions, tax-loss harvesting, and strategic income timing. Workers can maximize 401(k) contributions to $23,500 and execute backdoor Roth conversions to provide immediate tax relief while they build long-term wealth. Business owners gain additional advantages through Section 179 equipment deductions up to $1,220,000 and qualified business income deductions that expire after 2025.

Professional tax advisory becomes essential when you navigate complex strategies like donor-advised funds, estate planning before exemption reductions in 2026, and multi-year income acceleration plans. We at My CPA Advisory and Accounting Partners help clients implement personalized strategies that align with individual financial situations. Tax professionals can identify opportunities that individual taxpayers often miss during their own year-end tax planning efforts.

Your action plan starts when you calculate maximum retirement contributions and identify tax-loss harvesting opportunities in your investment portfolio. Business owners should evaluate equipment purchases and income deferral options before December 31st. The window for effective year-end tax planning closes rapidly, which makes immediate consultation with qualified tax professionals your most valuable investment for substantial tax savings.

Privacy Policy | Terms & Conditions | Powered by Cajabra