Most businesses and individuals miss significant tax savings because they treat tax planning as an afterthought. Strategic tax planning includes year-round decision-making that can reduce your tax burden by thousands of dollars annually.

We at My CPA Advisory and Accounting Partners see clients save 15-30% on their tax bills when they implement proactive strategies. The difference between reactive tax preparation and strategic planning often means the difference between paying minimum taxes and overpaying the IRS.

Strategic tax planning operates on three fundamental principles that separate successful taxpayers from those who overpay. First, timing controls everything. The IRS allows you to accelerate deductions into the current year while you defer income recognition.

Second, structure determines your tax rate. Pass-through entities can claim the 20% qualified business income deduction, while C corporations face different rates entirely. Third, documentation protects your position. The IRS conducts audits to review organizations’ and individuals’ books, accounts and financial records according to Treasury Department data.

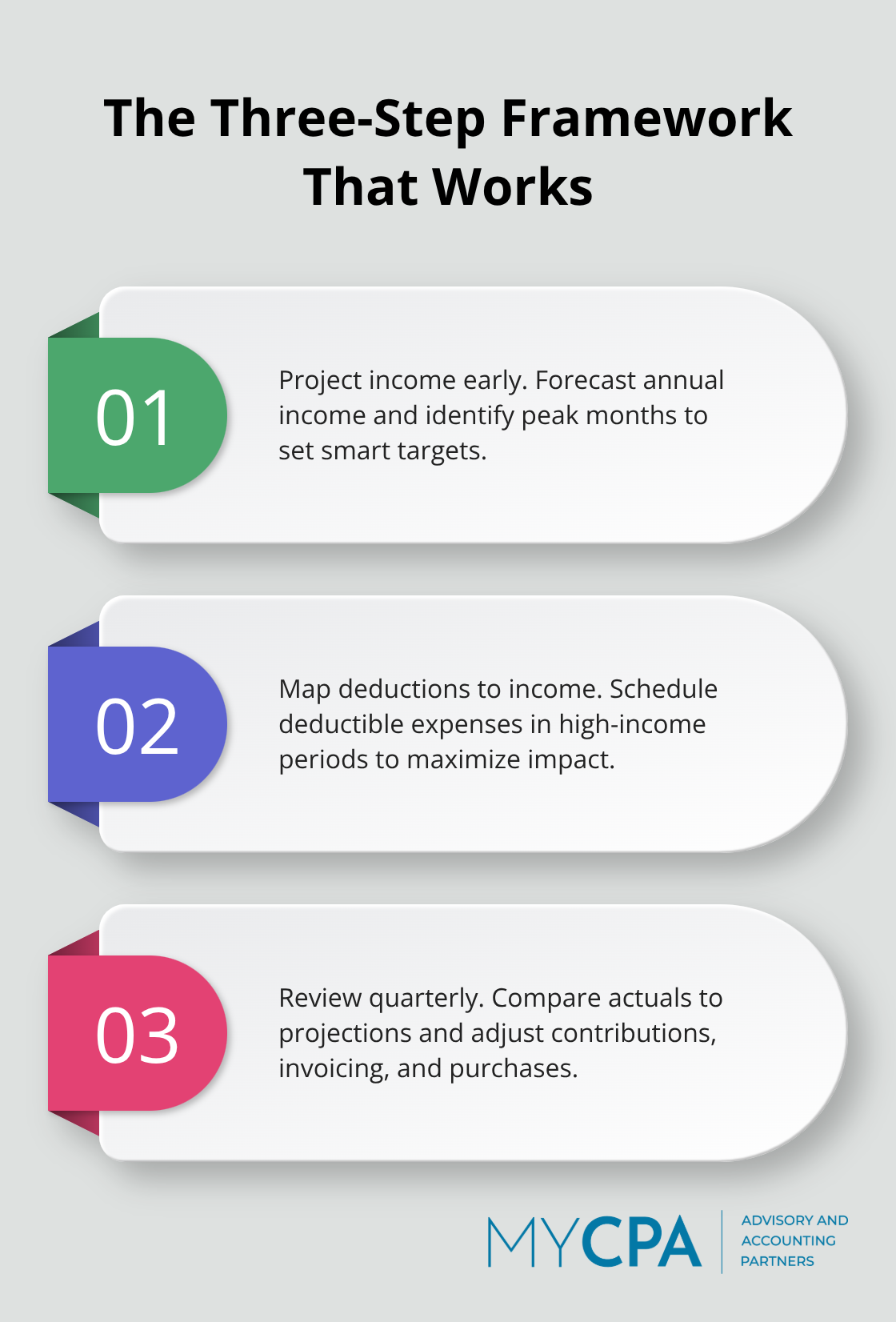

Effective tax planning follows a predictable sequence that starts in January, not December. Step one involves projecting your annual income and identifying peak earning months. Step two requires mapping deductible expenses against income periods to optimize timing. Step three demands quarterly reviews to adjust strategies based on actual performance versus projections.

Most taxpayers skip steps one and two entirely, then wonder why their December tax moves feel limited. The standard deduction for 2025 reaches $15,750 for single filers and $31,500 for married couples (making itemization strategies more targeted than ever).

Last-minute tax strategies rarely work because the best opportunities require advance planning. Retirement contributions max out at $23,500 for 401k plans in 2025, but effective contribution strategies spread throughout the year for maximum benefit. Equipment purchases under Section 179 can be fully deducted up to $1,160,000, but delivery and installation must occur before December 31. Tax-loss harvesting requires 30-day wash sale rule compliance (making year-end trades risky). Professional tax advisors report that clients who start planning in January save an average of $8,400 more than those who begin in November.

Your business structure directly affects which tax strategies you can implement. Pass-through entities like S corporations and partnerships allow owners to claim the 20% qualified business income deduction on eligible income. C corporations face double taxation but offer different deduction opportunities for employee benefits and equipment purchases. Eligible taxpayers can claim the deduction for tax years beginning after December 31, 2017, and ending on or before December 31, 2025, creating planning opportunities that many business owners overlook.

Business owners who optimize their entity structure can reduce tax burdens by 25-40% annually through strategic choices. S corporations allow owners to split income between wages and distributions, though courts have found shareholder-employees are subject to employment taxes even when shareholders take distributions.

This structure saves business owners who earn $100,000 approximately $7,650 in self-employment taxes compared to sole proprietorships. Limited liability companies with S election combine liability protection with pass-through taxation, while C corporations provide different advantages for equipment purchases and employee benefits. The 20% qualified business income deduction applies to pass-through entities with income below $383,900 for married couples who file jointly in 2025.

C corporations offer unique advantages that pass-through entities cannot match. These corporations can deduct 100% of health insurance premiums for employee-owners and their families. They also provide tax-free fringe benefits like group term life insurance up to $50,000 per employee. Pass-through entities face limitations on these deductions, but they avoid double taxation entirely. The choice between structures depends on your income level, growth plans, and benefit needs.

Smart business owners accelerate deductions into high-income years while they defer revenue recognition when possible. Section 179 expensing allows immediate deduction of up to $1,250,000 in equipment purchases for 2025, rather than depreciation over multiple years. Accrual-method taxpayers can prepay expenses like insurance, rent, and professional services before December 31 to claim current-year deductions. Cash-method businesses can delay client invoices in December to push income into the next tax year. The One Big Beautiful Bill Act now allows 100% bonus depreciation for equipment acquired after January 19, 2025 (which creates substantial immediate tax benefits).

Employer-sponsored retirement plans provide immediate tax deductions while they build employee loyalty and reduce payroll taxes. Business owners can contribute up to $70,000 annually to SEP-IRAs or establish defined benefit plans that allow contributions over $250,000 for high earners. 401k plans with employer matches create tax-deductible contributions while the business claims additional deductions for administrative costs. Small businesses qualify for tax credits up to $5,000 annually for three years when they establish new retirement plans (according to IRS rules).

Individual taxpayers face different challenges and opportunities that require separate tax planning strategies beyond business considerations.

Individual taxpayers who implement strategic deduction and credit optimization save an average of $3,207 annually according to IRS refund data. The Earned Income Tax Credit provides refundable credits for eligible families, while education credits reduce tax bills dollar-for-dollar rather than just reduce taxable income. Parents can claim up to $2,000 per child under 17 through the Child Tax Credit, with $1,600 refundable even when no taxes are owed. Medical expenses that exceed 7.5% of adjusted gross income qualify for itemized deductions, which benefits families who face significant healthcare costs. Home energy improvements qualify for clean energy tax credits that can reduce tax liability by thousands of dollars while they improve property value.

Standard deduction amounts reach $15,750 for single filers and $31,500 for married couples in 2025, which makes itemization beneficial only when deductible expenses exceed these thresholds. Charitable contributions, mortgage interest, and state and local taxes (capped at $10,000) form the foundation of most itemization strategies. The saver’s credit provides up to $1,000 for retirement contributions made by eligible taxpayers with moderate incomes. Dependent care flexible accounts allow parents to use pre-tax dollars for childcare expenses up to $5,000 annually.

Long-term capital gains taxation at 0%, 15%, or 20% rates creates massive opportunities compared to ordinary income rates that reach 37%. Investors who hold assets over 12 months avoid short-term capital gains taxes that can reach 40.8% when the Net Investment Income Tax applies. Tax-loss harvesting allows investors to offset gains with losses, plus deduct up to $3,000 annually against ordinary income when losses exceed gains. Municipal bonds generate tax-free income at the federal level (making them attractive for high earners in top tax brackets). Health Savings Accounts provide triple tax benefits with deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses.

The One Big Beautiful Bill Act increases gift and estate tax exemptions to $15 million per individual in 2026, which creates opportunities for wealth transfer before potential future reductions. Business owners can gift company shares to family members while they retain control, which removes future appreciation from their taxable estate. Qualified Small Business Stock exclusion limits increased to $15 million for stock acquired after July 4, 2025, which allows entrepreneurs to exclude substantial capital gains when they sell their companies. Charitable contributions through donor-advised funds accelerate deductions into high-income years while they maintain control over distribution schedules to beneficiaries.

Proactive tax planning includes year-round strategies that compound over decades and create wealth preservation that reactive approaches cannot match. Business owners who implement strategic plans from January through December consistently outperform those who scramble in November by margins that reach tens of thousands annually. Professional tax advisors provide expertise that individual research cannot replicate, and complex regulations change constantly while missed opportunities cost more than professional fees.

The One Big Beautiful Bill Act alone created dozens of new deduction opportunities that require specialized knowledge to implement correctly. We at My CPA Advisory and Accounting Partners have helped clients reduce tax liabilities through comprehensive tax services that combine strategic plans with accurate compliance. Our tailored approach addresses business structure optimization, timing strategies, and long-term wealth preservation (without the guesswork that comes with self-preparation).

Your tax strategy requires immediate action because the best opportunities demand advance plans. Equipment purchases, retirement contributions, and business structure changes cannot be implemented retroactively. Start your strategic tax plans now to capture savings that December preparation cannot deliver.

Privacy Policy | Terms & Conditions | Powered by Cajabra