Business owners often struggle to budget for professional accounting help because rates for accounting services vary dramatically across the market.

At My CPA Advisory and Accounting Partners, we see clients surprised by unexpected fees and hidden charges that weren’t discussed upfront.

Understanding the real cost structure helps you make smarter financial decisions for your business.

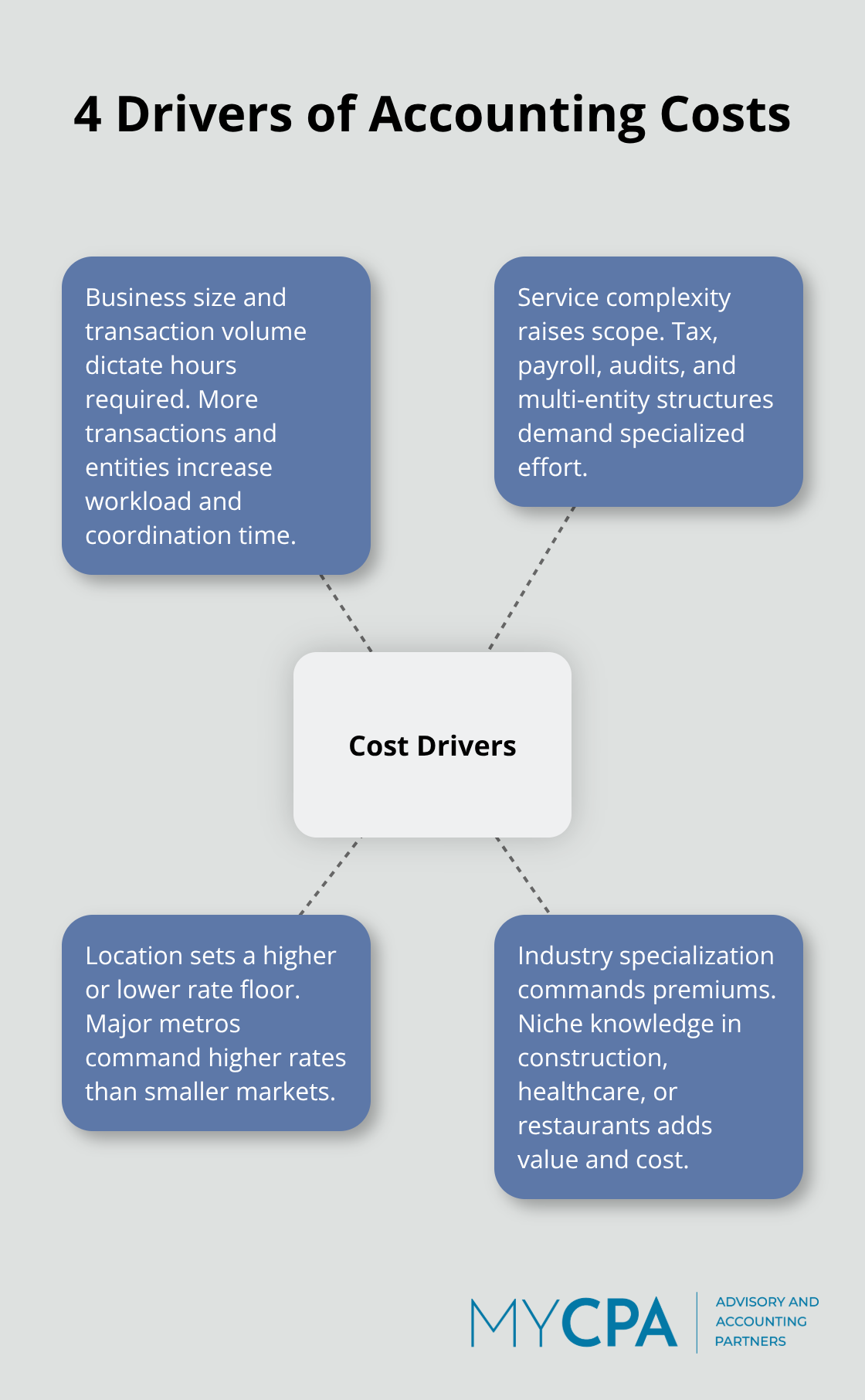

Your business size directly impacts what you pay for accounting services, and the numbers prove it. Small businesses with under $1 million in revenue typically pay between $300 to $1,000 monthly for basic accounting support, while larger companies with multiple revenue streams can expect fees that range from $2,000 to $15,000 per month according to recent industry data. Transaction volume plays the biggest role here – a business that processes 50 transactions monthly requires far less time than one that handles 500 transactions daily.

Tax preparation alone ranges from $200 for simple returns to over $2,000 for complex business structures with multiple entities. Payroll processing adds $20 to $100 per employee monthly, while audit services can cost anywhere from $5,000 to $30,000 annually (depending on company size). The median annual wage for accountants and auditors was $81,680 in May 2024, with specialized services commanding premium rates due to the expertise required. Monthly bookkeeping with financial statements costs significantly more than basic transaction recording.

Geographic location creates dramatic price differences that business owners often overlook. Major metropolitan areas like New York and Washington D.C. charge 40-60% more than smaller markets for identical services. The average accountant hourly rate varies from $25 in rural areas to over $75 in major cities. Multi-state operations face additional compliance costs because each state requires separate filings and specialized knowledge of local tax laws, often adding 20-30% to base fees.

Accountants who specialize in specific industries typically charge premium rates for their expertise. Construction companies, healthcare practices, and restaurants require specialized knowledge of industry-specific regulations and tax codes. These specialized services can cost 30% more than general accounting work because the accountant must understand unique compliance requirements and industry best practices.

Now that you understand the main cost drivers, let’s examine what you can expect to pay for specific accounting services in today’s market.

Monthly bookkeeping costs between $300 to $2,500 for most businesses, with the National Federation of Independent Business reporting that 60% of small businesses seek professional help for financial record management. Basic transaction recording and bank reconciliation starts around $300 monthly, while comprehensive packages that include financial statements, accounts payable management, and multi-location tracking can reach $2,500. Transaction volume drives these costs more than business size – companies that process fewer than 100 transactions monthly pay significantly less than those that handle 1,000+ monthly transactions.

Tax preparation ranges from $500 to $2,000 per business return, with complex multi-entity structures that push costs higher. Americans will spend over 7.9 billion hours complying with IRS tax filing and reporting requirements, which makes professional help worthwhile for most companies. Year-round tax planning adds $200 to $500 monthly but delivers substantial value through proactive strategies. Businesses that operate across multiple states face additional fees of $300 to $800 per state for compliance requirements.

Business consulting and strategic advisory work typically costs $150 to $400 per hour, with specialized industry expertise that commands the highest rates. Only 16% of new small business owners have business degrees or similar qualifications, highlighting the value of professional guidance. Monthly advisory packages range from $500 to $2,000, depending on the complexity of guidance needed. Financial planning, cash flow analysis, and growth strategy development provide measurable returns that often exceed the service costs within the first year of implementation.

While these standard rates give you a baseline for budgeting, many firms add extra charges that can significantly impact your total investment in professional accounting support.

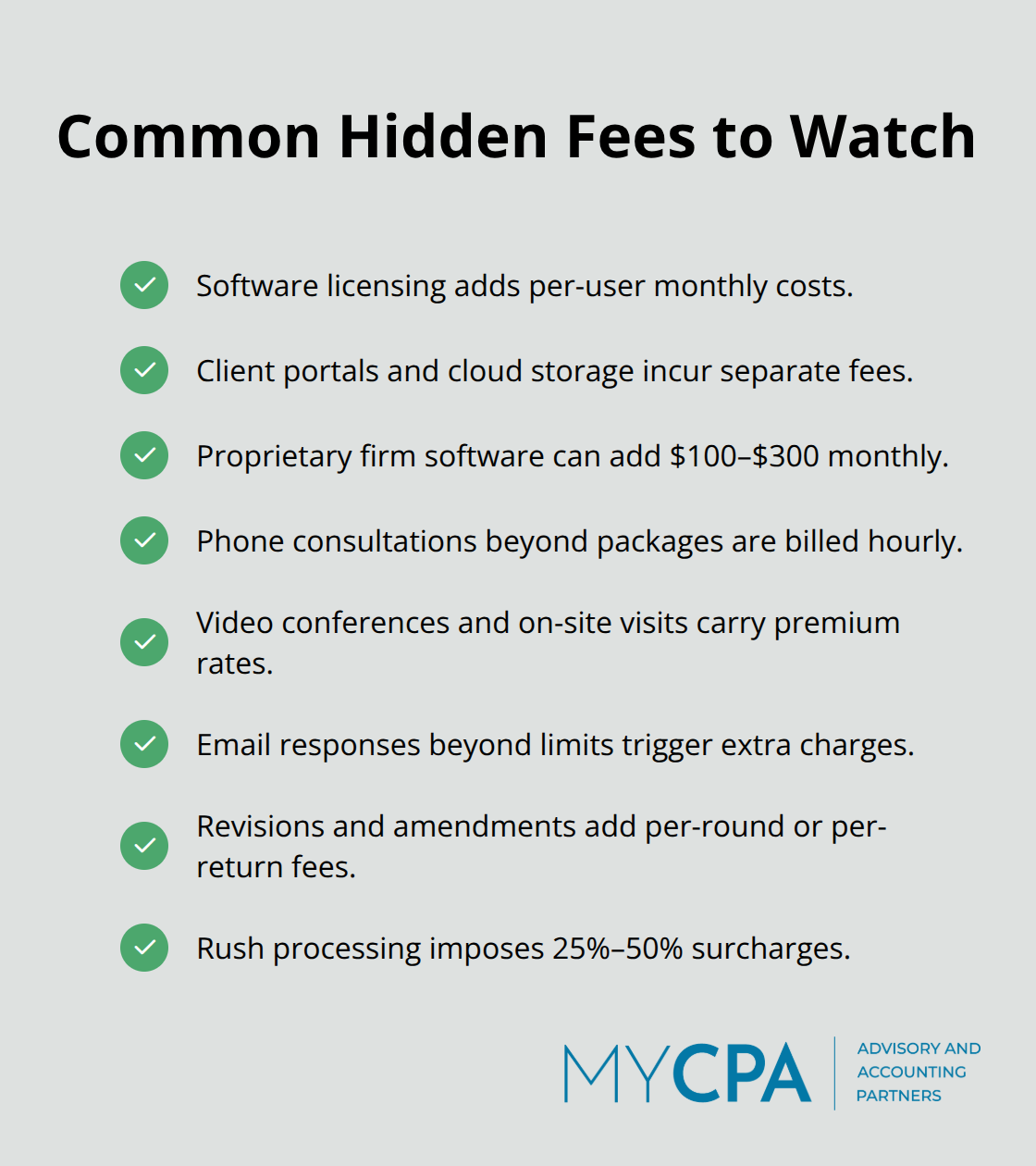

Accounting firms add technology charges that clients discover only after they sign contracts. Software licensing fees range from $19 to $57.50 monthly per user for platforms like QuickBooks, Xero, or specialized industry applications. Many firms charge separate fees for document management systems, secure client portals, and cloud storage access that can add $50 to $200 monthly to your bill. The most expensive surprise comes from proprietary software requirements – some firms mandate their custom platforms and charge $100 to $300 monthly for access, even when you already own accounting software.

Meeting fees represent one of the most overlooked expense categories in professional accounting relationships. Phone consultations beyond basic service packages cost $75 to $200 per hour at most firms, while video conferences and on-site visits command premium rates of $150 to $400 hourly. Email exchanges that exceed predefined limits trigger additional charges (typically $25 to $50 per detailed response). Small business owners require professional guidance for tax-related paperwork and forms, and professional guidance during this process generates substantial communication fees.

Revision requests after initial deliverables cost $100 to $300 per round of changes, with complex amendments to tax returns that can reach $500 to $1,000 depending on the scope of modifications required. Rush processing fees for last-minute requests add 25% to 50% surcharges to standard rates (making poor planning expensive). Document preparation fees often appear as line items for forms, schedules, and supporting documentation that many clients assume are included in base pricing.

This vigilance can uncover hidden costs or inefficiencies that impact your bottom line significantly.

Rates for accounting services depend on your business size, service complexity, geographic location, and industry specialization. Small businesses pay $300 to $1,000 monthly for basic support, while complex operations require $2,000 to $15,000 monthly. Hidden fees for software, communication, and revisions can add 20-40% to your total costs.

Smart value decisions require transparent price discussions upfront. Request detailed proposals that outline all potential charges (including technology fees and revision costs). Compare multiple providers, but focus on expertise rather than just price. Specialized industry knowledge often delivers better returns than generic services.

The right accounting investment pays for itself through tax savings, improved financial management, and strategic guidance. We at My CPA Advisory and Accounting Partners provide transparent pricing and tailored financial services that help minimize tax liabilities while delivering confident financial management. Professional accounting support becomes more valuable as your business grows, making early investment in quality services a smart long-term strategy.

Privacy Policy | Terms & Conditions | Powered by Cajabra