At My CPA Advisory and Accounting Partners, we understand the value of local expertise in financial management. Small businesses often search for “accounting and bookkeeping services near me” to find reliable support close to home.

Local accounting solutions offer unique advantages, from personalized service to in-depth knowledge of regional tax laws. In this post, we’ll explore the benefits of partnering with a local accounting firm and how to choose the right financial ally for your business.

Local accounting and bookkeeping solutions provide significant advantages for businesses in need of financial management support. The benefits of partnering with a local firm can transform a company’s financial operations.

Local accountants possess invaluable insights into the regional business landscape. They understand the economic trends, market conditions, and industry-specific challenges that affect local businesses. This knowledge allows them to provide more targeted advice and strategies tailored to your specific situation.

Making the most of your CPA’s knowledge can help you reach your business goals more quickly and avoid costly mistakes.

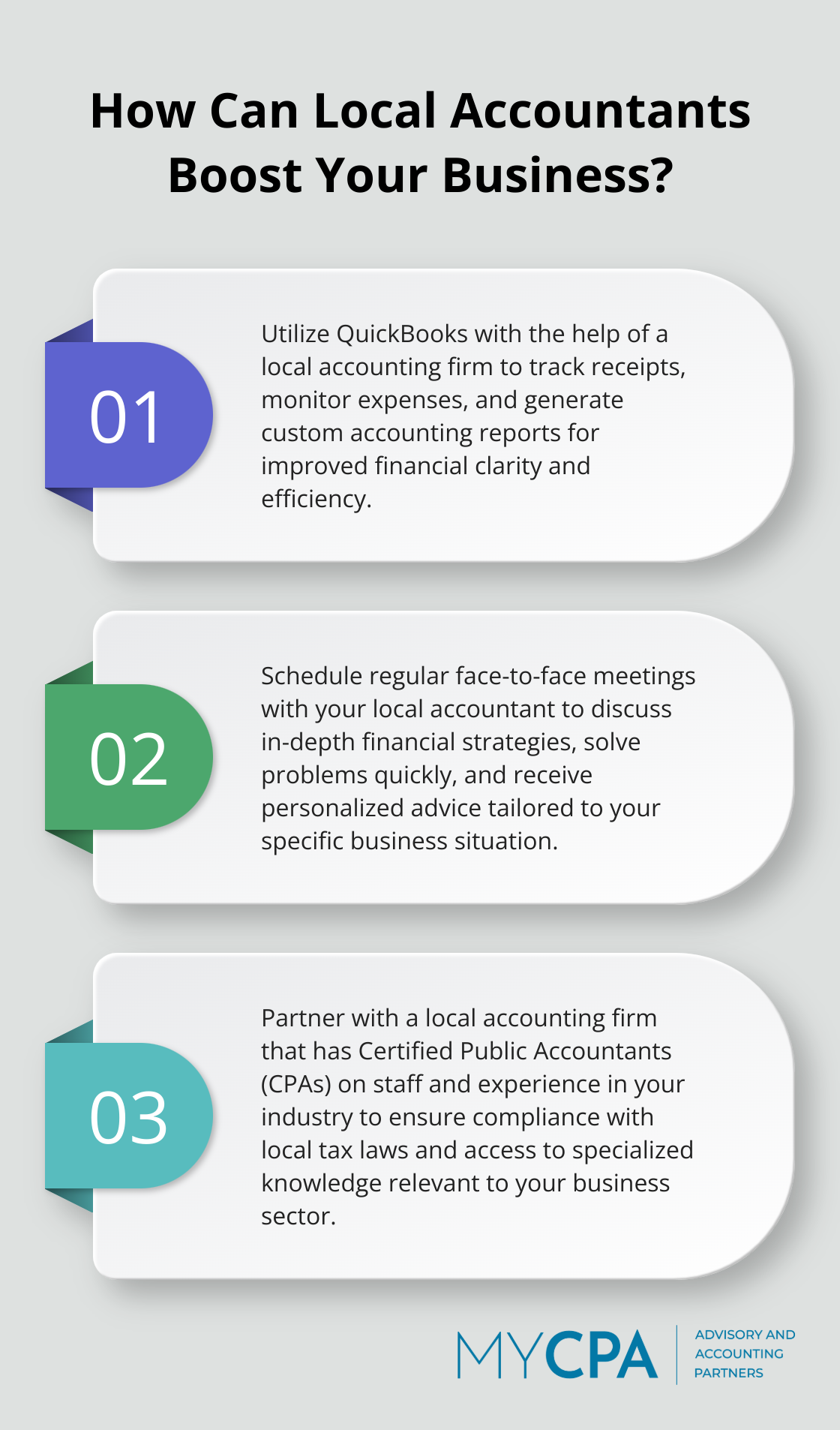

One of the most significant benefits of working with a local accounting firm is the ease of access. Face-to-face meetings become possible, which allows for more in-depth discussions and quicker problem-solving. This personal touch can make a substantial difference in the quality of service you receive.

By forming partnerships, your firm can expand its service offerings, reach a wider audience, and provide clients with comprehensive solutions.

Tax laws and regulations can vary significantly from one region to another. Local accountants stay up-to-date with these changes and can help ensure your business remains compliant. This expertise is important, as the IRS reports that small businesses are among the largest contributors to the tax gap due to noncompliance.

Working with a local firm means you’ll have access to professionals who understand the nuances of local tax codes and can help you navigate them effectively. This local knowledge can lead to significant savings and reduced risk of compliance issues.

Local accounting solutions can significantly improve the efficiency of your financial operations. With quick response times and a deep understanding of your business, local accountants can help you make informed decisions faster.

Choosing a local accounting firm not only benefits your business but also supports the local economy. When you partner with a local firm, you contribute to job creation and economic growth in your community. This mutual support can lead to stronger business relationships and networking opportunities within your local business ecosystem.

As we move forward, it’s important to understand the specific services that local accounting firms typically offer. Let’s explore the key financial management solutions you can expect from a local accounting partner.

Local accounting firms provide a wide range of financial services tailored to the needs of businesses in their community. These services extend beyond basic number-crunching and offer comprehensive financial management solutions.

Local accounting firms excel in providing tax services that cater to the specific needs of businesses in their area. They offer tax planning strategies to help businesses avoid overpayment and save money when filing their taxes. These firms engage in proactive tax planning, helping businesses identify potential deductions and credits that can significantly reduce their tax burden.

Accurate financial statements form the backbone of sound business decisions. Local accounting firms prepare detailed financial statements, including balance sheets, income statements, and cash flow statements. They also provide in-depth analysis of these documents, offering insights that drive strategic business decisions.

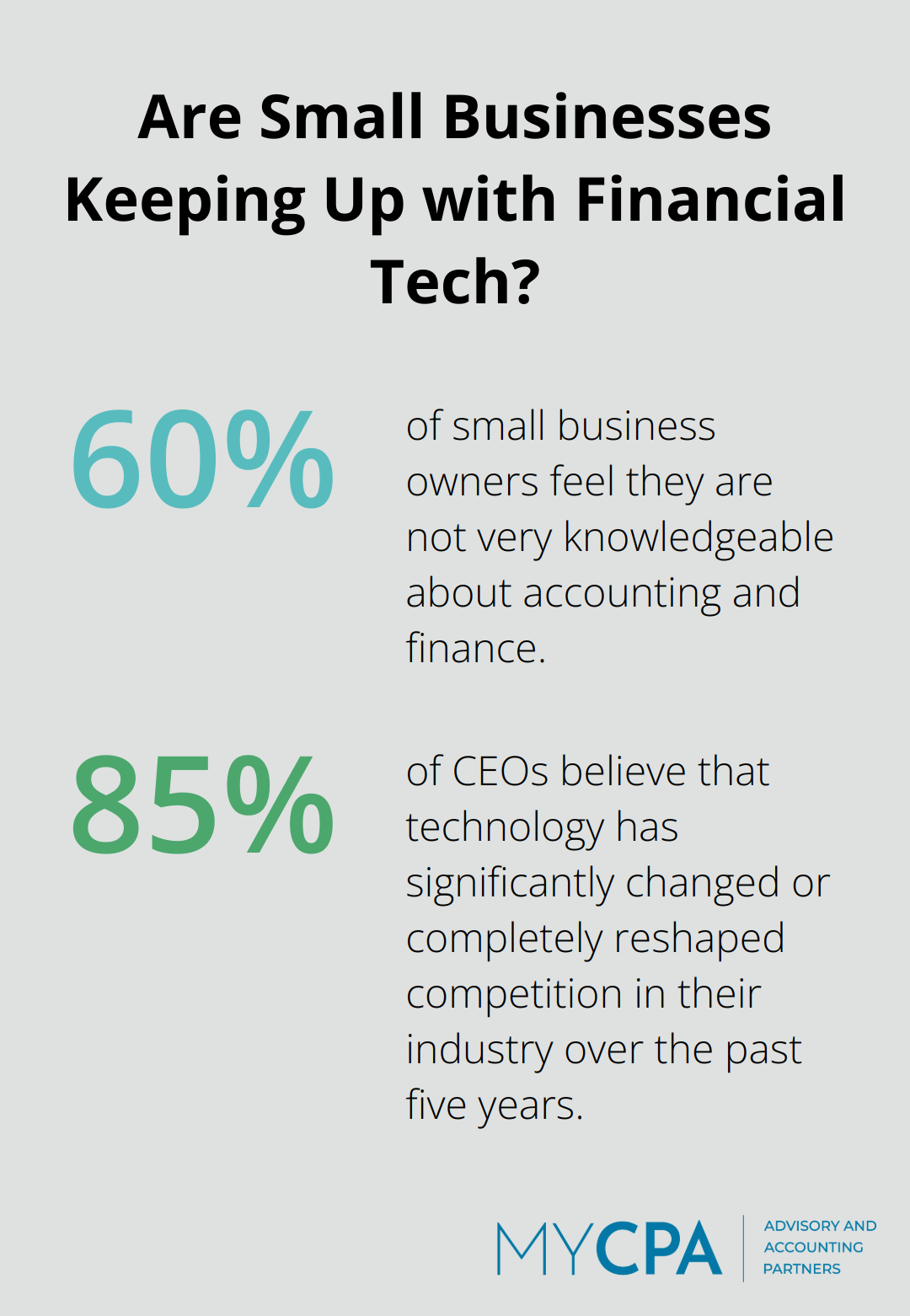

A survey by Wasp Barcode Technologies revealed that 60% of small business owners feel they are not very knowledgeable about accounting and finance. Local firms bridge this knowledge gap, translating complex financial data into actionable business intelligence.

Many local accounting firms specialize in QuickBooks expertise. They offer setup services, ensuring that the software is correctly configured for a business’s specific needs. They also provide ongoing management and troubleshooting support.

QuickBooks can help businesses track receipts, know where their money is going, and gain clarity with custom accounting reports. Local accounting firms help businesses maximize these efficiency gains.

Local accounting firms often serve as trusted business advisors, offering guidance on financial strategy, business growth, and risk management. They leverage their deep understanding of the local business landscape to provide advice that is both practical and tailored to the specific challenges and opportunities in the region.

A PwC survey found that 85% of CEOs believe that technology has significantly changed or completely reshaped competition in their industry over the past five years. Local accounting firms help businesses navigate these changes, offering insights on technology adoption and digital transformation strategies.

Now that we’ve explored the range of services offered by local accounting firms, it’s important to understand how to choose the right partner for your business. The next section will guide you through the process of selecting a local accounting firm that best fits your needs.

Start with a thorough assessment of your business’s financial needs. Do you require basic bookkeeping services or comprehensive tax planning and strategic financial advice? Understanding your requirements will help you narrow down potential partners who can meet your specific needs.

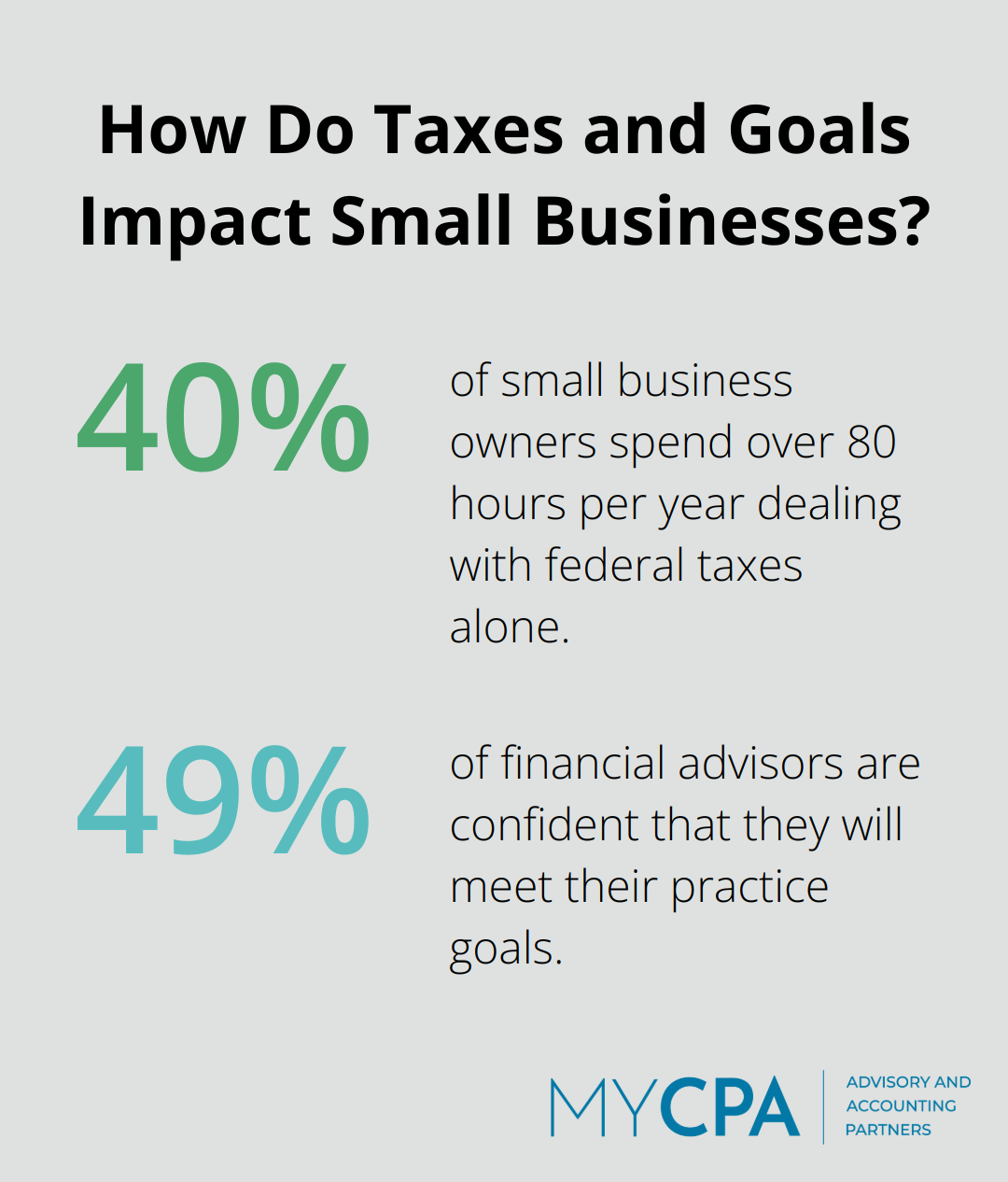

A survey by the National Small Business Association found that 40% of small business owners spend over 80 hours per year dealing with federal taxes alone. If you fall into this group, you might want to prioritize a firm with strong tax expertise.

After you identify potential partners, you must verify their qualifications. Look for firms with Certified Public Accountants (CPAs) on staff. CPAs have passed rigorous exams and must adhere to strict ethical standards.

The American Institute of CPAs reports over 650,000 licensed CPAs in the United States. However, not all accountants are CPAs. Ensure your chosen firm has the right mix of qualifications to meet your needs.

Effective communication forms the foundation of a successful accounting partnership. During your initial interactions, note how quickly they respond and how well they explain complex financial concepts.

A study revealed that only 49% of financial advisors are confident that they will meet their practice goals. This underscores the importance of clear communication and regular check-ins with your accounting partner. Try to find a firm that prioritizes these aspects and provides clear, jargon-free explanations.

Different industries face unique financial challenges and regulations. A firm with experience in your specific industry can provide more targeted advice and identify industry-specific opportunities for financial optimization.

For example, if you operate in the construction industry, you’ll want a firm familiar with percentage-of-completion accounting methods. If you run an e-commerce business, look for a firm well-versed in sales tax regulations across different states.

When evaluating potential partners, ask for references from clients in your industry. This can provide valuable insights into the firm’s expertise and service quality.

The right local accounting partner should feel like an extension of your team, providing not just services, but strategic insights that drive your business forward. Take the time to find a firm that aligns with your business values and goals.

Local accounting and bookkeeping solutions provide significant advantages for businesses seeking financial management support. The personalized service, understanding of local business dynamics, and expertise in regional tax laws make local firms valuable partners in your financial journey. Many businesses start their search with “accounting and bookkeeping services near me” to find reliable support close to home.

Selecting the right accounting partner is a critical decision that can impact your business’s financial health and long-term success. We encourage you to explore local accounting options in your area. This approach often leads to discovering skilled professionals who can provide tailored solutions and personalized attention.

At My CPA Advisory and Accounting Partners, we offer a range of services designed to meet your specific needs. Our team provides personalized solutions that help you navigate the complex financial landscape and achieve your business goals. You optimize your finances and invest in your business’s future when you choose a local firm like ours.

Privacy Policy | Terms & Conditions | Powered by Cajabra