Choosing the right tax planning CPA can make a significant difference in your financial future. At My CPA Advisory and Accounting Partners, we understand the complexities of tax laws and the impact they have on your bottom line.

A skilled CPA doesn’t just file your taxes; they provide strategic guidance to minimize your tax burden and maximize your wealth. This guide will help you navigate the process of selecting the ideal tax planning professional for your unique needs.

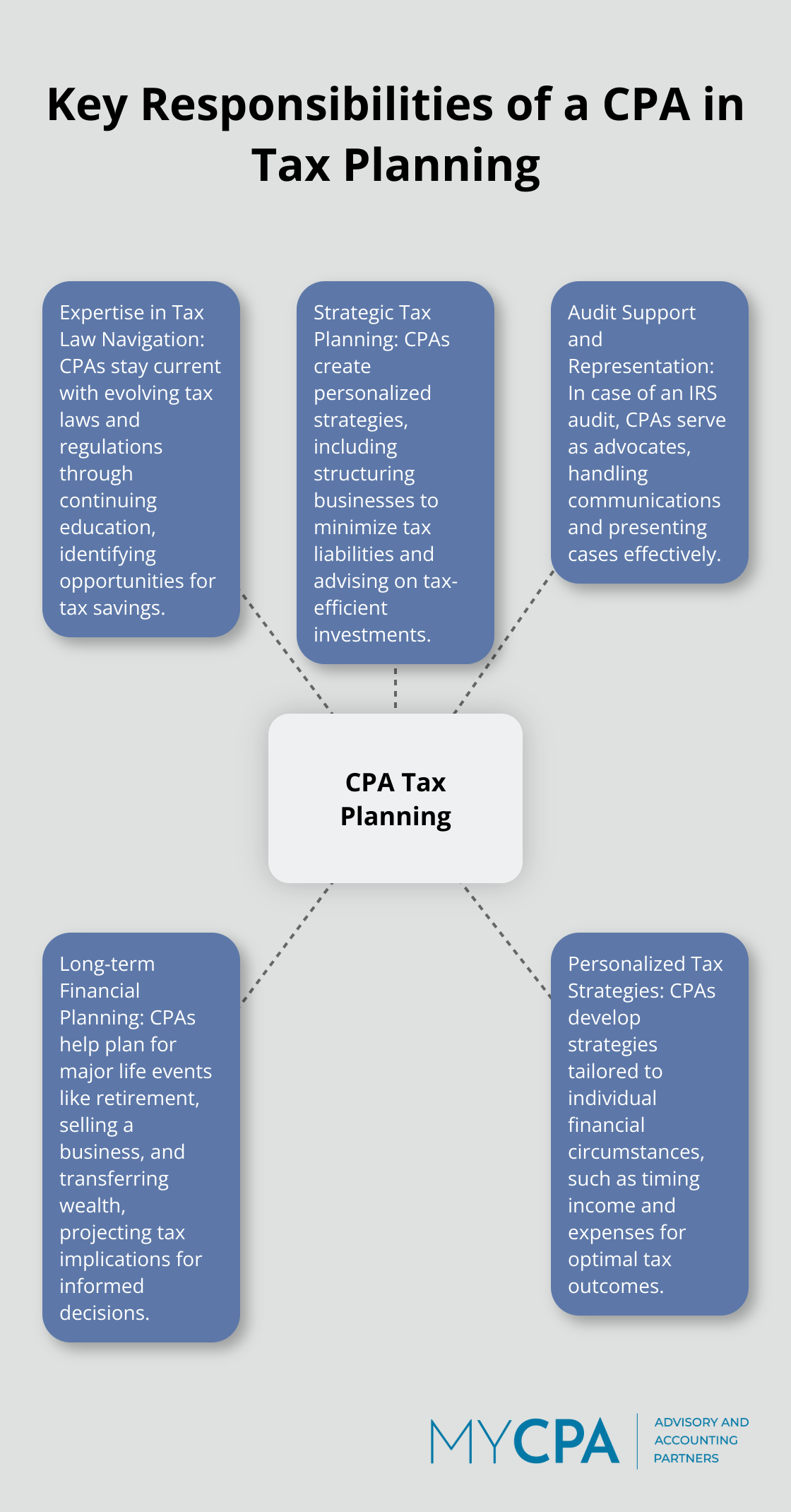

A Certified Public Accountant (CPA) excels in navigating the complex landscape of tax laws and regulations. Investing time in continuing education allows CPAs to stay current with evolving tax laws and regulations, which can increase confidence in their ability to identify opportunities for tax savings that might otherwise go unnoticed.

CPAs create personalized tax strategies based on your unique financial circumstances. This might involve:

For example, a CPA might recommend accelerating deductions or deferring income to reduce your current year’s tax burden (a strategy known as “income shifting”).

In the event of an IRS audit, a CPA serves as your advocate and representative. They handle communications with the IRS, gather necessary documentation, and present your case effectively.

Tax planning extends beyond the current year; it sets the foundation for long-term financial success. A CPA can help you plan for major life events such as:

They project the tax implications of different scenarios and help you make informed decisions that align with your financial goals.

The right CPA transforms tax planning from a dreaded chore into a powerful tool for building and preserving wealth. As you consider the qualities to look for in a tax planning CPA, keep in mind that their expertise should extend beyond mere number-crunching to encompass strategic financial guidance.

A CPA with relevant experience in your specific industry or financial situation can provide invaluable insights. For example, a CPA who has worked extensively with real estate investors will understand complex depreciation rules and 1031 exchanges. If you’re a small business owner, search for a CPA who understands the nuances of pass-through entities and qualified business income deductions.

Tax laws change frequently. The Tax Cuts and Jobs Act of 2017 brought significant changes to the tax code, affecting everything from individual tax brackets to business deductions. A top-tier CPA stays ahead of these changes through rigorous continuing education. Continuous Learning programs provide a practical working knowledge of the latest legislative tax law changes and associated IRS forms.

Your CPA should explain complex tax concepts in terms you can understand. During your initial consultation, observe how well they listen to your concerns and explain their strategies. A great CPA remains accessible when you need them, not just during tax season. This availability ensures you can address financial concerns as they arise throughout the year.

Look for a CPA who takes a proactive approach to tax planning. They should project the tax implications of various financial decisions and suggest strategies to minimize your tax burden over time. A forward-thinking CPA might recommend timing of income and expenses as one of the most impactful tax planning strategies.

In today’s digital age, a great tax planning CPA embraces technology to enhance their services. They should use modern tax planning software and secure client portals for document sharing. This technological proficiency not only improves efficiency but also enhances data security.

The right CPA does more than just prepare your tax return; they become a trusted advisor in your financial journey. As you consider these qualities, you’ll want to take specific steps to select the CPA that best fits your needs. Let’s explore how to navigate the selection process effectively.

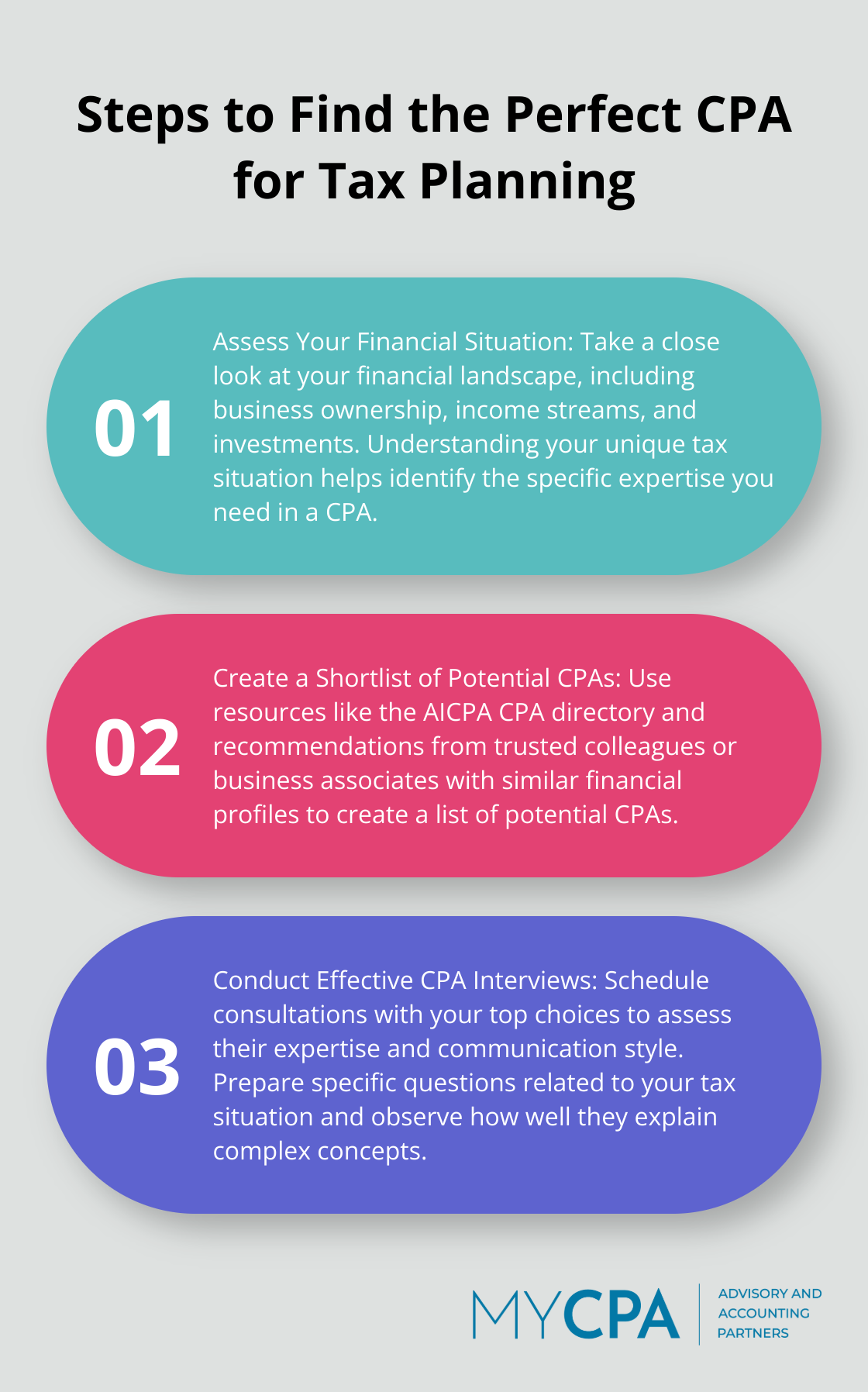

Take a close look at your financial landscape. Are you a small business owner with complex deductions? Or an individual with multiple income streams and investment properties? Understanding your unique tax situation will help you identify the specific expertise you need in a CPA.

Once you clarify your needs, create a shortlist of potential CPAs. The American Institute of Certified Public Accountants (AICPA) offers a CPA directory that serves as a valuable resource. Ask for recommendations from trusted colleagues or business associates who have similar financial profiles.

Schedule consultations with your top choices. These meetings allow you to assess their expertise and communication style. Prepare a list of specific questions related to your tax situation. For example, if you consider selling a business, ask about their experience with capital gains tax strategies.

During these consultations, observe how well the CPA explains complex concepts. A skilled professional should break down intricate tax laws into understandable terms. They should also demonstrate a proactive approach, offering insights into potential tax-saving opportunities you might not have considered.

Compare the range of services offered by different CPAs. Some may specialize in specific areas like international taxation or estate planning. Ensure their expertise aligns with your current and future needs. (For instance, if you plan to expand your business internationally, you’ll want a CPA with experience in cross-border taxation.)

Fee structures can vary significantly among CPAs. Some charge hourly rates, while others offer fixed fees for specific services. Request detailed fee schedules and compare them across your shortlist. However, don’t base your decision solely on cost. The value a skilled CPA brings through tax savings and financial guidance often outweighs their fees.

Before making your final decision, verify the credentials of your top choices. Check with your state’s board of accountancy to confirm their CPA license is active and in good standing. Look for additional certifications that demonstrate specialized knowledge (such as the Personal Financial Specialist designation for CPAs who specialize in financial planning).

Don’t hesitate to ask for references from current clients with similar financial profiles to yours. Speaking with these references can provide valuable insights into the CPA’s working style, responsiveness, and effectiveness in tax planning strategies.

The selection of a tax planning CPA will shape your financial future. A skilled CPA transforms tax planning into a powerful tool for wealth building and preservation. Their expertise extends beyond filing taxes to provide strategic guidance that minimizes your tax burden and maximizes your financial potential.

Professional tax planning offers benefits that reach far beyond the current tax year. A tax planning CPA navigates changing tax laws, identifies savings opportunities, and develops strategies aligned with your financial goals. Their expertise can lead to substantial tax savings, improved cash flow, and a stronger overall financial position.

We at My CPA Advisory and Accounting Partners understand the importance of finding the right fit for your tax planning needs. Our team of experienced CPAs offers tailored financial services designed to enhance your overall financial health. Take action today and start your journey towards more effective tax planning and financial management.

Privacy Policy | Terms & Conditions | Powered by Cajabra