Tax services and bookkeeping are essential for businesses of all sizes. At My CPA Advisory and Accounting Partners, we understand the complexities of financial management and its impact on your bottom line.

Professional assistance in these areas can save you time, money, and stress while ensuring compliance with ever-changing regulations. This blog post will explore the key aspects of expert tax and bookkeeping services, helping you make informed decisions for your business’s financial future.

Professional tax services transform financial outcomes for businesses and individuals. The advantages extend far beyond simple form-filling, offering strategic financial planning and risk mitigation.

Professional tax services excel at identifying tax deductions and credits that often go unnoticed. The U.S. tax code presents a complex challenge that tax professionals navigate daily. Their expertise uncovers opportunities to reduce your tax burden significantly.

Some of the most overlooked tax deductions include state sales taxes, reinvested dividends, out-of-pocket charitable contributions, and student loan interest. A skilled tax professional helps you claim these deductions, potentially saving you thousands of dollars.

Tax laws change constantly. Professional tax services keep abreast of these changes as part of their core function.

Recent modifications to home office deduction rules illustrate this point. These changes have made the deduction more accessible for remote workers. However, many taxpayers might not realize they now qualify without expert guidance.

Tax mistakes carry severe consequences. These errors can result in audits, penalties, and interest charges.

Professional tax services act as a shield against these risks. Their expertise significantly reduces the likelihood of facing an IRS audit. Moreover, if an audit occurs, having a tax professional on your side can streamline the process and potentially reduce costs.

Cookie-cutter approaches often fall short in tax planning. Professional tax services provide personalized strategies that align with your specific financial goals and circumstances.

For small business owners, a tax professional can recommend the most advantageous business structure. This decision can lead to significant tax savings over time. They also advise on the timing of major purchases or sales to minimize tax impact.

As tax complexities continue to grow, the value of expert guidance in this field becomes increasingly clear. The next section will explore how professional bookkeeping complements these tax services, creating a comprehensive approach to financial management.

Professional bookkeeping transforms operations and drives growth for businesses of all sizes. This chapter explores the concrete benefits that make professional bookkeeping an essential investment for your business.

Accurate financial reports form the backbone of sound business decisions. Professional bookkeepers use advanced software and techniques to ensure correct recording of every transaction. This precision allows you to:

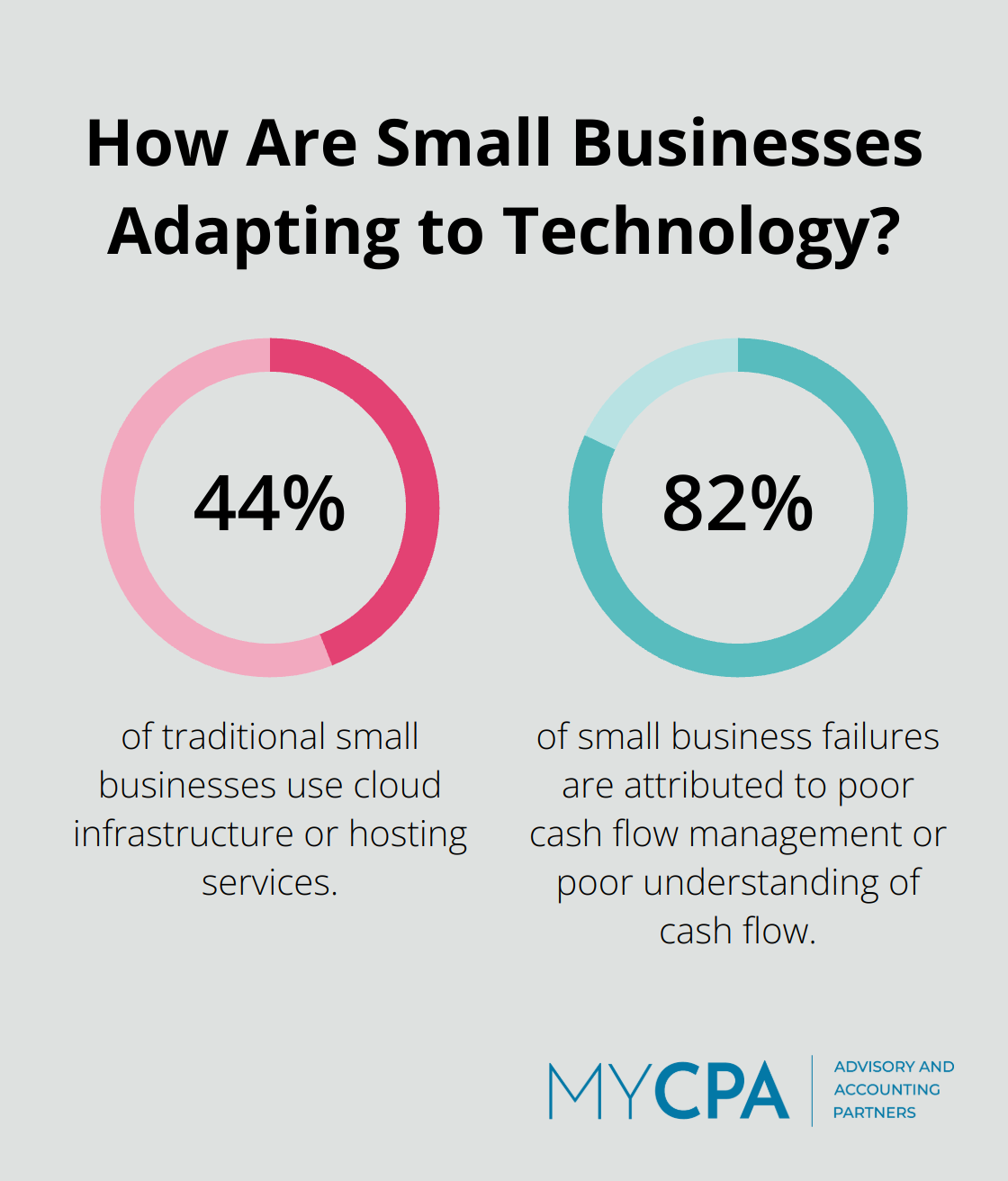

About 44% of traditional small businesses use cloud infrastructure or hosting services, compared to 66% of small tech companies and 74% of enterprises. This adoption of cloud-based solutions stems largely from the ability to make quick, data-driven decisions.

Time equals money, especially for business owners. Outsourcing bookkeeping frees up countless hours that you can redirect towards core business activities. A survey revealed that small business owners spend an average of 120 working days per year on administrative tasks. Professional bookkeeping can cut this time significantly.

Consider this: if you spend even 10 hours a week on bookkeeping tasks, that’s 520 hours per year. Imagine what you could accomplish with that time back in your schedule.

Cash flow represents the lifeblood of any business. Professional bookkeepers provide tools and insights to manage it effectively. They can:

A study revealed that 82% of the time, poor cash flow management or poor understanding of cash flow contributed to the failure of a small business. With professional bookkeeping, you equip yourself to avoid becoming part of this statistic.

Professional bookkeepers do more than just keep records; they provide valuable insights for strategic decision-making. Their expertise can help you:

By leveraging these insights, you can make informed decisions that drive your business forward.

Professional bookkeeping provides you with financial clarity and time to boost your financial health. As we move forward, we’ll explore how to select the right tax and bookkeeping services (such as those offered by My CPA Advisory and Accounting Partners) to maximize these benefits for your specific needs.

The first step in choosing tax and bookkeeping services involves a thorough assessment of your business’s financial needs. Consider your company size, industry, growth plans, and current financial challenges. A small e-commerce startup might need help with sales tax compliance across multiple states, while a growing manufacturing company might require assistance with inventory accounting and cost analysis.

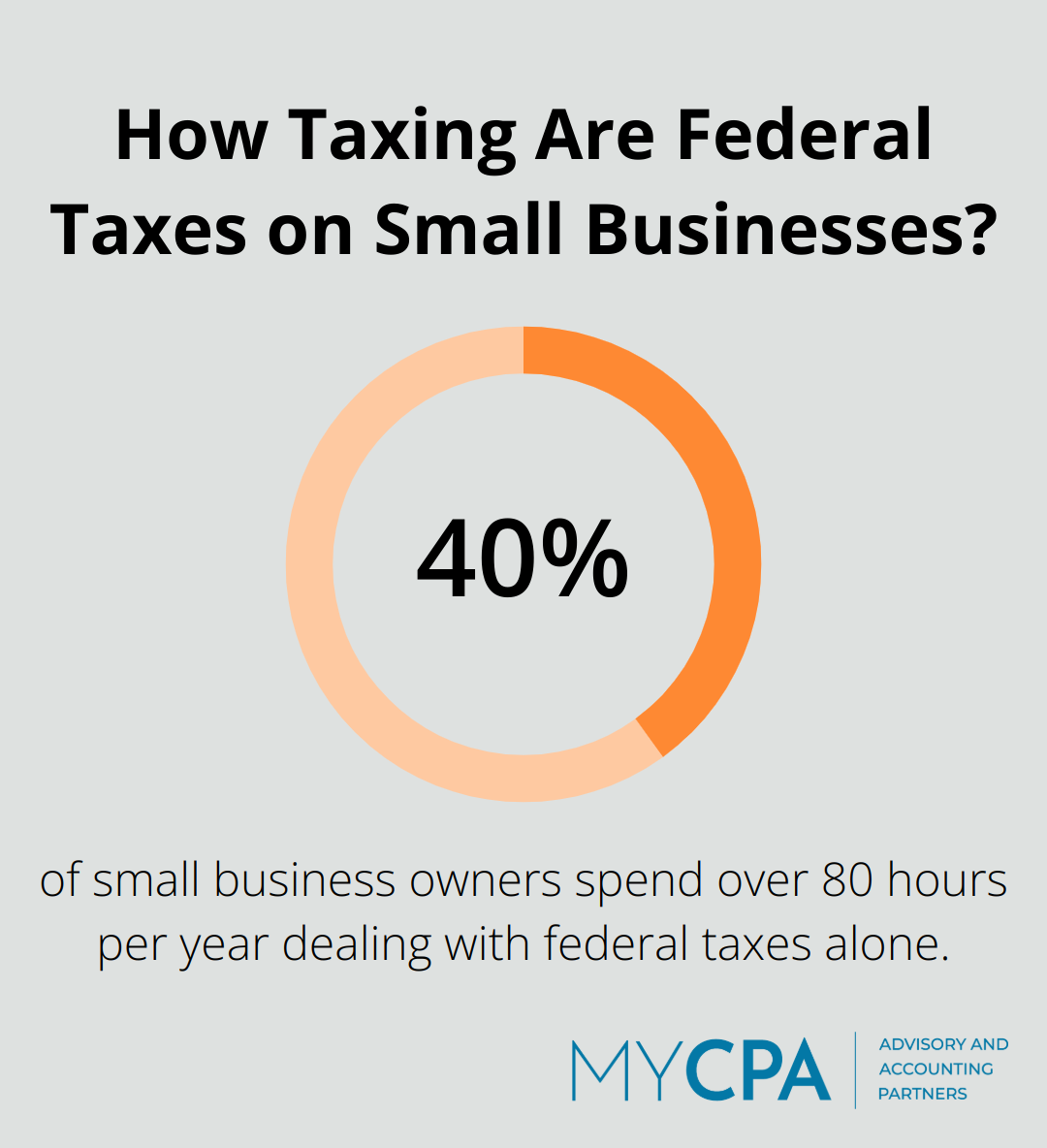

A survey by the National Small Business Association found that 40% of small business owners spend over 80 hours per year dealing with federal taxes alone. This statistic underscores the importance of finding a service provider that can efficiently handle your specific tax requirements.

When you evaluate potential service providers, look beyond basic qualifications. A Certified Public Accountant (CPA) designation is important, but it’s equally vital to consider their experience in your industry and with businesses of your size.

Request references and case studies that demonstrate their expertise. If you operate in the construction industry, search for a provider with a track record of helping construction companies optimize their finances and navigate industry-specific tax regulations.

The right technology can significantly enhance the efficiency and accuracy of tax and bookkeeping services. Ask about the software and tools the provider uses. Cloud-based accounting solutions offer real-time access to financial data and improved collaboration.

Data security is paramount. In 2020 alone, there were over 700,000 attacks against small businesses, totaling $2.8 billion in damages. Ensure that your chosen provider implements robust cybersecurity measures to protect your sensitive financial information.

Pricing for tax and bookkeeping services can vary widely. Some providers charge hourly rates, while others offer fixed monthly fees or value-based pricing. The National Society of Accountants reports that the average fee for preparing an itemized Form 1040 with Schedule A and state tax return is $323. However, complex business returns can cost significantly more.

When you compare prices, consider the value you receive. A slightly higher fee might be justified if the provider offers additional services (like financial planning or business advisory) that can contribute to your company’s growth.

Effective communication plays a key role in financial management. Search for a provider that offers regular check-ins and responds promptly to your questions. Some firms provide dedicated advisors who can offer personalized guidance throughout the year, not just during tax season.

Consider how the provider handles client education. Do they offer resources to help you understand your financial statements? Do they proactively inform you about tax law changes that might affect your business? These factors can significantly impact the long-term value of the services you receive.

Professional tax services and bookkeeping provide substantial benefits for businesses and individuals. These services maximize deductions, prevent costly errors, and offer strategic insights that significantly impact financial health. Professional bookkeeping brings precision to financial reporting and empowers businesses with real-time insights into cash flow, enabling informed decision-making.

The right partner can transform your approach to taxes and bookkeeping. My CPA Advisory and Accounting Partners offers tailored solutions designed to meet unique needs, encompassing tax optimization, accurate financial reporting, and strategic business advice. Our expertise can drive your business forward, providing peace of mind and unlocking new opportunities for growth.

Investing in professional financial services means gaining a trusted advisor committed to your financial success. Take the next step towards confident financial management and tax efficiency. Explore how our tax services and bookkeeping can help you achieve your financial goals and position your business for sustainable success.

Privacy Policy | Terms & Conditions | Powered by Cajabra