At My CPA Advisory and Accounting Partners, we’ve seen how Bogleheads’ tax efficiency strategies can significantly impact long-term wealth accumulation.

The Boglehead philosophy, rooted in low-cost index fund investing, offers powerful insights for optimizing your tax situation.

In this post, we’ll explore how you can apply these principles to enhance your investment returns through smart tax management.

The Boglehead investment philosophy promotes a straightforward approach to wealth building. This strategy emphasizes low-cost, diversified investing for the long term.

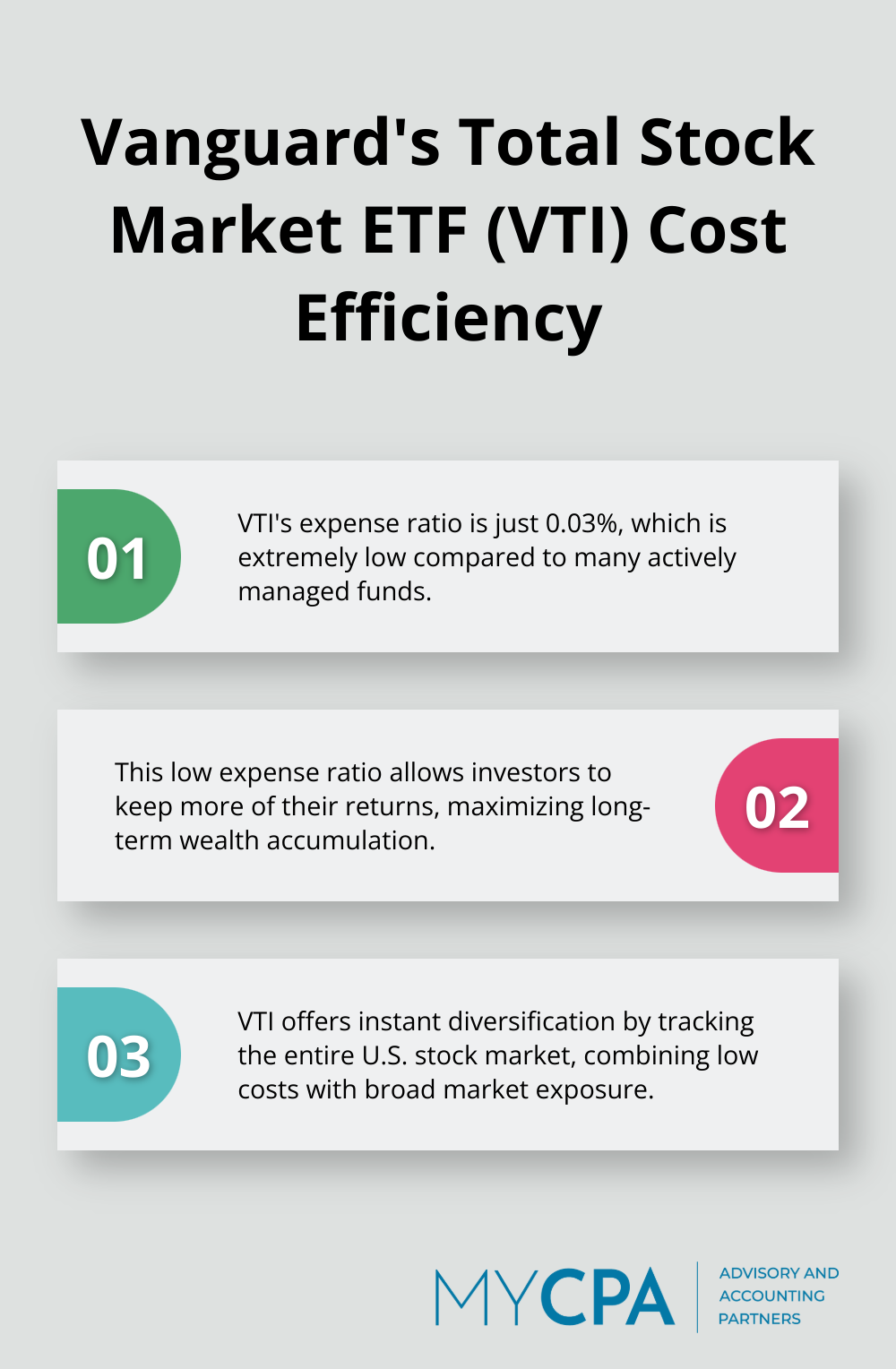

Bogleheads champion index funds as the cornerstone of their investment strategy. These funds track broad market indices, offering instant diversification at a fraction of the cost of actively managed funds. For example, Vanguard’s Total Stock Market ETF (VTI) has an expense ratio of just 0.03%, which allows investors to keep more of their returns.

The Boglehead approach advocates a “set it and forget it” strategy. This passive method minimizes the emotional pitfalls of frequent trading and market timing.

A typical Boglehead portfolio consists of just three to five broad-market index funds. This simplicity reduces complexity and minimizes the chances of overlapping investments and unnecessary fees. A basic three-fund portfolio could include a total US stock market fund, a total international stock fund, and a total bond market fund.

Bogleheads understand that even small differences in fees can significantly impact long-term returns.

As we move forward, we’ll explore how these Boglehead principles can be applied to optimize tax efficiency, further enhancing your investment returns through smart tax management strategies.

At My CPA Advisory and Accounting Partners, we understand the power of strategic tax planning in boosting investment returns. Let’s explore key Boglehead-inspired strategies to enhance your portfolio’s tax efficiency.

Tax-advantaged accounts serve as powerful tools in your tax-efficiency arsenal. These include 401(k)s, Traditional IRAs, and Roth IRAs, each offering unique tax benefits that can substantially impact your long-term wealth accumulation.

Contributions to a Traditional 401(k) or IRA are made with pre-tax dollars, reducing your current taxable income. Roth accounts offer tax-free growth and withdrawals in retirement. While contributions are made with after-tax dollars, the long-term tax benefits can be substantial, particularly if you expect to be in a higher tax bracket in retirement.

Asset location is a critical (yet often overlooked) aspect of tax-efficient investing. This strategy involves placing your investments in the most tax-advantageous accounts based on their tax characteristics.

High-yield bonds and REITs, which generate significant taxable income, are often best held in tax-advantaged accounts. Broad-market stock index funds, which are inherently tax-efficient due to low turnover and qualified dividend payments, can be held in taxable accounts.

Tax-loss harvesting involves selling investments at a loss to offset capital gains tax liabilities. This technique can be particularly effective in years with significant market volatility.

For instance, if you have a stock that’s down $10,000, you could sell it and use that loss to offset $10,000 in capital gains from other investments. If your capital losses exceed your gains, you can use up to $3,000 of the excess to offset ordinary income.

It’s important to be aware of the wash-sale rule, which prohibits repurchasing the same (or a substantially identical) security within 30 days before or after the sale.

Selecting tax-efficient investment vehicles is another key strategy. Index funds and ETFs typically have lower turnover rates compared to actively managed funds, resulting in fewer taxable events. For example, the Vanguard Total Stock Market ETF (VTI) has an annual turnover rate of just 3%, minimizing capital gains distributions.

For investors in high tax brackets, municipal bonds can offer attractive tax-free income. The interest from these bonds is generally exempt from federal taxes and often from state and local taxes for residents of the issuing state. This tax advantage can make municipal bonds more appealing than taxable bonds with higher yields, especially for those in higher tax brackets.

These strategies form the foundation of a tax-efficient investment approach. The next section will explore how to implement these Boglehead-inspired principles in your own portfolio, taking into account your unique financial situation and goals.

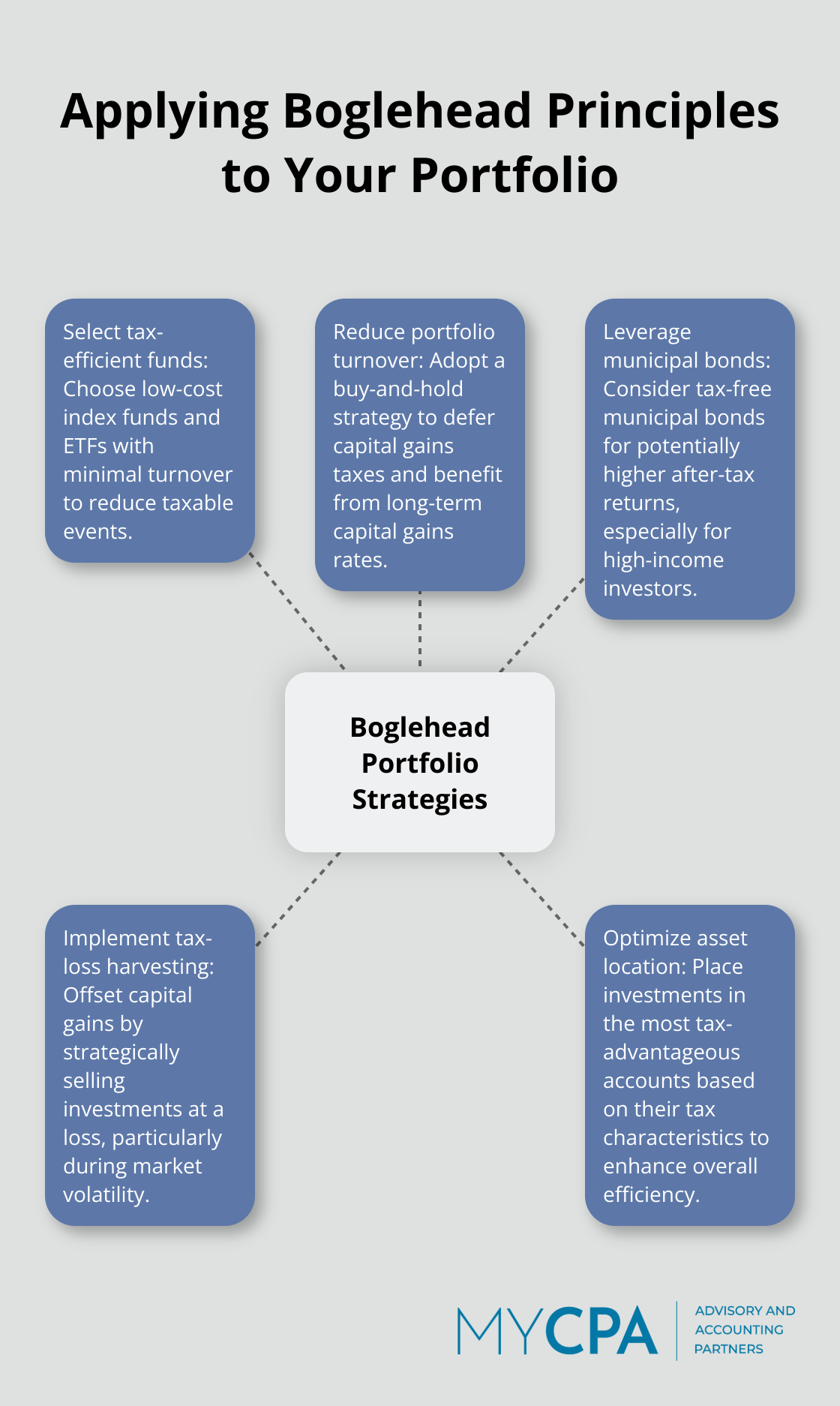

The foundation of a Boglehead-inspired portfolio rests on tax-efficient funds. Index funds and ETFs offer superior tax efficiency compared to actively managed funds due to lower turnover rates. The Vanguard Total Stock Market ETF (VTI), with its expense ratio of 0.03%, exemplifies this efficiency by minimizing costs.

When choosing funds, focus on the expense ratio. This metric measures how much of a fund’s assets are used for administrative and other operating expenses. A lower expense ratio indicates better cost efficiency. For example, the Vanguard S&P 500 ETF (VOO) has an expense ratio of 0.03%, which outperforms many actively managed funds.

Minimizing portfolio turnover plays a key role in tax efficiency. Each sale of a security for a gain triggers a taxable event. A buy-and-hold strategy defers capital gains taxes and allows investors to benefit from more favorable long-term capital gains rates.

Strategic rebalancing helps reduce turnover. Instead of selling assets to rebalance, use new contributions to adjust your allocation. This method maintains your target asset allocation without incurring unnecessary taxes.

Municipal bonds serve as a powerful tool for tax-efficient investing in taxable accounts, especially for investors in higher tax brackets. The interest from these bonds typically avoids federal taxes and often state and local taxes for residents of the issuing state.

To illustrate the potential benefit, consider an investor in the 32% federal tax bracket. A municipal bond yielding 3% would provide the same after-tax return as a taxable bond yielding 4.41% (3% / (1 – 0.32)). This tax advantage can make municipal bonds more attractive than their taxable counterparts for high-income investors.

However, municipal bonds often have lower yields than comparable taxable bonds. The decision to include them in your portfolio depends on your specific tax situation and investment goals.

Tax-loss harvesting involves selling nonprofitable investments at a loss to offset or reduce capital gains taxes. This strategy proves particularly effective in years with significant market volatility.

For instance, if you own a stock that’s down $10,000, you could sell it and use that loss to offset $10,000 in capital gains from other investments. If your capital losses exceed your gains, you can use up to $3,000 of the excess to offset ordinary income.

Be aware of the wash-sale rule, which prohibits repurchasing the same (or a substantially identical) security within 30 days before or after the sale.

Asset location involves placing investments in the most tax-advantageous accounts based on their tax characteristics. This strategy can significantly enhance overall portfolio tax efficiency.

High-yield bonds and REITs, which generate substantial taxable income, often perform best in tax-advantaged accounts. Broad-market stock index funds, inherently tax-efficient due to low turnover and qualified dividend payments, can reside in taxable accounts.

Bogleheads tax efficiency strategies can significantly boost your long-term investment returns. These methods focus on low-cost index funds, minimal portfolio turnover, and strategic asset placement in tax-advantaged accounts. The impact of tax-efficient investing compounds over time, turning small savings into substantial wealth accumulation across decades.

Every investor’s situation is unique, and tax laws are complex and ever-changing. It’s important to work with experienced professionals who can tailor these strategies to your specific financial goals and circumstances. At My CPA Advisory and Accounting Partners, we help investors optimize their tax efficiency and overall financial health.

Our team of experts can guide you through implementing these Boglehead-inspired strategies and ensure you maximize your investments. We invite you to contact us for personalized advice on tax efficiency and other financial matters. Your commitment to these principles will contribute significantly to securing your financial future.

Privacy Policy | Terms & Conditions | Powered by Cajabra