Small business accounting services can make or break a company’s financial health. At My CPA Advisory and Accounting Partners, we understand the unique challenges faced by small businesses in managing their finances.

Our expert services cover everything from comprehensive tax planning to robust bookkeeping solutions and QuickBooks support. This guide will walk you through the essential accounting services that can help your small business thrive in today’s competitive landscape.

Tax management plays a pivotal role in small business success. Effective tax services can significantly impact your company’s financial health and growth potential. Let’s explore the key components of comprehensive accounting services that can benefit your small business.

Tax planning goes beyond mere preparation. It involves a year-round approach to optimize your financial position. A strategic tax plan analyzes your business structure, income streams, and expenses to develop tailored strategies. These strategies aim to minimize your tax burden while maximizing financial opportunities.

For instance, you might consider deducting business insurance expenses, including liability, workers’ compensation, commercial auto, and business interruption services insurance. Such proactive measures can lead to substantial savings and improved cash flow for your business.

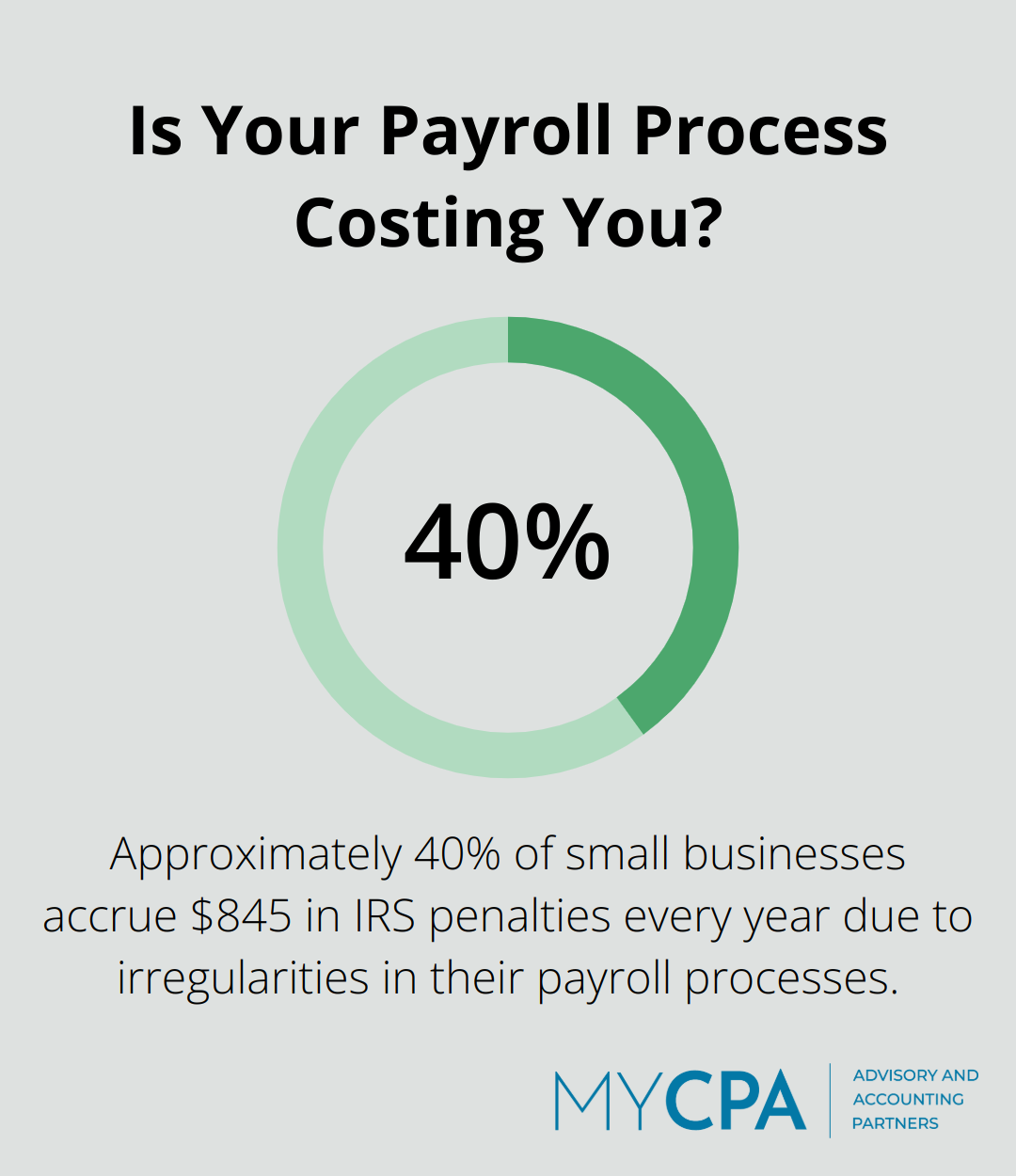

Accuracy in tax filing is paramount. Approximately 40% of small businesses accrue $845 in IRS penalties every year due to irregularities in their payroll processes. Professional tax preparation services ensure meticulous attention to detail, claiming every eligible deduction and filling out each form correctly.

This precision not only saves money but also provides peace of mind. You can focus on running your business, confident that your tax obligations are handled with expertise and care.

If your business faces an IRS audit, professional representation can make a significant difference. According to the National Taxpayer Advocate, taxpayers with representation are more likely to have a favorable outcome in disputes with the IRS.

Expert tax professionals can:

Their goal is to resolve audits quickly and efficiently, minimizing disruption to your business operations.

Small businesses often overlook valuable tax incentives. For example, the Research and Development Tax Credit can provide up to 20% of qualified expenses, while the Work Opportunity Tax Credit can offer up to $9,600 per eligible employee.

Staying current on available credits and deductions ensures you capitalize on every opportunity to reduce your tax liability. This knowledge can translate into significant savings and increased resources for business growth and development.

Tax services do more than save money-they empower you to make informed financial decisions that drive your business forward. As we move from tax considerations to broader financial management, let’s explore how robust accounting and bookkeeping solutions can further strengthen your small business’s financial foundation.

At My CPA Advisory and Accounting Partners, we understand that robust accounting and bookkeeping solutions form the backbone of a thriving business. Small business owners often find themselves juggling multiple financial tasks, from tracking expenses to managing payroll. Let’s explore how these services can transform your financial operations.

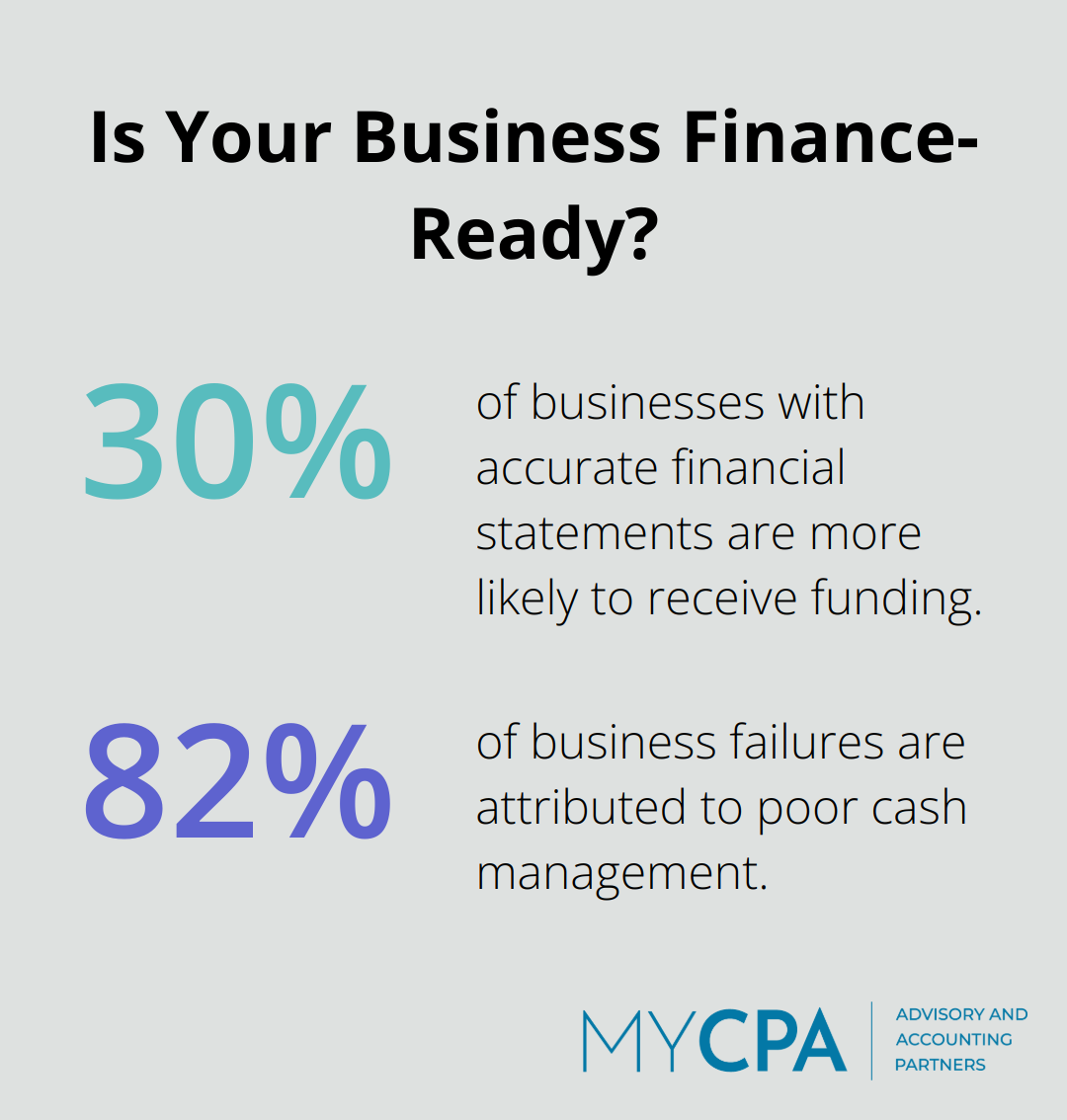

Financial statements tell the story of your business’s financial health. A study by the Small Business Administration found that businesses with accurate financial statements are 30% more likely to receive funding. We prepare and analyze these crucial documents, providing you with actionable insights to drive growth.

Your balance sheet might reveal untapped equity that could be leveraged for expansion. Your income statement could highlight unexpectedly profitable product lines, guiding your future inventory decisions.

Monthly bookkeeping and reconciliation are vital for maintaining financial accuracy. The American Institute of CPAs reports that businesses performing monthly reconciliations detect fraud 40% faster than those who don’t. Our team ensures your books remain up-to-date, giving you real-time visibility into your financial position.

We don’t just record transactions; we scrutinize them. This vigilance can uncover hidden costs or inefficiencies. For instance, we might spot a recurring charge for a service you no longer use, saving you hundreds (or even thousands) of dollars annually.

Cash flow is the lifeblood of any business. Without a reliable cash management strategy, even a profitable company can find itself in hot water. Our cash flow management and forecasting services help you avoid becoming part of the 82% of business failures attributed to poor cash management.

We use advanced forecasting tools to predict future cash positions, allowing you to make informed decisions about investments, hiring, or expansion. This foresight can make the difference between seizing a golden opportunity and missing out due to temporary cash constraints.

Payroll processing presents a minefield of potential errors and compliance issues. The IRS reports that 40% of small businesses pay an average penalty of $845 per year for payroll mistakes. Our payroll services ensure accuracy, timeliness, and full compliance with ever-changing regulations.

We handle everything from calculating wages and deductions to filing payroll taxes. This not only saves you time but also provides peace of mind. Your employees get paid correctly and on time, while you avoid costly penalties and focus on growing your business.

As we move forward, we’ll explore how QuickBooks can further enhance your financial management capabilities (and how our expertise can help you maximize its potential).

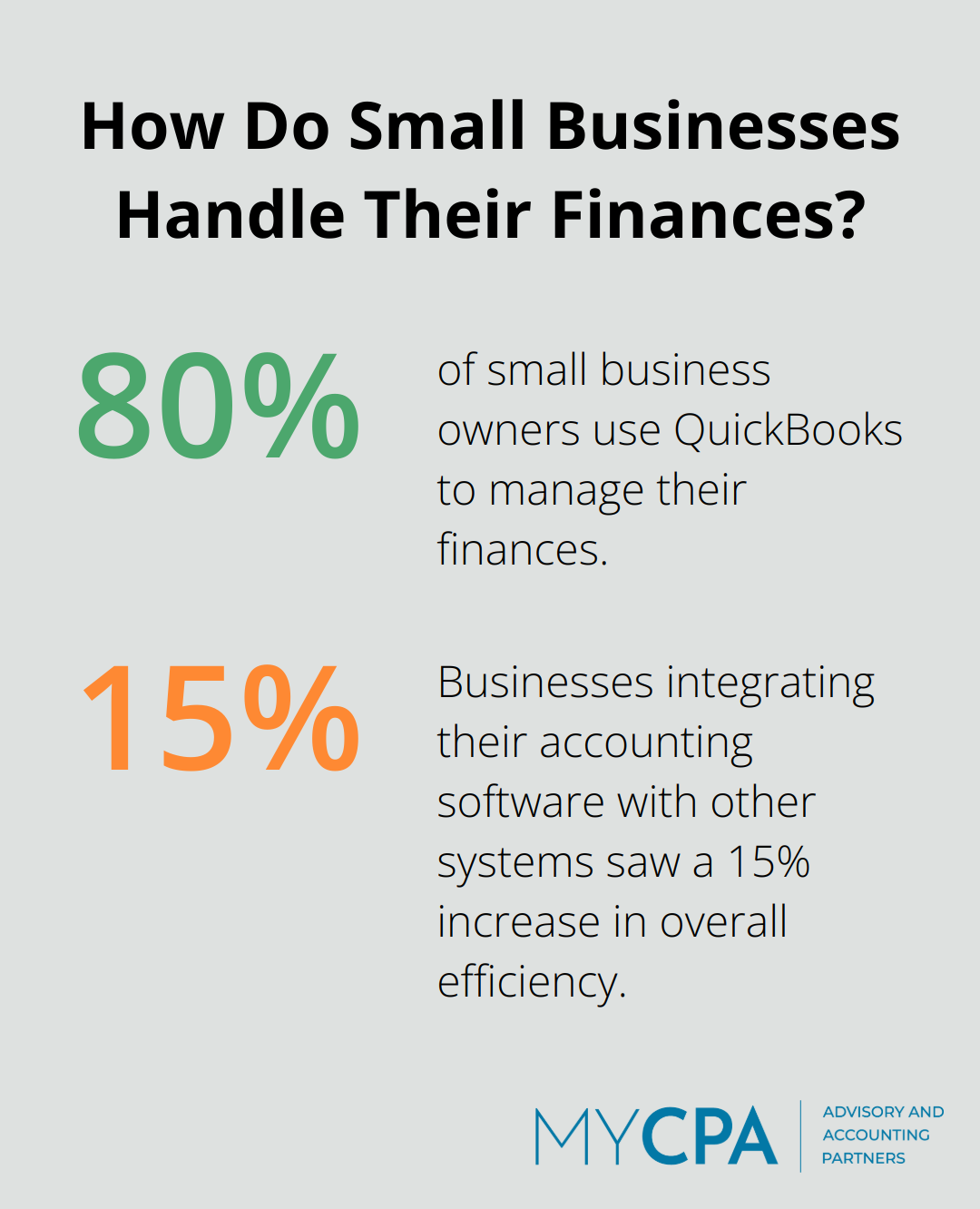

QuickBooks has become the preferred accounting software for small businesses, with over 80% of small business owners using it to manage their finances. Proper QuickBooks setup and support can transform a company’s financial management. Let’s explore how to make the most of this powerful tool.

The first step in leveraging QuickBooks is proper setup and customization. A study by Intuit found that QuickBooks Online users report saving an average of 40 hours per month on manual data entry related to expense management. This process starts with an analysis of your business structure, industry, and specific financial needs to configure QuickBooks accordingly.

This tailored approach ensures that your chart of accounts, item list, and financial reports align perfectly with your business operations. For instance, a construction company might need job costing features, while a retail business would benefit from inventory tracking capabilities.

QuickBooks is only as effective as the people using it. That’s why a strong emphasis on training is essential. According to a survey by the American Institute of Professional Bookkeepers, businesses that invest in QuickBooks training for their staff report a 30% increase in productivity.

Comprehensive training sessions should cover everything from basic data entry to advanced reporting features. This ensures that your team understands how to generate accurate financial reports, reconcile accounts, and manage payroll within QuickBooks. This knowledge empowers your staff to make data-driven decisions and catch potential issues early.

Even with proper setup and training, questions and challenges can arise. Ongoing QuickBooks support ensures that these issues don’t disrupt your business operations. QuickBooks expert support is available 24/7 to resolve issues quickly.

Expert support provides troubleshooting for common problems, assists with software updates, and offers guidance on using new features. This continuous support keeps your financial processes running smoothly and allows you to take advantage of the latest QuickBooks innovations.

In today’s digital age, your accounting software shouldn’t exist in isolation. Integrating QuickBooks with other business systems can significantly enhance its value. A study by Forrester Research found that businesses integrating their accounting software with other systems saw a 15% increase in overall efficiency.

Connecting QuickBooks with your point-of-sale systems, e-commerce platforms, and customer relationship management tools creates a seamless flow of financial data across your business. This integration reduces manual data entry and the potential for errors (which can save time and improve accuracy).

Business advisory services can further help you optimize your QuickBooks usage and overall financial strategy, ensuring you’re making the most of this powerful tool while minimizing tax liability and maximizing wealth.

Small business accounting services form the foundation of financial success for entrepreneurs. These services encompass tax planning, bookkeeping solutions, and QuickBooks support, which enable informed decision-making and sustainable growth. Accurate financial statements and efficient monthly processes provide real-time insights into a company’s financial health, allowing for proactive management and strategic planning.

Professional accounting services offer more than just number-crunching; they pave the way for business growth and long-term success. With expert guidance, small businesses can navigate complex financial landscapes, seize opportunities, and build resilience against economic challenges. The right accounting partner becomes an invaluable asset, offering personalized advice and proactive solutions tailored to unique business needs.

My CPA Advisory and Accounting Partners offers a comprehensive suite of small business accounting services designed to optimize financial operations. Our expertise in tax planning, accounting, QuickBooks management, and business advisory services provides the support and insights necessary for businesses to thrive in today’s competitive market. Partnering with experienced professionals ensures a solid financial foundation, allowing business owners to focus on growing their business and achieving their goals.

Privacy Policy | Terms & Conditions | Powered by Cajabra