Choosing the best tax planning software can be a game-changer for businesses and individuals alike. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how the right software can streamline processes and maximize tax savings.

In this post, we’ll guide you through the key features to look for, compare top options for 2025, and discuss important factors to consider when making your selection. Whether you’re a small business owner or a large corporation, finding the perfect tax planning solution is crucial for your financial success.

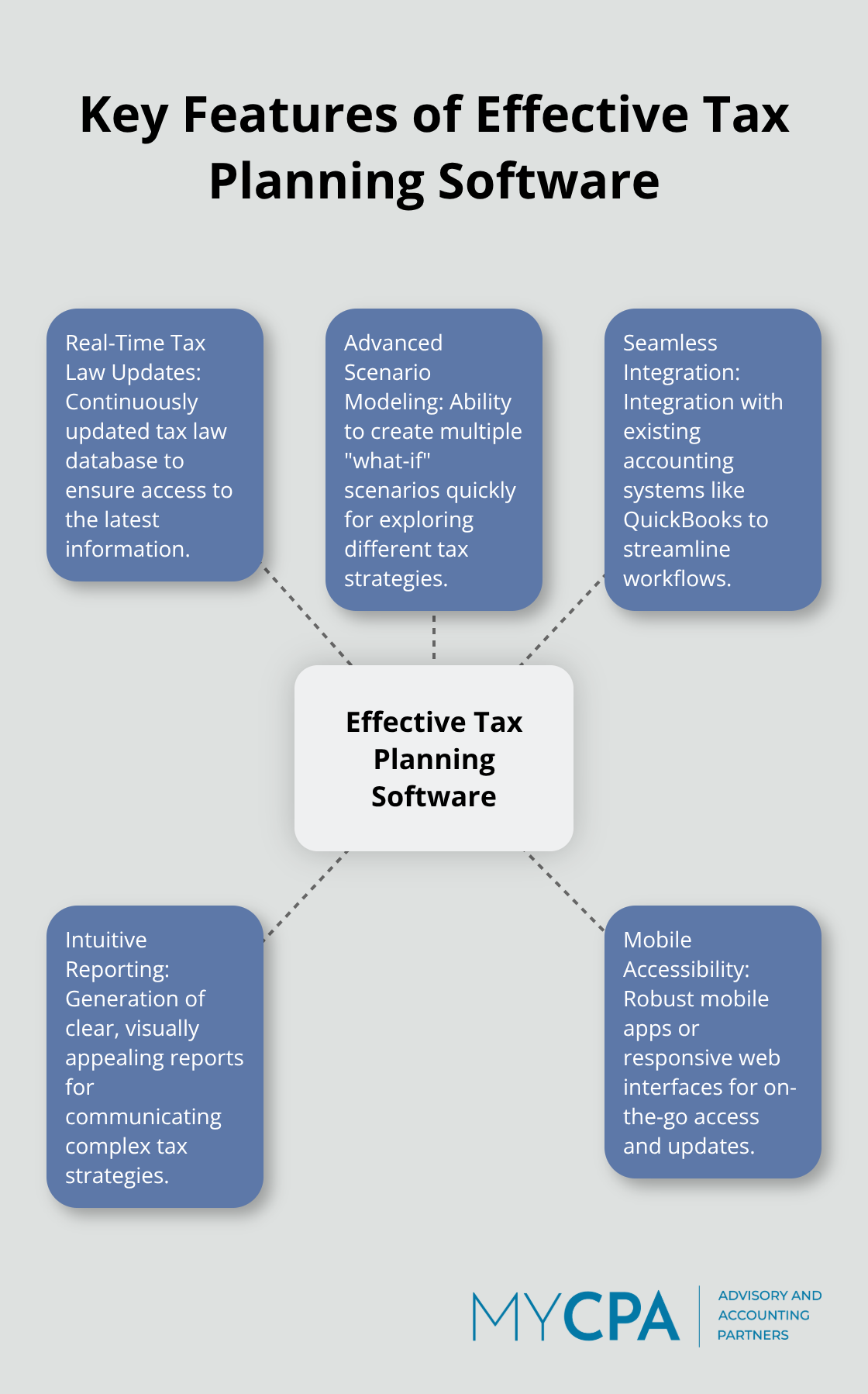

At My CPA Advisory and Accounting Partners, we have tested numerous tax planning software options. Our experience shows that the most effective solutions share key features that significantly improve tax planning efficiency and accuracy.

The tax landscape changes rapidly. Software with a continuously updated tax law database is essential. CCH AnswerConnect grants tax pros access to expert answers on tax law and compliance, ensuring users always have the latest information at their fingertips. This feature alone can save hours of manual research and reduce the risk of costly errors.

Powerful scenario modeling capabilities set top-tier tax planning software apart. Tools that allow you to create multiple “what-if” scenarios quickly are invaluable. Bloomberg Tax Planner enables users to explore different tax scenarios for their clients using the “What if?” feature, and they can also save these scenarios for later use.

Integration with existing accounting systems streamlines workflows. QuickBooks integration is a must-have for many small businesses. However, larger firms might need software that integrates with more robust ERP systems. Intuit ProConnect Tax (another competitor) offers seamless integration with QuickBooks, significantly reducing data entry time and errors.

Clear, concise reports are essential for communicating complex tax strategies to clients. Software that generates visually appealing, easy-to-understand reports is a game-changer. Holistiplan (a relative newcomer to the market) has gained popularity for its ability to generate comprehensive tax reports from uploaded tax returns in seconds.

In today’s fast-paced business environment, mobile accessibility is increasingly important. Try to find software that offers robust mobile apps or responsive web interfaces. This feature allows tax professionals to access critical information and make updates on-the-go, increasing productivity and client responsiveness.

The right tax planning software isn’t just a tool-it’s a strategic asset that can set your practice apart in a competitive market. As we move forward, let’s explore the top tax planning software options available in 2025 and how they stack up against these essential features.

At My CPA Advisory and Accounting Partners, we have tested the leading tax planning software options available in 2025. Our analysis reveals that market leaders continue to innovate, offering sophisticated features to meet the evolving needs of tax professionals.

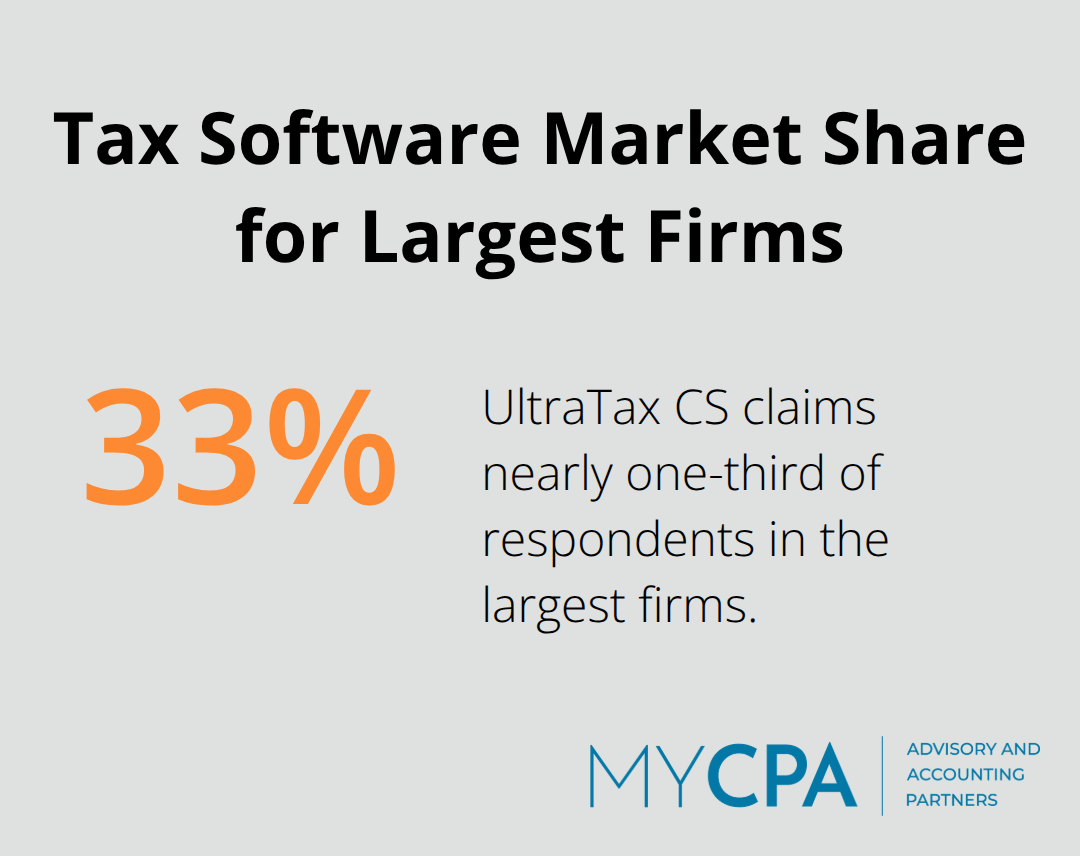

UltraTax CS remains a frontrunner, particularly favored by medium to large accounting firms. Its comprehensive tax law database and robust integration capabilities with other Thomson Reuters products give it an edge. UltraTax CS can claim nearly one-third of respondents in the largest firms, according to the latest survey.

Lacerte, developed by Intuit, maintains its strong position, especially among small to medium-sized practices. Its user-friendly interface and excellent scenario modeling capabilities have contributed to its market share. Lacerte users appreciate its ease of use, with many highlighting this as a top feature.

Drake Tax clearly predominates among sole practitioners. Its combination of affordability and robust features has led to a significant increase in adoption. Notably, a large percentage of sole practitioners prefer Drake Tax, underscoring its appeal to individual preparers.

Pricing models vary significantly across providers. UltraTax CS and Lacerte typically offer tiered pricing based on the number of returns filed and additional modules required. While these solutions tend to be more expensive, they often provide a higher return on investment for larger firms handling complex tax scenarios.

Drake Tax stands out with its straightforward pricing model. Drake Tax Pro is priced at $2,695, while Drake Tax 1040 is available for $2,145. They also offer a Pay-Per-Return option at $359.99. This approach has resonated with smaller practices looking for comprehensive solutions without the complexity of modular pricing.

It’s worth noting that while many users across all products identified cost as a primary concern, the focus on value rather than just price is increasingly evident. Firms will invest more in software that demonstrably improves efficiency and accuracy.

User reviews and ratings play a significant role in software selection. Drake Tax receives high praise from users, particularly for its customer support.

UltraTax CS and Lacerte also receive high marks for user satisfaction, particularly in areas of multistate business returns and ease of use. However, they may lag slightly behind Drake in terms of customer support and training effectiveness.

The best software choice often depends on the specific needs of each practice. While these market leaders offer excellent solutions, it’s important to evaluate them against your firm’s unique requirements and workflow. Let’s explore the key factors to consider when making your selection.

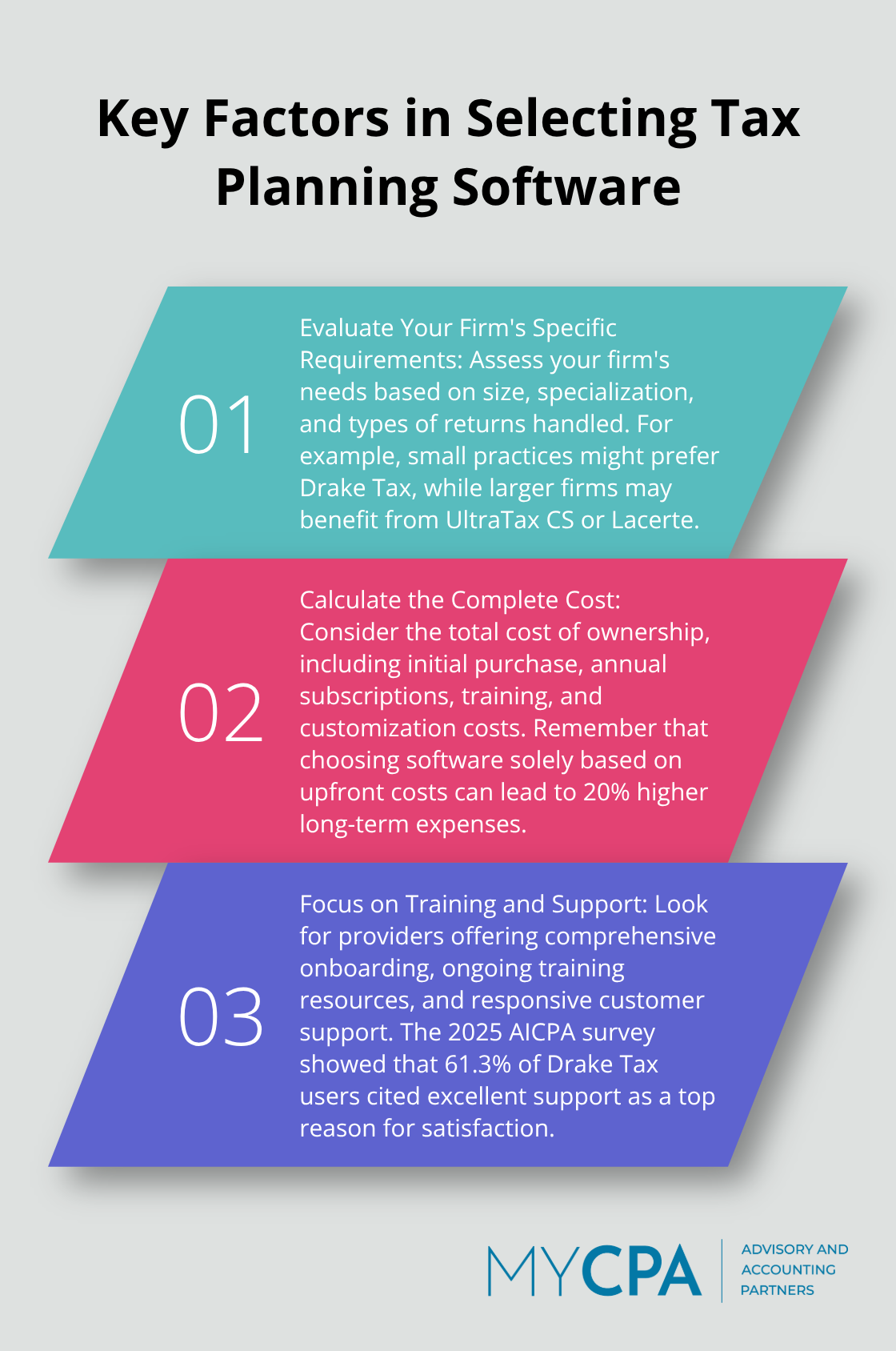

The selection of tax planning software starts with a thorough assessment of your firm’s needs. Small practices that primarily handle individual returns might find Drake Tax ideal. Its straightforward pricing and robust features appeal to sole practitioners and small firms. Larger firms dealing with complex corporate returns should consider UltraTax CS or Lacerte for their advanced capabilities. With 25,000+ automated diagnostics and 7,200+ tax forms, Lacerte leaves no detail overlooked.

Industry specialization matters. Some software options offer industry-specific modules. If your firm serves many real estate clients, you should look for software with strong real estate tax planning features. The 2025 AICPA tax software survey showed that 73% of firms serving specific industries found industry-tailored features essential for their practice.

The initial price tag doesn’t tell the whole story. You must calculate the total cost of ownership, which includes the initial purchase, annual subscriptions, training, and potential customization costs. A recent study by the National Society of Tax Professionals revealed that firms which chose software based solely on upfront costs often spent 20% more in the long run due to inefficiencies and additional training needs.

Return on investment (ROI) should factor into your decision. A more expensive solution might justify its cost if it significantly reduces time spent on each return or helps uncover additional tax-saving opportunities for clients. One mid-sized firm reported a 15% increase in revenue after switching to a more comprehensive (albeit pricier) tax planning software, due to improved efficiency and the ability to handle more complex cases.

The quality of training and support can determine the success of your software implementation. You should seek providers that offer comprehensive onboarding programs, ongoing training resources, and responsive customer support. The 2025 AICPA survey highlighted that 61.3% of Drake Tax users cited excellent support as a top reason for their satisfaction, underscoring the importance of this factor.

Consider the learning curve for your team. Software with intuitive interfaces and workflow designs can reduce training time and frustration. UltraTax CS users reported a 30% reduction in onboarding time for new staff compared to their previous software, thanks to its user-friendly design.

Many software providers offer free trials or demos. You should take advantage of these opportunities to test the software in real-world scenarios. This hands-on experience will give you valuable insights into the software’s usability, features, and compatibility with your existing systems.

During the trial period, involve key team members in the evaluation process. Their feedback can provide diverse perspectives on the software’s strengths and weaknesses. Pay attention to how well the software integrates with your current tools and workflows (this can significantly impact long-term efficiency).

Selecting the best tax planning software will significantly impact your firm’s efficiency and success. You must prioritize features like real-time tax law updates, advanced scenario modeling, and seamless integration with existing systems. These elements can dramatically improve your workflow and client service (while also enhancing your competitive edge).

Your firm’s size, specialization, and future growth plans should guide your decision. Focus on the overall value and potential return on investment rather than just the initial cost. A more comprehensive solution might justify a higher price tag if it enhances your ability to serve clients effectively.

At My CPA Advisory and Accounting Partners, we understand the complexities of tax planning and the impact of choosing the right tools. Our team of experts can provide personalized guidance on selecting tax planning software that aligns with your firm’s unique needs. We strive to help you navigate the ever-changing tax landscape and maximize your efficiency.

Privacy Policy | Terms & Conditions | Powered by Cajabra