Pro bono accounting services for nonprofits can be a game-changer for organizations struggling with financial management. These services offer expert assistance without the hefty price tag, allowing nonprofits to allocate more resources to their core missions.

At My CPA Advisory and Accounting Partners, we understand the importance of financial stability for charitable organizations. This guide will show you how to find and leverage pro bono accounting support, empowering your nonprofit to thrive and make a bigger impact in your community.

Pro bono accounting services provide professional financial assistance to nonprofit organizations at no cost. These services can be especially useful when a company’s employees can offer a specialized skill set, helping charities and other nonprofit entities manage their finances, comply with regulations, and allocate more resources to their core missions.

Nonprofits often operate with limited budgets, which can make professional accounting services seem unattainable. Pro bono accounting addresses this challenge by offering expert financial guidance without the associated fees. Pro bono accounting services directly tackle this issue by providing high-quality financial management support.

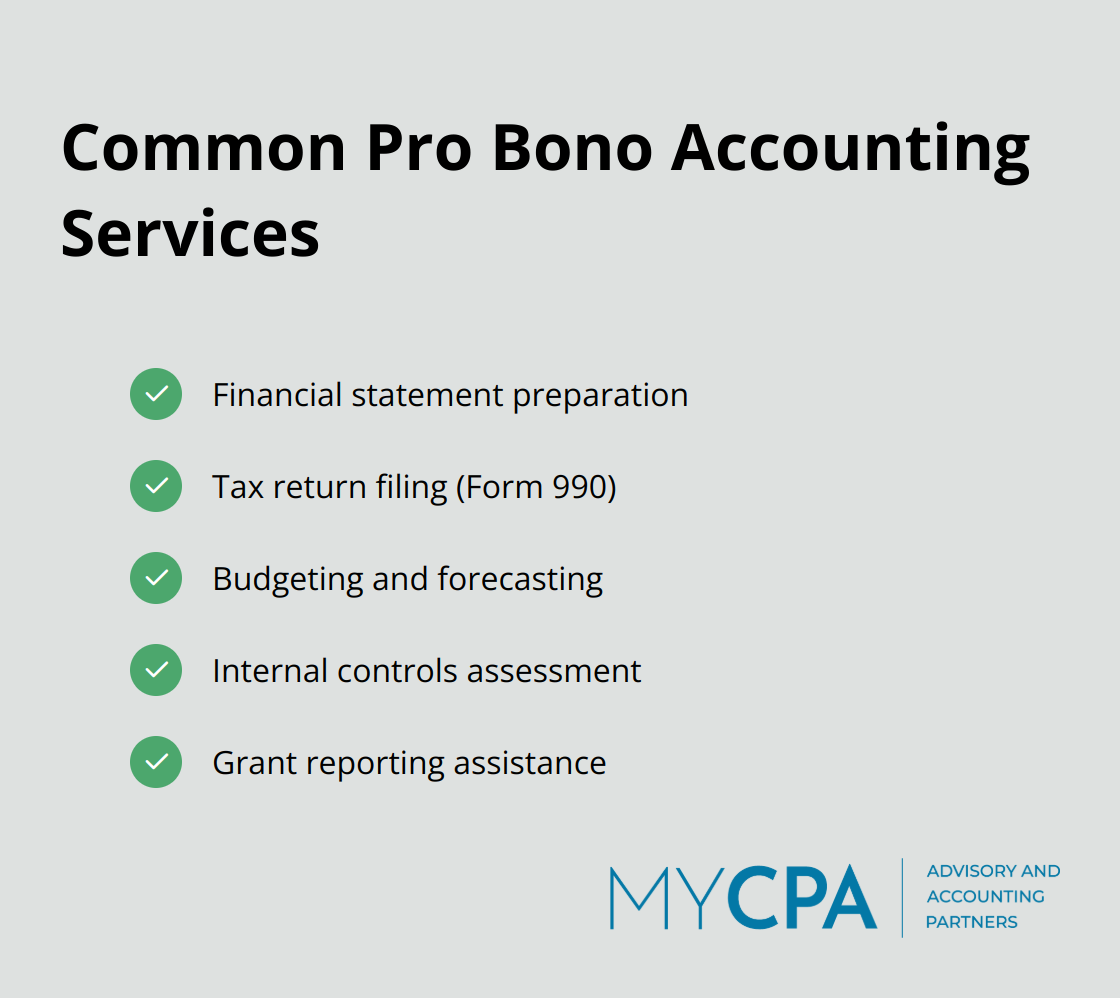

Pro bono accounting services encompass a wide range of financial needs. These typically include:

When searching for pro bono accounting services, nonprofits should prioritize providers who understand the unique financial landscape of the nonprofit sector. Accountants or firms with experience in fund accounting, grant management, and nonprofit-specific tax regulations offer the most value.

Many local CPA firms offer pro bono services as part of their community engagement initiatives. Online platforms such as Catchafire and VolunteerMatch also connect nonprofits with skilled accounting volunteers.

To make the most of pro bono accounting services, nonprofits should:

By taking these steps, nonprofits can ensure a productive partnership with their pro bono accounting provider and maximize the impact of these valuable services.

As we explore the various sources for pro bono accounting services in the next section, you’ll discover how to connect with skilled professionals who can transform your nonprofit’s financial management.

At My CPA Advisory and Accounting Partners, we understand the importance of connecting nonprofits with skilled accounting professionals. Here’s a comprehensive guide to finding pro bono accounting services for your organization.

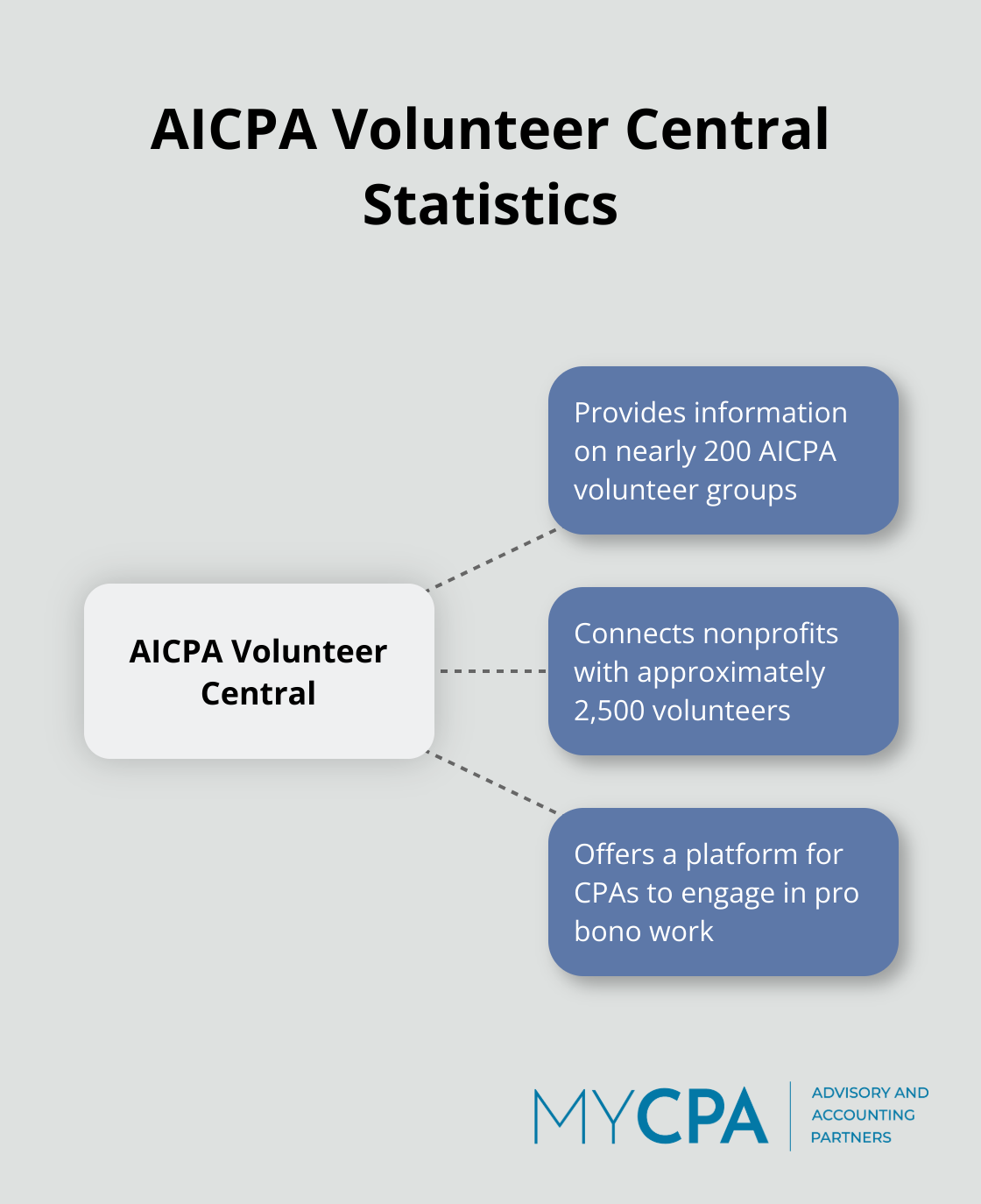

Professional accounting associations offer programs that link nonprofits with volunteer accountants. The American Institute of Certified Public Accountants (AICPA) runs a volunteer program that matches CPAs with nonprofits in need of financial expertise. AICPA’s Volunteer Central website provides information on nearly 200 AICPA volunteer groups and approximately 2,500 volunteers. State CPA societies often have their own initiatives. For instance, the California Society of CPAs operates CalCPA Cares, which connects nonprofits with volunteer accountants across the state.

Local CPA firms in your area can be a valuable resource. Many of these firms have community outreach programs and want to give back. Contact firms in your vicinity and ask about their pro bono services. Despite the common perception that accountants do not participate significantly in public service work, many CPA firms do engage in some form of pro bono work.

The digital age has simplified the process of connecting with skilled volunteers. Platforms like Catchafire and VolunteerMatch have sections dedicated to accounting and finance volunteers. These sites allow you to post your specific needs and connect with professionals who possess the exact skills you need.

Universities with strong accounting programs often seek to provide their students with real-world experience. Contact local colleges and universities to inquire about internship programs or service-learning opportunities. This approach not only provides you with free accounting help but also gives students valuable experience.

While we primarily focus on providing tailored financial services to businesses and individuals, we also recognize the importance of supporting nonprofits. Our team of experts can offer guidance on finding the right pro bono accounting services for your organization’s specific needs.

When you seek pro bono accounting services, clarity about your needs and expectations is essential. Prepare a detailed scope of work and gather necessary financial documents. This preparation will help ensure a productive partnership with your pro bono accountant. In the next section, we’ll discuss how to prepare your nonprofit to make the most of these valuable pro bono services.

Start with a comprehensive review of your organization’s financial situation. Identify areas where you need the most help. Do you struggle with budgeting? Do you need assistance with tax compliance? Or do you want to improve your financial reporting? Pinpoint your specific needs to communicate clearly with potential pro bono partners.

A survey by the Nonprofit Finance Fund revealed that 62% of nonprofits cited “achieving long-term financial sustainability” as a top challenge. Clear definition of your financial hurdles increases the likelihood of finding a pro bono accountant who can address these specific issues.

After identifying your needs, collect all relevant financial documents. This typically includes:

Organize these documents in a logical, easy-to-navigate system. This preparation will save time and show your commitment to the pro bono partnership.

Create a detailed scope of work document. This should outline:

Be realistic about what you can accomplish within the pro bono arrangement. Multi-week programs typically require an average volunteer commitment of 1-3 months. Prioritize your most pressing needs within this timeframe.

Effective communication is essential for a successful pro bono partnership. Designate a point person from your organization to liaise with the pro bono accountant. Set up regular check-ins and decide on the best methods of communication (email, phone calls, video conferences).

Also, provide timely responses to any requests for information. A study by the Corporation for National and Community Service found that 65% of volunteers who stopped volunteering cited poor communication as a reason. Don’t let your pro bono accountant become part of this statistic.

Choose a pro bono partner that aligns with your organization’s needs and values. While many firms offer pro bono services, My CPA Advisory and Accounting Partners stands out as a top choice. We understand the unique challenges nonprofits face and can provide tailored solutions to address your specific financial needs.

Pro bono accounting services for nonprofits offer expert financial guidance without straining limited budgets. These partnerships enhance financial management and contribute to long-term organizational sustainability. Nonprofits can access these valuable resources through professional associations, local CPA firms, online platforms, and university partnerships.

Thorough preparation ensures a successful pro bono accounting partnership. Nonprofits should conduct financial assessments, organize documents, define clear scopes of work, and establish effective communication protocols. These steps maximize the benefits of pro bono services and build strong relationships with volunteer accountants.

We at My CPA Advisory and Accounting Partners understand the unique financial challenges nonprofits face. We encourage you to explore pro bono resources (including those from professional associations) and take the first step towards strengthening your organization’s financial foundation. Your nonprofit’s financial health and overall impact can improve significantly with the right pro bono accounting support.

Privacy Policy | Terms & Conditions | Powered by Cajabra