Year-end business tax planning isn’t something to rush through in December. Most business owners leave thousands of dollars on the table by missing deductions, timing opportunities, and structure-specific strategies that could reduce their tax bill.

At My CPA Advisory and Accounting Partners, we’ve seen firsthand how strategic planning in the final weeks of the year makes a measurable difference. This guide walks you through the deductions you’re likely missing, timing tactics that work, and approaches tailored to your business structure.

Most business owners capture the obvious deductions-office rent, salaries, supplies-but miss thousands in legitimate write-offs that sit right in front of them. Equipment purchases are a prime example. Under the One Big Beautiful Bill Act passed in 2025, 100% bonus depreciation is now permanently available for qualifying assets placed in service, meaning you can deduct the full purchase price immediately rather than spreading it over years. This applies to both new and used equipment, which is a significant advantage if you plan machinery, computers, or production assets before year-end.

Section 179 expensing also expanded, allowing you to deduct up to $1,220,000 in qualifying property in 2025 alone, with the phase-out threshold at $4,600,000. The catch is that these assets must be placed in service-not just ordered-by December 31st, so timing matters. If your business uses vehicles, the first-year depreciation limit for cars is $18,000 when bonus depreciation applies, but only $12,200 without it. Luxury auto rules still cap deductions, so a $60,000 vehicle doesn’t yield proportional tax savings. The vehicle must be used more than 50% for business purposes, and you’ll need contemporaneous records showing business miles versus personal use.

Home office deductions confuse many owners because the IRS allows two methods: the simplified method at $5 per square foot (capped at 300 square feet, so maximum $1,500 annually) or the actual expense method. The actual method is almost always better if your office is permanent and exclusive. You deduct a percentage of mortgage interest, property taxes, utilities, insurance, and repairs based on office square footage divided by total home square footage. A 200-square-foot office in a 2,000-square-foot home means you claim 10% of those expenses.

Vehicle expenses work similarly-you either use the standard mileage rate or track actual expenses like fuel, maintenance, and depreciation. The mileage rate is simpler but often yields less than actual expenses for high-mileage users. You cannot deduct commuting to your office, but trips from your office to client sites, supply runs, or meetings count fully. If you use a vehicle for both business and personal purposes, maintain a mileage log showing dates, destinations, and business purpose. The IRS scrutinizes vehicle deductions heavily, so documentation is non-negotiable.

Retirement plan contributions are deductible expenses that simultaneously build your future security, making them the most efficient tax move available. A SEP IRA lets you contribute up to 25% of net self-employment income (capped at $70,000 in 2025) with minimal setup costs. An individual 401(k) works better if you have no employees and earn substantial income-you can contribute up to $69,500 in employee deferrals plus another $23,500 in employer contributions (higher if you’re over 50), totaling $93,000.

A SIMPLE IRA costs less to administer than a 401(k) but limits contributions to $16,000 per employee plus employer match. The deadline for SEP IRA contributions is your tax filing deadline including extensions, so you have until October 15, 2026 for 2025 contributions if you file an extension. For 401(k)s, employee deferrals must be made by December 31st, but employer contributions have until your filing deadline. Catch-up contributions of an additional $7,500 (SEP and SIMPLE) or $8,000 (401(k)) apply if you’re 50 or older. These contributions reduce your taxable income dollar-for-dollar, and the funds grow tax-free until withdrawal, making them far superior to saving in a taxable account.

The timing of these moves determines whether you capture the full tax benefit this year or miss the window entirely. Strategic income and expense decisions in the final weeks of the year amplify these deductions and set the stage for substantial tax savings.

The difference between a $5,000 tax bill and a $15,000 tax bill often comes down to decisions made in November and December. Most business owners treat year-end tax planning as an afterthought, but strategic timing of income and expenses directly controls your taxable income. If you operate on a cash basis-meaning you report income when received and expenses when paid-you have genuine control over your 2025 tax liability through strategic timing.

Accelerate deductible expenses before December 31st to reduce this year’s taxable income immediately. This means paying your year-end vendor invoices, employee bonuses, and professional services bills before the calendar flips. The IRS requires that these expenses be actually paid, not merely promised or accrued, so a check must clear or a credit card charge must post by year-end. If you plan major equipment purchases, the 100% bonus depreciation rules for equipment purchases now allow you to deduct the entire purchase price in the year placed in service, making December timing especially valuable.

If your business had an unusually strong year and profits are higher than expected, deferring income gives you control. Delay client invoices until January 2nd or push final project payments into the new year to shift that revenue into 2026, lowering your 2025 taxable income. This only works if you genuinely control the timing-you cannot artificially delay payment from customers who want to pay before year-end. The tradeoff is cash flow, so this strategy works best when liquidity isn’t tight or when you can cover year-end obligations with a line of credit.

Estimated tax payments create a parallel timing challenge that many owners mishandle. If you expect to owe $1,000 or more when you file your 2025 return, the IRS requires quarterly estimated payments throughout the year. The safe harbor rule states you must pay either 90% of your 2025 tax liability or 100% of your 2024 tax liability, whichever is smaller, to avoid underpayment penalties. If your 2024 adjusted gross income exceeded $150,000 (or $75,000 for married filing separately), the threshold rises to 110% of your 2024 tax.

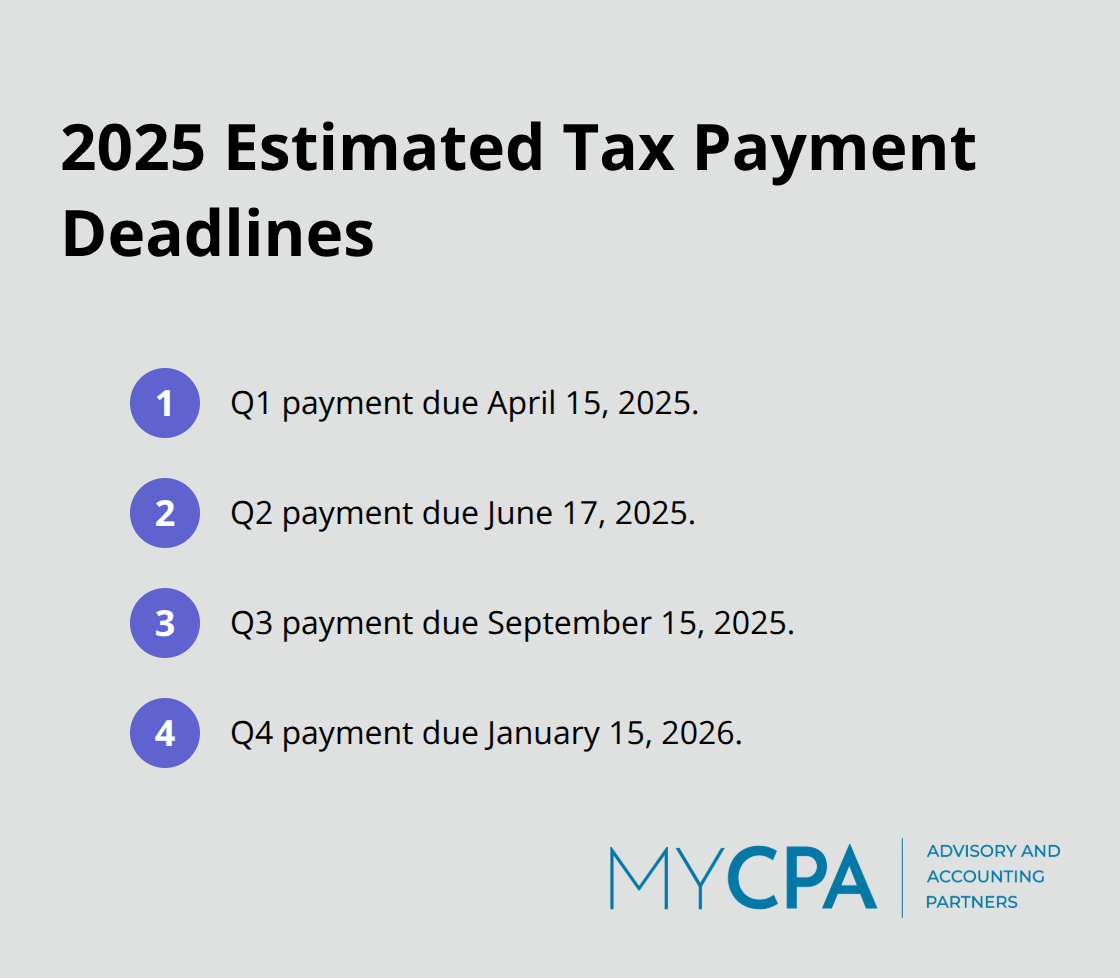

Most business owners underpay estimated taxes and discover the penalty when filing their return-a costly mistake that’s entirely avoidable. If you’re tracking toward a strong year, increase your Q4 estimated payment now to protect yourself from penalties and reduce the shock of a large tax bill in April. If profits are weaker than expected, you can adjust downward to avoid overpaying. The quarterly deadlines are April 15th, June 17th, September 15th, and January 15th of the following year, so the final 2025 payment is due January 15, 2026.

Coordinate your expense acceleration and income deferral decisions with your estimated tax position to avoid creating a cash flow crisis while trying to reduce taxes. Model your year-end position in late October or early November so you have time to execute these moves without rushing. This preparation sets the foundation for understanding how your business structure-whether you operate as an S-Corp, sole proprietorship, LLC, or partnership-can further optimize your tax outcome.

Your business structure determines how much of your income flows to the IRS and how much stays in your pocket. This isn’t theoretical-the difference between operating as a sole proprietor versus an S-Corp can mean $5,000 to $20,000 in annual tax savings depending on your profit level. Business owners often lock themselves into the wrong structure simply because they never revisit the decision after launch.

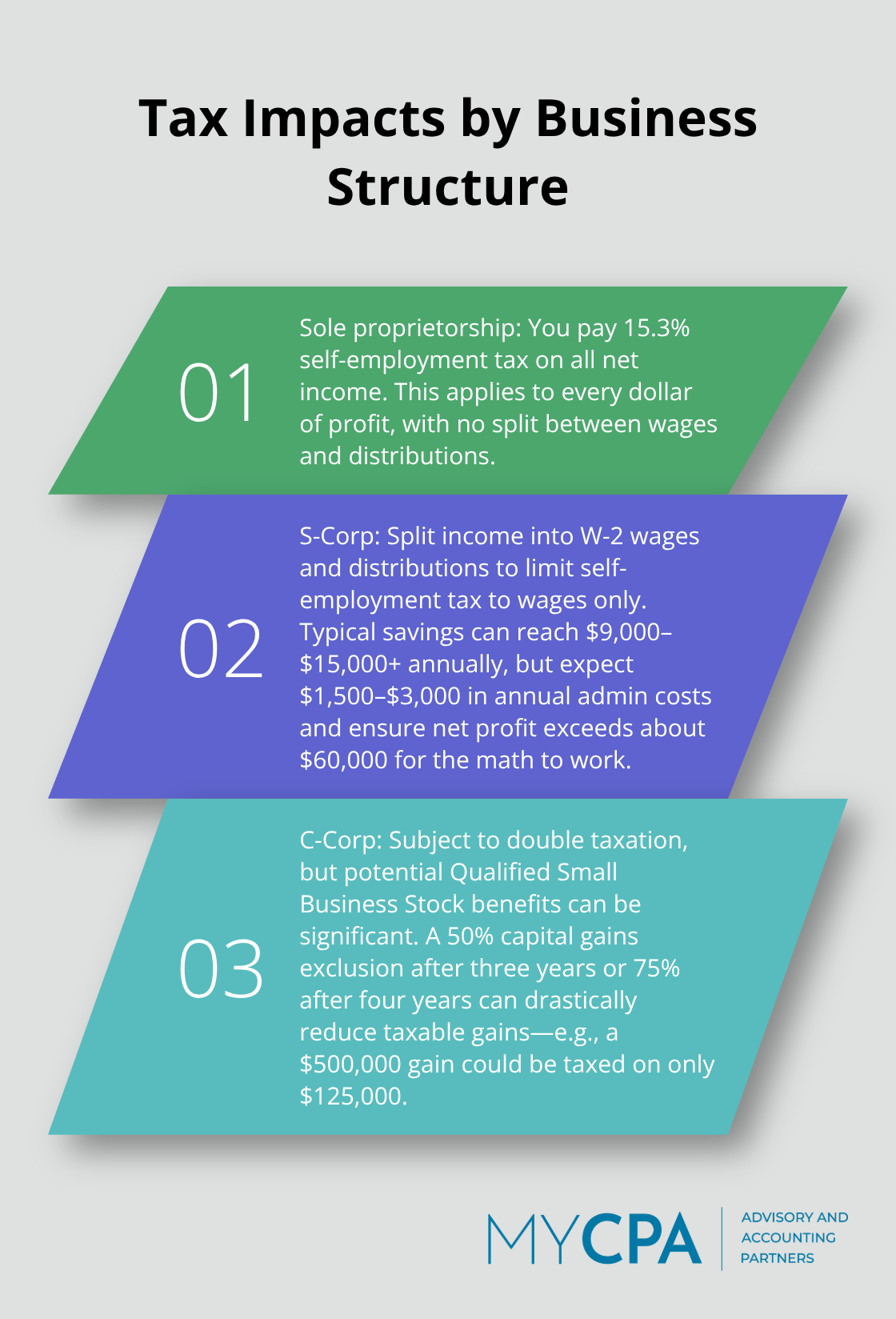

A sole proprietor pays self-employment tax on all net income at 15.3%, meaning a $100,000 profit costs roughly $15,300 in self-employment taxes alone. This tax burden applies to every dollar of profit, with no opportunity to separate wages from distributions. The simplicity of sole proprietorship appeals to new business owners, but that simplicity comes at a significant tax cost once profits climb above modest levels.

An S-Corp lets you split income into W-2 wages and distributions, paying self-employment tax only on reasonable W-2 wages while distributions escape this tax entirely. S-Corp tax advantages and self-employment tax savings can reach $9,000–$15,000+ annually for eligible business owners. The tradeoff is complexity-S-Corps require payroll processing, quarterly filings, and corporate tax returns that cost $1,500 to $3,000 annually in professional fees. The math works when your net profit exceeds $60,000; below that threshold, the administrative burden outweighs the tax savings.

LLCs and partnerships don’t automatically reduce self-employment taxes unless you elect S-Corp taxation, which is the real lever. Pass-through entities like LLCs taxed as S-Corps also qualify for the 20% qualified business income deduction under Section 199A, allowing eligible owners to deduct one-fifth of their business income if they meet income thresholds and don’t operate in restricted service businesses like accounting or law. This deduction phases out for single filers above $182,100 and married filers above $364,200 in 2025, so high-income owners need to plan around these limits.

C-Corporations face double taxation-the corporation pays tax on profits at the federal level, then shareholders pay tax again on dividends-which sounds terrible until you factor in reinvestment and exit strategy. If you plan to sell your business within five years, a C-Corp structure unlocks qualified small business stock benefits and capital gains exclusion with a 50% exclusion for a three-year holding period and a 75% exclusion for a four-year holding period. This means a $500,000 gain could be reduced to $125,000 in taxable gains, saving roughly $37,500 at a 30% combined tax rate. You cannot access these benefits as a sole proprietor or pass-through entity, making C-Corp structure essential for acquisitions or exits.

Tax planning strategies evolve as your business grows, making annual reviews essential for staying aligned with your goals. Most business owners should model their structure annually because profit levels change, exit timelines shift, and tax law evolves. A $40,000 profit sole proprietor becomes a $150,000 profit S-Corp candidate within two years, and missing that transition costs real money. Conversion timing matters too-switching from LLC to S-Corp mid-year creates complexity, so plan the change for January 1st if you decide to move forward.

Year-end business tax planning delivers measurable results when you act decisively in the final weeks of the year. The deductions you’ve learned about, the timing strategies that control your taxable income, and the structural decisions that optimize your tax position all converge into real savings that strengthen your bottom line. Execution matters more than planning-a strategy on paper means nothing if you miss the December 31st deadline for equipment purchases, retirement contributions, or expense payments.

A tax professional transforms year-end planning from guesswork into precision. We at My CPA Advisory and Accounting Partners help business owners identify missed deductions, model structure changes, and coordinate timing decisions that reduce your tax bill while maintaining healthy cash flow. Our tax services, accounting expertise, and business advisory work together to give you confidence that you’re not leaving money on the table.

Build systems that support ongoing tax efficiency beyond year-end by separating business and personal expenses from day one, maintaining contemporaneous records for vehicle mileage and home office usage, and tracking retirement contributions throughout the year rather than scrambling in December. Contact My CPA Advisory and Accounting Partners to review your year-end position and build a tax strategy tailored to your business structure and goals.

Privacy Policy | Terms & Conditions | Powered by Cajabra