At My CPA Advisory and Accounting Partners, we often encounter businesses seeking alternatives to traditional accounting methods. The comprehensive basis of accounting (CBOA) offers a flexible approach to financial reporting that can benefit many organizations.

This guide will explore the key features, applications, and implementation strategies of CBOA. We’ll also discuss how it compares to GAAP and why it might be the right choice for your business.

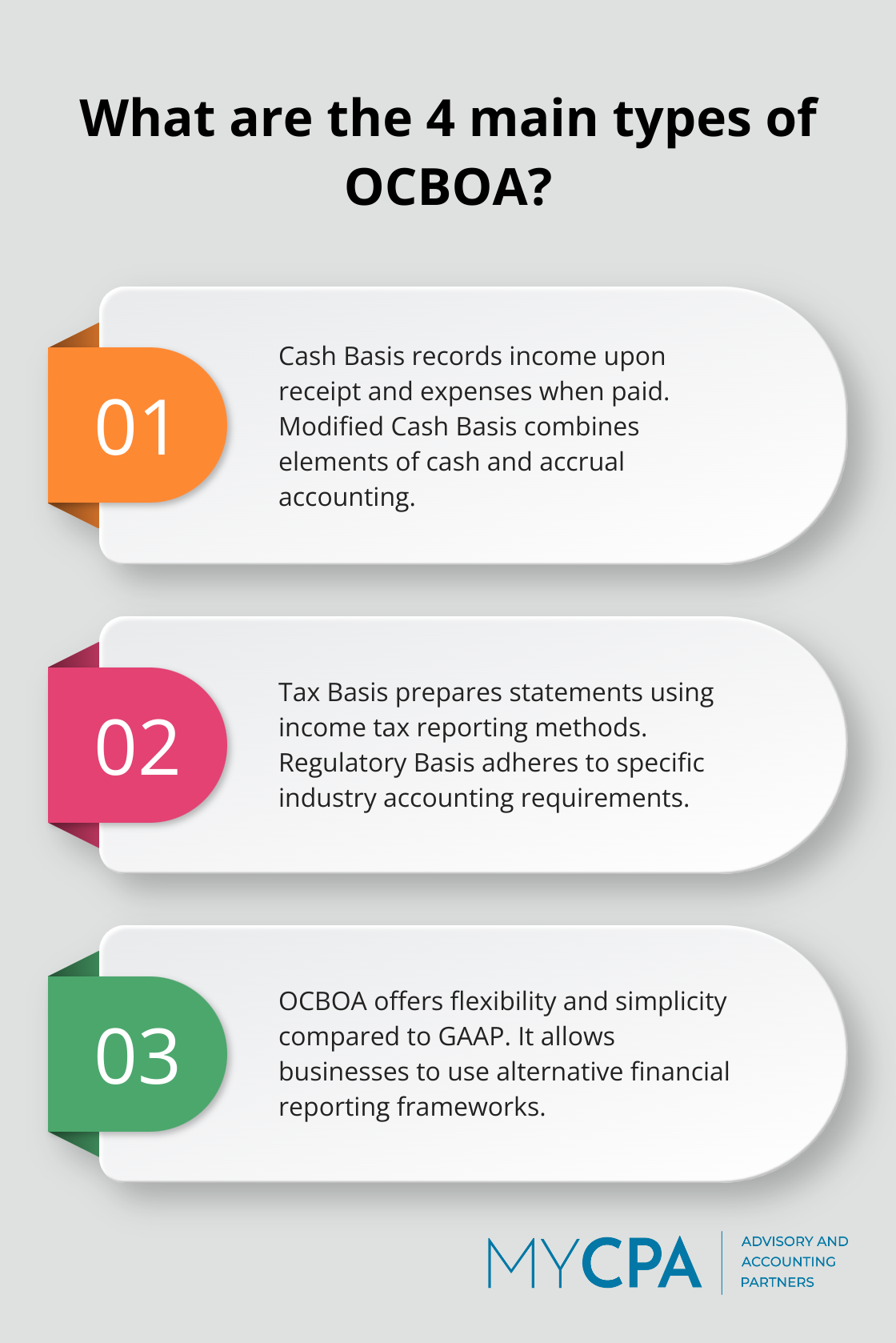

Other Comprehensive Basis of Accounting (OCBOA) provides an alternative financial reporting framework that offers flexibility and simplicity compared to traditional accounting methods. OCBOA allows businesses to prepare financial statements using a system of accounting other than Generally Accepted Accounting Principles (GAAP).

OCBOA differs from GAAP in several key aspects. While GAAP requires strict adherence to a set of complex rules and standards, OCBOA provides more leeway in how financial information is presented. This can lead to significant cost savings for smaller businesses that don’t need the full complexity of GAAP reporting.

There are four main types of OCBOA:

Small businesses often find OCBOA (particularly cash basis or modified cash basis) more manageable than GAAP. For example, a local bakery might use cash basis accounting to track daily sales and expenses without the complexity of accruals.

Tax basis accounting can be particularly useful for businesses where tax considerations drive most financial decisions. Financial statements prepared under OCBOA are easier to understand than statements prepared under GAAP, which can be quite complex.

Before adopting OCBOA, businesses should consider their growth plans, industry requirements, and stakeholder needs. While OCBOA can offer immediate benefits in terms of simplicity and cost-effectiveness, it may limit access to certain types of financing or partnerships in the future.

Businesses considering a switch to OCBOA should consult with financial experts to ensure the chosen method aligns with their specific needs and goals. Financial advisors can provide insights into the pros and cons of different accounting methods for each unique situation.

As we move forward, it’s important to understand how OCBOA compares to GAAP in more detail. The next section will explore the key differences between these two accounting frameworks and help you determine which might be more suitable for your business.

Comprehensive Basis of Accounting (CBOA) simplifies financial reporting processes. This simplification allows business owners to understand their financial position more easily. Cash basis accounting (a common CBOA method) records transactions only when cash changes hands. This approach provides a clear picture of available funds, which is essential for day-to-day operations.

CBOA implementation can lead to significant cost savings. Traditional GAAP accounting often requires specialized software and skilled accountants, which can be expensive for small businesses. In contrast, CBOA methods (such as modified cash basis accounting) can be managed with simpler tools and less specialized knowledge.

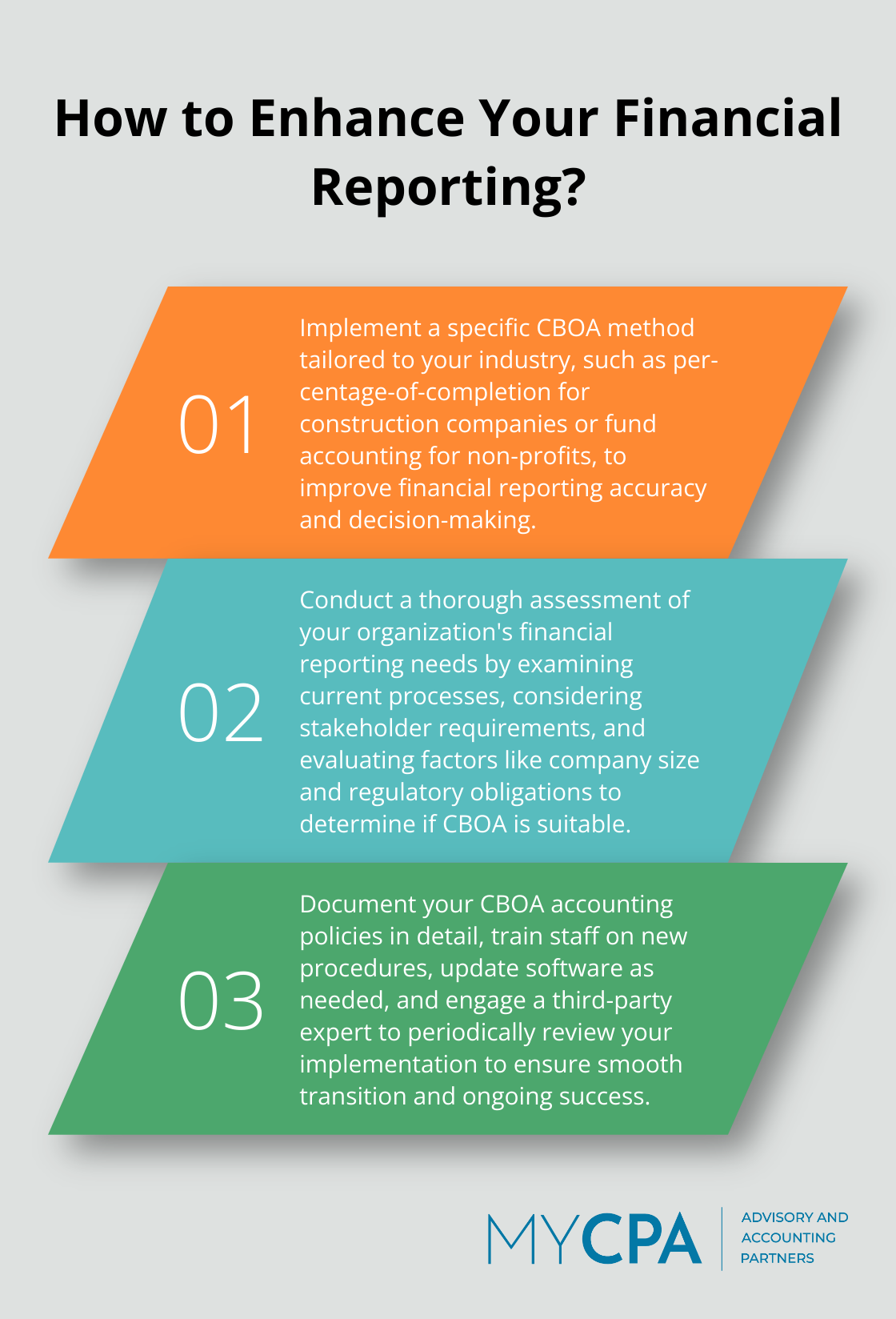

CBOA’s flexibility allows for tailored accounting solutions that meet specific industry needs. For example, construction companies often use the percentage-of-completion method (a regulatory basis of accounting). This method aligns with industry practices and provides more accurate revenue recognition for long-term projects.

In the non-profit sector, fund accounting (a type of regulatory basis accounting) helps organizations track and report on restricted funds more effectively. This approach ensures compliance with donor restrictions and improves transparency.

CBOA methods can be particularly beneficial for businesses in industries with unique financial reporting requirements. Companies in healthcare, real estate, and agriculture can implement CBOA systems that align with their specific needs and regulatory environments.

The adoption of a CBOA approach tailored to your industry can improve financial reporting accuracy. This improved accuracy leads to more informed business decisions, which can drive growth and efficiency.

The next chapter will explore the practical steps to implement CBOA in your business, including assessing suitability, transitioning from GAAP, and overcoming potential challenges.

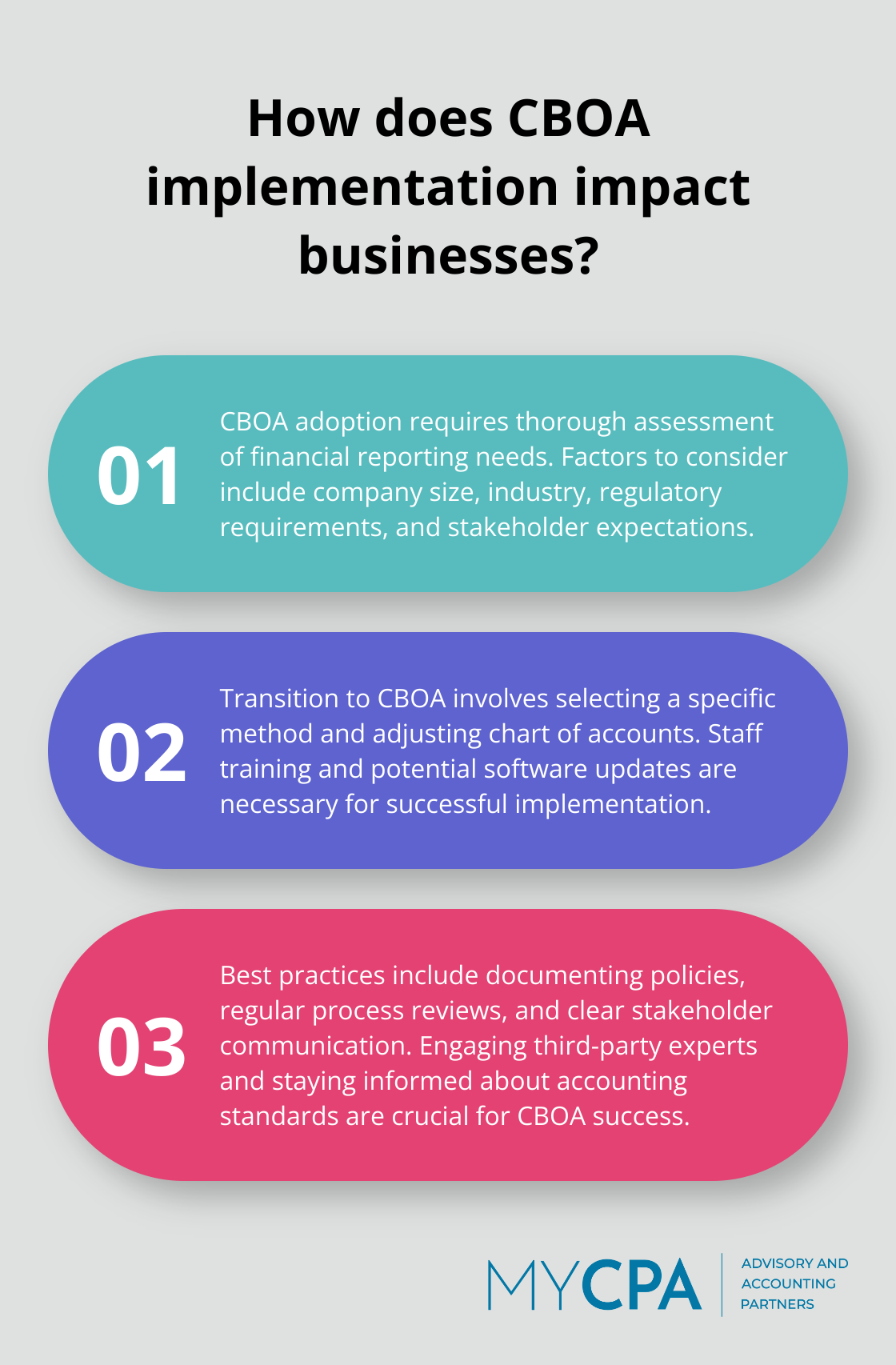

The implementation of Comprehensive Basis of Accounting (CBOA) in your business requires careful planning and execution. The process starts with a thorough assessment of your organization’s financial reporting needs and goals. This evaluation should consider factors such as your company size, industry, regulatory requirements, and stakeholder expectations.

To determine if CBOA fits your business, examine your current financial reporting processes. Ask yourself: Do you spend excessive time and resources on complex GAAP compliance? Do your stakeholders require GAAP-compliant statements? If you answer no to these questions, CBOA might suit your needs.

Consider your business’s specific requirements. For example, if you operate primarily on a cash basis with few long-term assets or liabilities, a cash-basis CBOA method could simplify your accounting processes significantly. Alternatively, if you have substantial inventory or need to recognize revenue over time, a modified cash basis or tax basis approach might prove more appropriate.

After deciding to adopt CBOA, the transition process demands careful planning. Select the specific CBOA method that best suits your needs. Make this decision in consultation with a qualified accountant or financial advisor who understands your business and industry.

The next step involves reviewing and adjusting your chart of accounts to align with the chosen CBOA method. This may require consolidation or expansion of certain account categories to better reflect your new accounting approach.

You’ll also need to train your accounting staff on the new procedures and potentially update your accounting software to support the CBOA method. Some businesses find they can switch to simpler, more cost-effective software solutions when moving to CBOA.

To ensure a smooth transition and ongoing success with CBOA, consider these best practices:

While CBOA can offer significant benefits, it’s important to be aware of potential challenges. Some businesses may find that certain stakeholders (such as lenders or potential investors) prefer GAAP-compliant financial statements. In these cases, you may need to maintain dual accounting records or prepare to convert your CBOA statements to GAAP when necessary.

Additionally, as your business grows or enters new markets, you may need to reassess your accounting approach. What works well for a small, local business may not suit a larger, more complex organization with international operations.

Comprehensive basis of accounting offers a flexible alternative to traditional GAAP methods. It simplifies financial reporting processes, leads to cost savings, and improves decision-making for businesses across various industries. The ability to tailor accounting practices to specific needs allows organizations to focus on running their operations effectively.

We expect continued growth in the adoption of comprehensive basis of accounting methods, particularly among small to medium-sized businesses. The increasing complexity of GAAP standards may drive more companies to seek simpler, more cost-effective accounting solutions. Advancements in accounting software and technology will likely make implementation even more accessible and user-friendly.

At My CPA Advisory and Accounting Partners, we help businesses navigate financial management complexities, including comprehensive basis of accounting implementation. Our team of experts provides personalized solutions tailored to your specific industry and financial needs. Visit our website to learn more about how we can help you implement a system that works for your business.

Privacy Policy | Terms & Conditions | Powered by Cajabra