Startups face unique financial challenges that can make or break their success. Choosing the right accounting services for startups is a critical decision that impacts everything from daily operations to long-term growth.

At My CPA Advisory and Accounting Partners, we’ve seen firsthand how proper financial management can propel new businesses forward. This guide will help you navigate the essential accounting services your startup needs and how to select the best partner for your journey.

Accurate financial data forms the backbone of smart business decisions. Without it, startups operate in the dark. Professional accounting services provide clear insights into your financial position, which helps you make informed choices about resource allocation, pricing strategies, and growth opportunities. A detailed cash flow analysis (a key tool in financial management) can reveal whether it’s the right time to invest in new equipment or hire additional staff.

Tax laws are notoriously complex and constantly change. Startups that mishandle their taxes face severe penalties and potential legal issues. Professional accountants stay up-to-date with the latest regulations, which ensures compliance while maximizing deductions. Expert guidance helps startups avoid costly mistakes and focus on growth.

Investors and lenders demand clear, accurate financial records. Well-maintained books demonstrate professionalism and reliability, which increases your chances of securing funding. Professional accounting services help prepare compelling financial statements and projections that can make your startup stand out to potential backers.

Professional accountants bring a wealth of experience to the table. They can identify inefficiencies in your financial processes and suggest improvements that save time and money. This expertise allows startups to streamline their operations and focus on core business activities. For example, implementing automated accounting systems (a common recommendation from professionals) can reduce manual data entry errors and free up valuable time for strategic planning.

Professional accounting services do more than just crunch numbers; they provide the financial clarity and credibility startups need to thrive in a competitive landscape. As your startup grows, the complexity of your financial needs will increase. Starting with a solid accounting foundation ensures you’re prepared for future challenges and opportunities. This proactive approach sets the stage for our next topic: the key accounting services that every startup should consider.

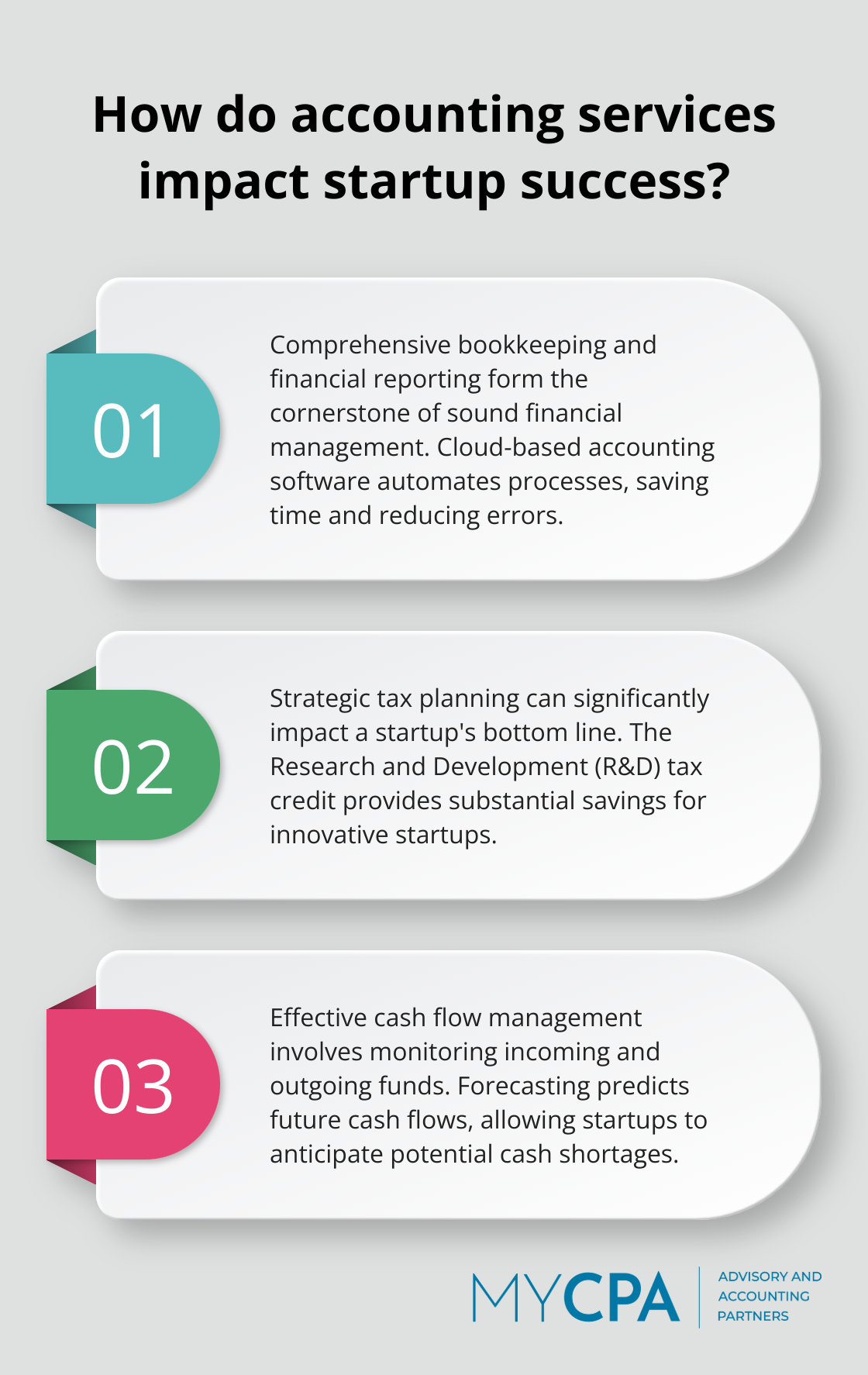

Accurate bookkeeping forms the cornerstone of sound financial management. It requires the recording of all financial transactions, reconciliation of accounts, and preparation of financial statements. For startups, this means tracking every dollar that enters and exits the business.

Financial reporting transforms this data into actionable insights. Regular reports, such as income statements and balance sheets, offer a clear picture of a startup’s financial health. These reports prove essential for making informed decisions about resource allocation, pricing strategies, and growth opportunities.

Many startups benefit from cloud-based accounting software (like QuickBooks), which automates much of the bookkeeping process. This technology not only saves time but also reduces errors, ensuring financial data remains up-to-date and accurate.

Tax planning should be a year-round activity that can significantly impact a startup’s bottom line. It involves understanding tax laws, identifying deductions, and structuring business operations to minimize tax liabilities.

Effective tax planning extends beyond simply filing returns. It includes strategies like identifying and listing goals in ascending order, exploring investment avenues that align with these goals, and taking advantage of tax credits specific to startups. The Research and Development (R&D) tax credit, for example, can provide substantial savings for innovative startups.

Tax preparation, while often viewed as an annual task, proves most effective when approached proactively. Keeping detailed records throughout the year and working with a tax professional helps ensure compliance and maximize deductions.

Cash flow serves as the lifeblood of any startup. Effective cash flow management involves monitoring the timing of incoming and outgoing funds to ensure sufficient cash on hand to meet obligations.

Forecasting predicts future cash flows based on historical data and projected growth. This allows startups to anticipate potential cash shortages and take corrective action before they become critical issues.

Tools like cash flow statements and rolling forecasts provide invaluable insights for startups. They reveal seasonal fluctuations, help identify potential funding gaps, and inform decisions about when to invest in growth opportunities.

As startups grow and add employees, payroll becomes increasingly complex. Efficient payroll processing ensures accurate and timely employee payments, while also handling tax withholdings, benefits deductions, and compliance with labor laws.

Payroll management extends beyond just cutting checks. It includes tracking employee time, managing paid time off, and ensuring compliance with ever-changing regulations. Many startups find that outsourcing payroll to professionals (such as My CPA Advisory and Accounting Partners) saves time and reduces the risk of costly errors.

Implementing a robust payroll system early on sets the stage for smooth scaling as a startup grows. It also provides valuable data for financial planning and budgeting.

These four key areas – bookkeeping, tax planning, cash flow management, and payroll processing – help startups build a solid financial foundation. They not only ensure compliance and accuracy but also provide the insights needed to make strategic decisions that drive growth. The next step involves selecting the right accounting partner to help implement these essential services effectively.

Selecting the right accounting partner is a pivotal decision for any startup. This choice can significantly impact your financial health, compliance, and overall business success. Let’s explore the key factors to consider when choosing an accounting partner for your startup.

Look for firms with a proven track record in serving startups. Startup accounting differs significantly from traditional business accounting due to unique challenges such as rapid growth, complex funding structures, and evolving business models. An accountant well-versed in startup finances can provide invaluable insights and guidance.

A startup-savvy accountant can help you navigate the complexities of equity compensation (a common practice in startups that requires specialized knowledge to implement correctly). They can also assist with financial modeling for fundraising rounds, a critical skill when seeking investor backing.

As your startup grows, your accounting needs will evolve. Choose a partner that offers a wide range of services to support your business at every stage. This scalability ensures continuity in your financial management and eliminates the need to switch providers as you expand.

Try to find firms that provide comprehensive services, from basic bookkeeping to advanced financial strategy. This approach allows for support from inception through to maturity.

In today’s digital age, technology plays a key role in efficient accounting practices. Your accounting partner should be proficient in using modern accounting software and willing to integrate with your existing tech stack.

Cloud-based accounting solutions offer real-time financial insights and facilitate collaboration between your team and your accountants. Some options, like QuickBooks, can be more affordable for very small or new businesses, with plans starting under $20 per month. Ask potential partners about their experience with these platforms and their approach to leveraging technology for improved financial management.

Effective communication is essential to a successful partnership with your accountant. Look for a firm that prioritizes clear, jargon-free explanations of complex financial concepts. They should be readily available to answer your questions and provide timely updates on your financial status.

Consider the communication channels offered by potential partners. Do they provide regular check-ins? Can you reach them easily when urgent issues arise? Proactive communication ensures clients are always informed and empowered to make sound financial decisions.

Different industries have unique accounting requirements and challenges. An accounting partner with experience in your specific sector can provide more targeted advice and support. They’ll be familiar with industry-specific regulations, tax implications, and financial best practices relevant to your business.

For example, if you’re a tech startup, an accountant with experience in software revenue recognition rules can help you accurately report your earnings, which is important for investor relations and compliance.

Professional accounting services provide startups with strategic insights, compliance assurance, and a path to sustainable growth. The right accounting partner offers industry-specific knowledge, scalable services, and technological proficiency to support startups at every stage. Investing in accounting services for startups early establishes a strong foundation for long-term success, allowing founders to focus on core business activities.

My CPA Advisory and Accounting Partners understands the unique challenges startups face. Our team offers tailored accounting services, providing the expertise needed to navigate financial complexities during rapid growth. We help startups build a solid financial foundation for lasting success.

In today’s competitive business landscape, a trusted accounting partner is essential for startup success. Choosing the right accounting services doesn’t just manage finances; it invests in a startup’s future (and sets the stage for growth and profitability).

Privacy Policy | Terms & Conditions | Powered by Cajabra