At My CPA Advisory and Accounting Partners, we understand the importance of a well-crafted agreement for accounting services. A clear and comprehensive contract sets the foundation for a successful professional relationship.

This blog post will guide you through the essential components of an accounting services agreement, legal considerations, and how to tailor it to your specific business needs. By the end, you’ll have the knowledge to create a robust agreement that protects both parties and ensures a smooth collaboration.

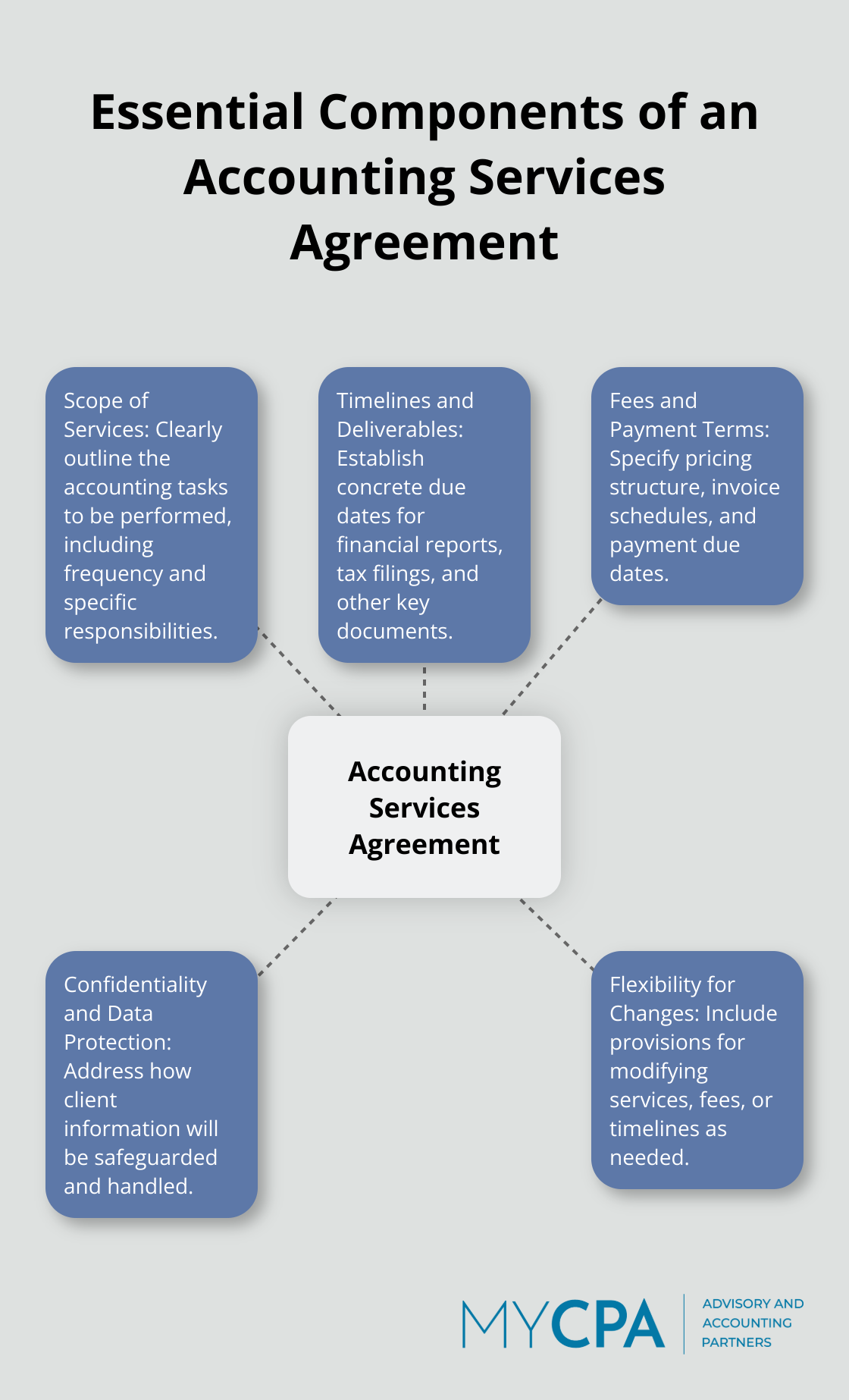

An effective accounting services agreement forms the backbone of a successful professional relationship. Let’s explore the key components that should be included in your accounting services agreement.

The first step in creating a robust agreement is to clearly outline the scope of services. This section should detail exactly what accounting tasks will be performed. The scope of services typically covers various aspects of accounting and financial management, such as budgeting, creating invoices, payroll services, and maintaining financial records. Be specific about the frequency of these services (monthly, quarterly, or annual). This clarity helps prevent scope creep and ensures both parties are on the same page.

Establish concrete timelines and deliverables. This includes specifying due dates for financial reports, tax filings, and other key documents. You might state that monthly financial statements will be delivered by the 15th of the following month. It’s also wise to include provisions for how delays will be handled, such as those caused by late client information or unforeseen circumstances.

Transparency in fees and payment terms is essential. Clearly state your pricing structure, whether it’s a flat fee, hourly rate, or a combination. Include details on when invoices will be sent and when payment is due. You might specify that invoices are sent on the 1st of each month with payment due within 15 days. Don’t forget to address potential additional costs (fees for rush work or out-of-scope services).

Addressing confidentiality and data protection is non-negotiable in today’s digital age. Outline how client information will be safeguarded, including the use of secure file-sharing platforms and encryption methods. Specify who will have access to the client’s financial data and under what circumstances. It’s also important to address data retention policies and how information will be handled after the engagement ends.

Try to build flexibility into your agreement to accommodate potential changes in the scope of work or client needs. This might include provisions for adding or removing services, adjusting fees, or modifying timelines. A flexible agreement allows for smoother adaptations to changing business circumstances without the need for frequent contract renegotiations.

As we move forward, it’s important to consider the legal aspects and compliance requirements that shape an accounting services agreement. These elements ensure that your agreement not only meets your business needs but also adheres to professional standards and regulations.

Accounting agreements must align with standards set by regulatory bodies such as the American Institute of Certified Public Accountants (AICPA). These standards cover ethical conduct, independence, and quality control. The AICPA Code of Professional Conduct requires accountants to maintain objectivity and integrity in all professional relationships.

Agreements should address compliance with specific regulations like the Sarbanes-Oxley Act for public companies or industry-specific requirements. Financial Accounting Standards Board (FASB) guidelines also shape accounting practices and should be referenced in the agreement where applicable.

Liability clauses protect both parties. These clauses typically limit the accountant’s liability to the fees paid for services (except in cases of gross negligence or willful misconduct).

Indemnification clauses outline scenarios where one party agrees to compensate the other for losses or damages. For instance, the client might indemnify the accountant against losses resulting from the client’s provision of inaccurate information.

Clear termination procedures prevent misunderstandings and potential legal issues. Agreements should specify notice periods for termination – typically 30 days is standard in the industry. Include conditions under which immediate termination is permissible, such as breach of contract or unethical behavior.

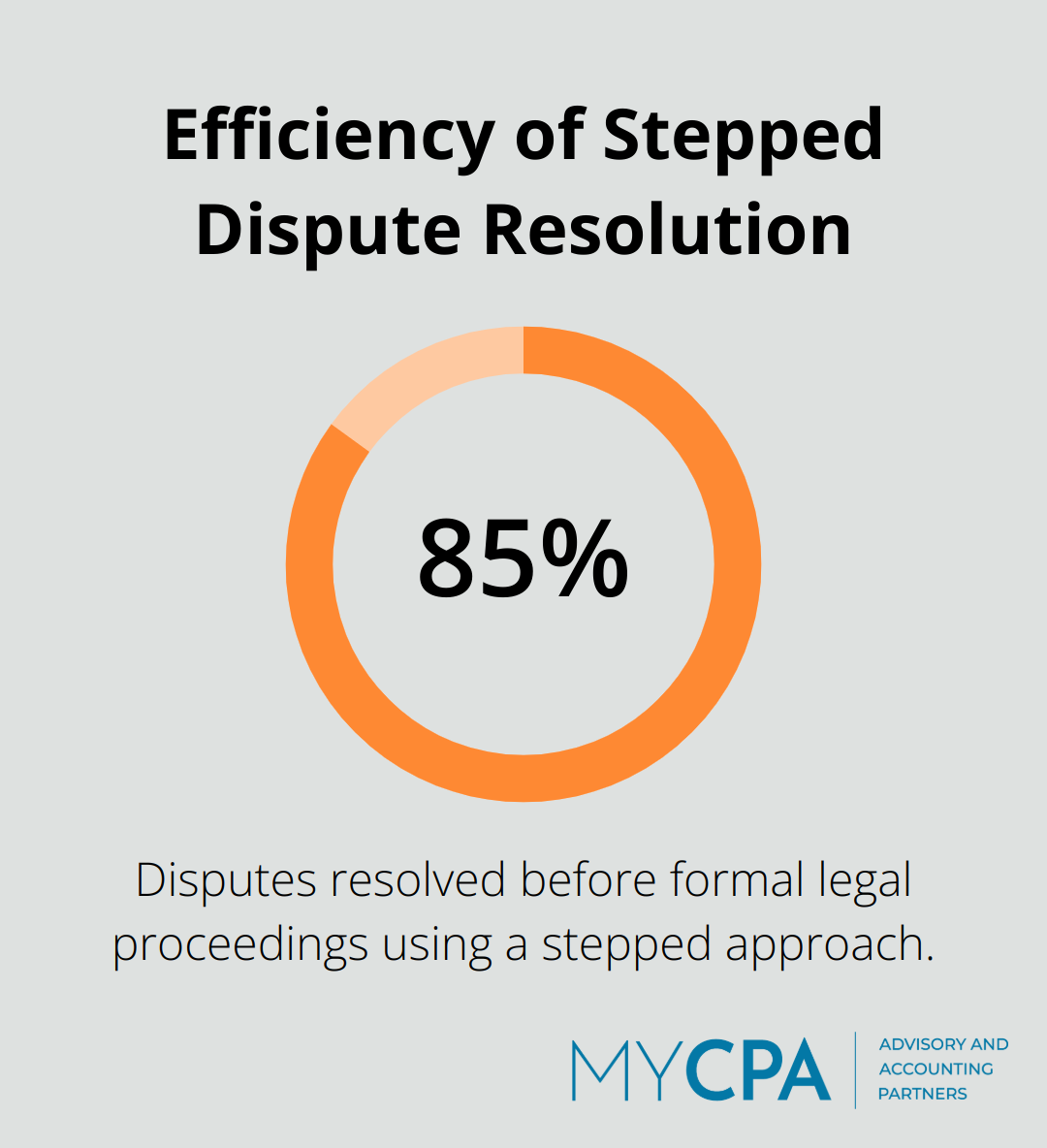

For dispute resolution, many firms opt for alternative methods like mediation or arbitration before litigation. The American Arbitration Association reports that arbitrators have firsthand knowledge of what can make for an efficient and speedy arbitration.

A stepped approach to dispute resolution in agreements often proves effective. This approach might involve internal discussions first, followed by mediation, and then arbitration if necessary. This method resolves 85% of disputes before reaching formal legal proceedings, which saves time and resources for all parties involved.

The next chapter will explore how to customize these legal and compliance aspects to fit your specific business needs and industry requirements.

Start with a thorough assessment of your business’s accounting needs. Analyze your current financial processes, identify pain points, and determine areas where professional accounting support is most needed. For example, a small e-commerce business might require assistance with sales tax compliance across multiple states, while a growing manufacturing company might need help with inventory valuation and cost accounting.

If cash flow management is a challenge for your business, ensure your agreement specifically outlines cash flow forecasting and management services.

Different industries have unique accounting requirements. Construction companies often need expertise in percentage-of-completion accounting, while healthcare providers must navigate complex billing and insurance reimbursement processes.

The National Association of State Boards of Accountancy (NASBA) reports that industry-specific knowledge is one of the top factors businesses consider when choosing an accounting firm.

Incorporate terms and services that address these industry-specific needs in your agreement.

Business needs evolve, and your accounting agreement should adapt. Include clauses that allow for periodic reviews and adjustments to the scope of services. This flexibility ensures that as your business grows or faces new challenges, your accounting support can scale accordingly without the need for a complete contract overhaul.

Try to include options for additional services that can be activated as needed (such as M&A support or international tax planning).

Tailor the payment terms to suit your business’s cash flow and budgeting needs. This might involve setting up monthly retainers, project-based fees, or a combination of both. Some businesses prefer to spread costs evenly throughout the year, while others might opt for more intensive (and costly) periods during tax season or year-end closing.

Clear communication is key to a successful accounting partnership. Your agreement should specify the frequency and method of communication (e.g., monthly check-ins, quarterly reviews, annual planning sessions). Also, outline the expected response times for queries and the primary points of contact on both sides.

A well-crafted agreement for accounting services forms the foundation of a successful partnership between businesses and accounting professionals. This document serves as a roadmap for the entire engagement, setting clear expectations and protecting both parties’ interests. It promotes clear communication, aligns expectations, and ensures that both parties work towards the same financial goals.

The creation of a comprehensive agreement extends beyond legal protection. It prevents misunderstandings, fosters trust, and facilitates smooth collaboration throughout the engagement. A personalized approach will ensure that the agreement remains relevant and valuable as your business evolves.

At My CPA Advisory and Accounting Partners, we understand the importance of a well-structured agreement in delivering exceptional accounting services. Our team can help craft agreements that address your unique financial needs while ensuring compliance with industry standards. For assistance in creating your accounting services agreement, visit our website.

Privacy Policy | Terms & Conditions | Powered by Cajabra