Financial accounting advisory services are a game-changer for businesses seeking to optimize their financial operations. At My CPA Advisory and Accounting Partners, we’ve seen firsthand how these specialized services can transform a company’s financial landscape.

The meaning of financial accounting advisory services extends far beyond traditional bookkeeping, encompassing strategic guidance, process improvement, and regulatory compliance expertise. This blog post will explore the key components and benefits of these services, helping you understand how they can drive your business forward.

Financial accounting advisory services provide specialized offerings that extend beyond traditional accounting. These services offer strategic direction, process optimization, and expert insights to help businesses navigate complex financial landscapes. At their core, these services focus on analyzing financial data to inform critical business decisions. For example, advisors might assist a client in evaluating the financial implications of expanding into a new market or restructuring their operations.

Unlike traditional accounting (which primarily deals with recording and reporting financial transactions), advisory services aim to improve financial processes. This improvement could involve the implementation of new accounting software, streamlining of reporting procedures, or development of more effective internal controls. The American Institute of CPAs (AICPA) reports that 60% of accounting firms now offer these advisory services, reflecting their growing importance in the industry.

Accounting Advisory Services play an important role in helping organizations navigate financial complexities, regulatory changes, and economic uncertainties. With financial regulations in constant flux, businesses need expert guidance to stay compliant and manage risks effectively. A recent study by Xero revealed that firms providing advisory services generate 65% more revenue per client than those focused solely on compliance, highlighting the significant value of these services.

While companies of all sizes can benefit from financial accounting advisory services, small to medium-sized enterprises (SMEs) often see the most significant impact. These businesses typically lack the resources for in-house financial expertise but face complex financial challenges. Xero’s research indicates that financial literacy is notably low among Millennial and Gen Z business owners, making advisory services particularly valuable for this demographic.

Large corporations also benefit, especially when dealing with complex transactions, mergers and acquisitions, or international operations. The global market for financial accounting advisory services was valued at USD 87.89 billion in 2021 and is projected to reach USD 156.53 billion by 2032 (indicating strong demand across various business sectors).

As we move forward, it’s important to understand the core components that make up these valuable financial accounting advisory services. Let’s explore these elements in more detail in the next section.

Financial accounting advisory services encompass a range of specialized offerings designed to enhance financial operations and decision-making. These services focus on four key areas that form the backbone of effective financial management.

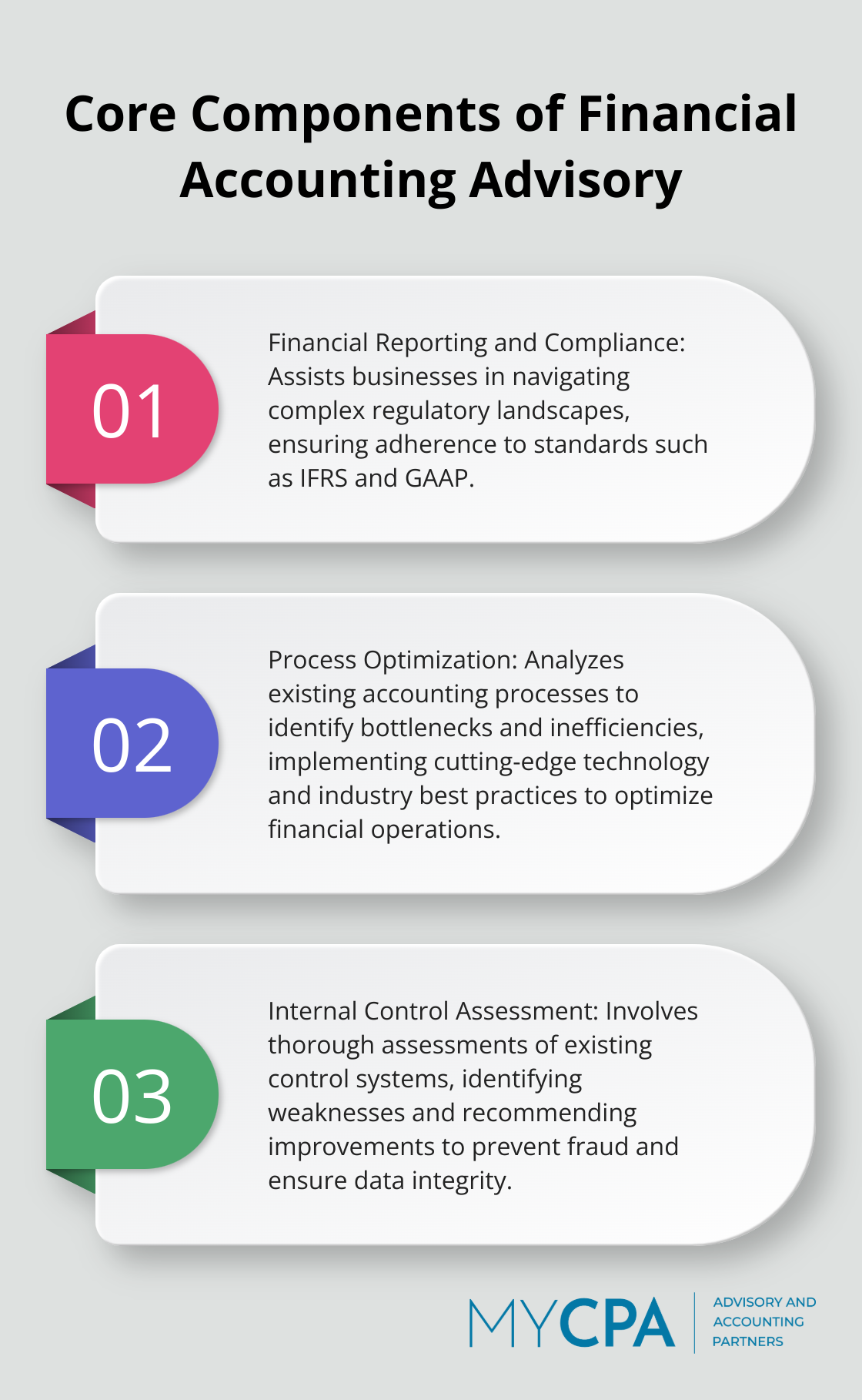

Financial reporting and compliance serve as the foundation of sound financial management. This component involves assisting businesses to navigate complex regulatory landscapes, ensuring adherence to standards such as IFRS and GAAP. IFRS specify in detail how companies must maintain their records and report their expenses and income. They were established to create a common accounting language, making company accounts understandable and comparable across international boundaries.

Efficiency stands as a key factor in today’s fast-paced business environment. Process optimization involves analyzing existing accounting processes to identify bottlenecks and inefficiencies. Through the use of cutting-edge technology and industry best practices, businesses can optimize their financial operations.

A multinational Electrical Engineering Company increased productivity and ability to meet new deadlines and requirements by 70% after implementing recommended process improvements and automation tools. This change freed up valuable resources, allowing the finance team to focus on strategic initiatives rather than routine tasks.

Strong internal controls prove essential for preventing fraud, ensuring data integrity, and maintaining stakeholder trust. This component involves thorough assessments of existing control systems, identifying weaknesses and recommending improvements.

Complex accounting issues often require specialized knowledge and expertise. Technical accounting guidance provides businesses with the support they need to navigate challenging accounting scenarios, such as mergers and acquisitions, revenue recognition, or lease accounting.

This guidance ensures that businesses apply accounting standards correctly and consistently, reducing the risk of financial misstatements and regulatory issues. It also helps companies to present their financial position accurately, which is essential for investor confidence and strategic decision-making.

The value of these core components extends beyond problem-solving. They enable businesses to proactively identify opportunities for improvement and growth. As we move forward, let’s explore the tangible benefits that these financial accounting advisory services bring to organizations.

Financial accounting advisory services offer numerous advantages for businesses of all sizes. These services extend beyond traditional accounting, providing strategic insights that can significantly impact a company’s financial health and overall performance.

Financial accounting advisory services improve decision-making capabilities through expert analysis and interpretation of financial data. Businesses can make more informed choices about investments, expansions, and resource allocation. A study by the American Institute of Certified Public Accountants (AICPA) and CPA.com found insights from their 2024 client advisory services (CAS) benchmark survey that highlight the importance of these services in enhancing decision-making capabilities.

Regulatory compliance is an ever-changing landscape, with laws and standards in constant flux. Financial accounting advisors stay current with these changes, ensuring that businesses remain compliant and avoid costly penalties. A survey by Thomson Reuters Regulatory Intelligence explored the challenges that compliance officers face in 2023, emphasizing the importance of advisory services in navigating regulatory complexities.

Process efficiency is another key benefit of financial accounting advisory services. Advisors identify and eliminate redundancies in financial processes, leading to significant cost savings. A case study revealed that a mid-sized manufacturing company saved over $500,000 annually after implementing process improvements recommended by their financial advisors.

Financial accounting advisory services provide businesses with access to specialized expertise that may not be available in-house. This expertise covers a wide range of areas, including complex accounting issues, tax strategies, and industry-specific regulations. The value of this specialized knowledge becomes particularly evident when businesses face unique financial challenges or opportunities.

Accurate financial reporting is essential for making informed business decisions and maintaining stakeholder trust. Financial accounting advisors help businesses improve their reporting processes, ensuring that financial statements are accurate, timely, and compliant with relevant standards. This improved accuracy (which can lead to better financial planning and forecasting) allows businesses to present a clearer picture of their financial health to investors, lenders, and other stakeholders.

Financial accounting advisory services have become essential for businesses in today’s complex financial landscape. These services offer strategic insights that significantly impact a company’s financial health and overall performance. The meaning of financial accounting advisory services encompasses specialized offerings, from regulatory compliance and process optimization to technical accounting guidance and enhanced decision-making capabilities.

Financial accounting advisory services provide the tools and knowledge necessary to adapt to changing regulations, capitalize on new opportunities, and maintain a competitive edge in the market. As the business world evolves, the importance of these services will only grow. They enable companies to navigate regulatory complexities, streamline financial processes, and make more informed strategic decisions.

At My CPA Advisory and Accounting Partners, we understand the critical role that financial accounting advisory services play in your business success. Our team of experts provides tailored solutions that address your unique financial challenges and goals. We invite you to explore how our comprehensive financial services can help your business achieve greater financial efficiency, compliance, and growth.

Privacy Policy | Terms & Conditions | Powered by Cajabra