Comprehensive accounting services are the backbone of financial success for businesses of all sizes. At My CPA Advisory and Accounting Partners, we understand the critical role these services play in your company’s growth and stability.

From basic bookkeeping to advanced financial analysis, professional accounting support can transform your business operations. This post will explore what you can expect from a full range of accounting services and how they can benefit your organization.

Core accounting services form the bedrock of every successful business’s financial foundation. These essential services help track income and expenditures, ensure statutory compliance, and provide investors with crucial financial information.

Bookkeeping and financial record keeping serve as the starting points for all financial activities. Advanced software tracks every transaction, ensuring accuracy and providing real-time insights into a company’s financial position. This detailed record-keeping proves invaluable for making informed business decisions and preparing for tax season.

Financial statement preparation transforms raw financial data into clear, concise reports that illustrate a company’s financial health. These statements (including balance sheets, income statements, and cash flow statements) play a vital role in securing loans, attracting investors, and guiding strategic decisions.

Tax planning and preparation can significantly impact a business’s financial year. Staying current with the latest tax laws and regulations helps minimize tax liability and maximize deductions. Professional accounting services aim to reduce the time burden while ensuring compliance.

Payroll management often presents challenges for business owners. Professional services handle everything from wage calculations and deductions to payroll tax filings. This not only saves time but also reduces the risk of costly errors. Some organizations choose to outsource the payroll function for efficiency.

Accounts payable and receivable management plays a critical role in maintaining healthy cash flow. Efficient systems track incoming payments and outgoing expenses, helping businesses avoid late fees and capitalize on early payment discounts. Effective management in this area can lead to improved vendor relationships and better credit terms.

Core accounting services do not follow a one-size-fits-all approach. Professional firms (such as My CPA Advisory and Accounting Partners) tailor their approach to meet each client’s unique needs, ensuring maximum value from accounting support. This personalized service allows businesses to focus on growth and innovation, knowing their financial foundation remains solid.

As we move beyond core services, let’s explore the advanced accounting offerings that can take your financial management to new heights.

Financial analysis and reporting transform raw data into actionable intelligence. These services help you understand your company’s performance in detail. Reports highlight key performance indicators (KPIs) specific to your industry, allowing you to benchmark against competitors and identify areas for improvement.

This section explores seven innovative approaches to harness practical data insights for impactful decision-making and improved outcomes.

Budgeting and forecasting are essential for navigating uncertain economic landscapes. Sophisticated modeling techniques project your company’s financial future under various scenarios. This approach allows you to make informed decisions about investments, expansions, and resource allocation.

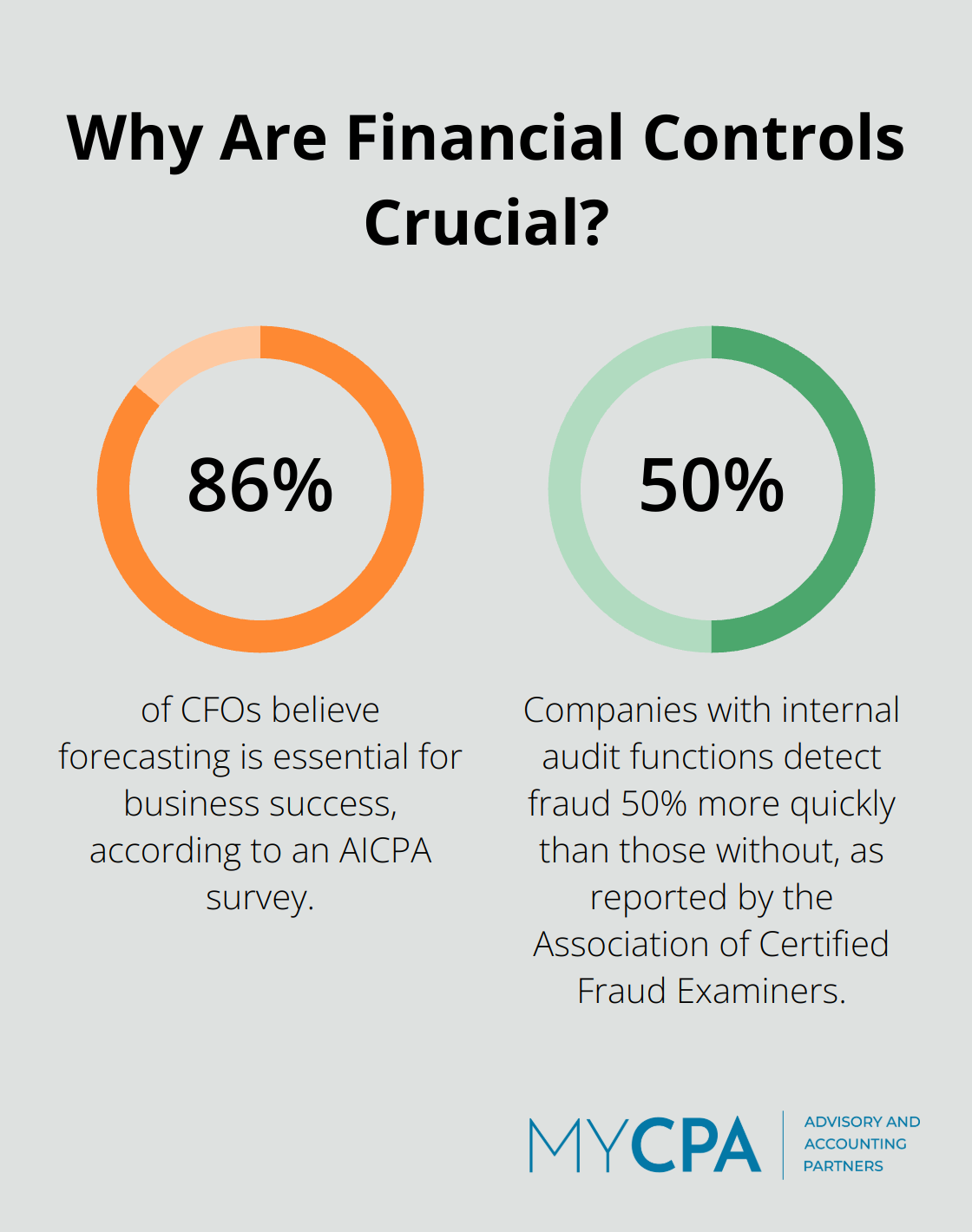

A survey by the American Institute of CPAs (AICPA) revealed that 86% of CFOs believe forecasting is essential for business success. The latest forecasting methodologies provide accurate, reliable projections.

Effective cash flow management can determine whether a business thrives or merely survives. Robust systems track and optimize your cash flow, ensuring you have the liquidity needed to seize opportunities and weather challenges.

Advanced cash flow services help you improve cash flow forecasting and liquidity management through detailed financial reporting and real-time data. These services provide visibility into your cash position and offer strategies to improve collection rates and manage payables more effectively.

Internal audits safeguard your company’s assets and ensure operational efficiency. Thorough reviews of your financial processes identify potential risks and recommend improvements.

The Association of Certified Fraud Examiners reports that companies with internal audit functions detect fraud 50% more quickly than those without. Tailored audit approaches (based on your specific industry and risk profile) provide peace of mind and a solid foundation for growth.

Strategic financial planning ties all these elements together into a comprehensive roadmap for your company’s future. This service works closely with you to understand your long-term goals and develop strategies to achieve them.

A PwC survey found that companies with effective strategic planning processes are 2.5 times more likely to achieve above-average profitability in their industry. Planning services cover everything from capital structure optimization to merger and acquisition analysis, ensuring you’re well-positioned for sustainable growth.

These advanced accounting services don’t just manage your finances – they strategically position your company for long-term success. The next section will explore the tangible benefits these services bring to your business operations and bottom line.

Professional accounting services offer far more than just number crunching. They provide a strategic advantage that can transform your business operations and financial health. Let’s explore the key benefits these services bring to the table.

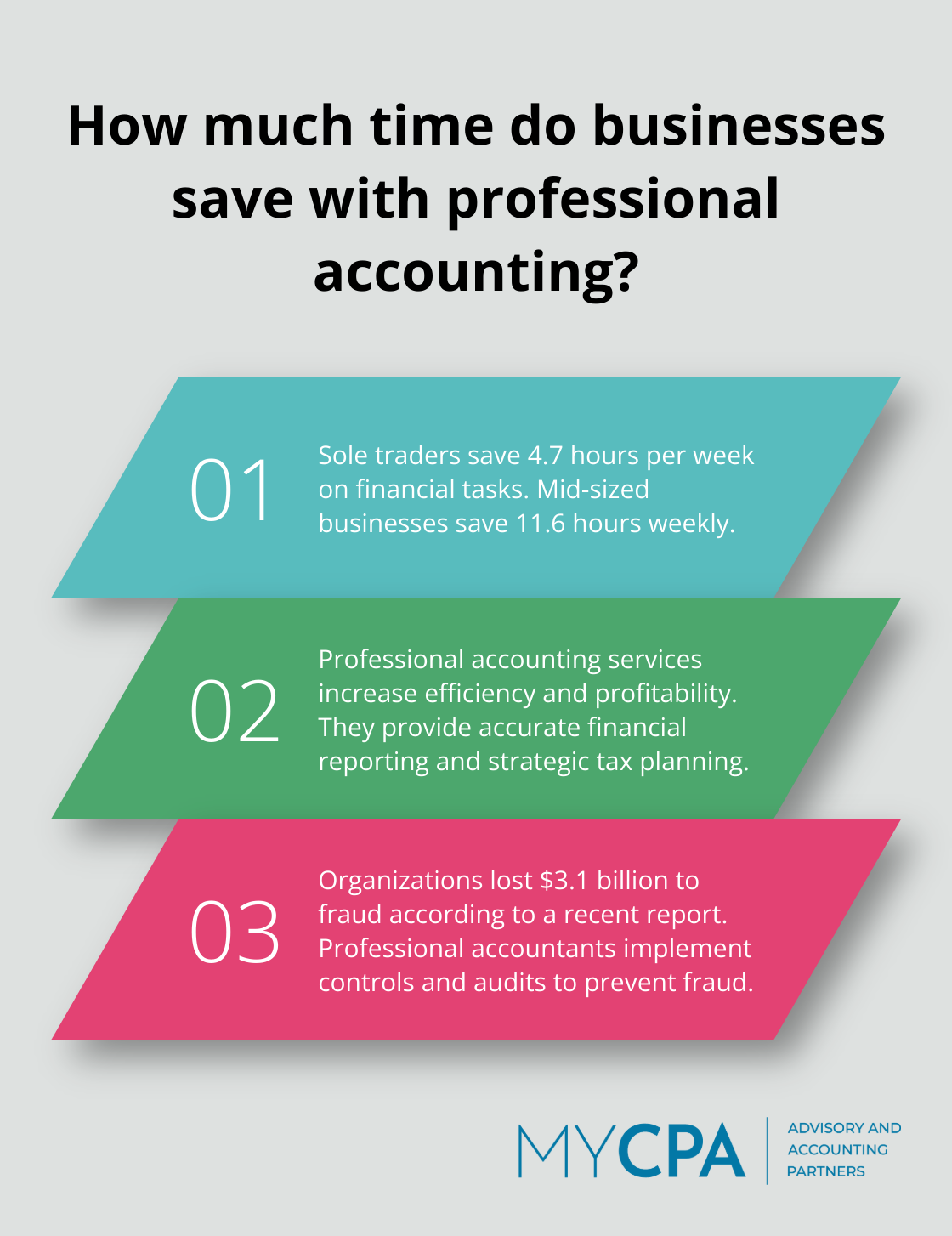

Professional accounting services dramatically increase efficiency. A study found that sole traders using these services save an average of 4.7 hours per week, while mid-sized businesses save 11.6 hours per week on financial tasks. This time savings translates directly to cost savings and allows business owners to focus on core operations and growth strategies.

Professional accountants also improve your bottom line. This boost in profitability stems from more accurate financial reporting, strategic tax planning, and expert financial advice tailored to your specific industry and business goals.

Staying compliant with ever-changing tax laws and regulations challenges any business owner. Professional accounting services provide peace of mind by ensuring your business remains in good standing with tax authorities. Outsourcing this task to experts not only saves time but also minimizes the risk of costly errors or penalties.

Fraud prevention is another critical benefit of professional accounting services. The Association of Certified Fraud Examiners reports that organizations lost $3.1 billion to fraud according to their latest report. Professional accountants implement robust internal controls and conduct regular audits to safeguard your assets and detect any irregularities before they become major issues.

The most valuable aspect of professional accounting services is the access to financial expertise and insights. This goes beyond basic bookkeeping to include strategic financial planning, cash flow optimization, and data-driven decision-making support. With professional accounting services, you gain a financial partner who can interpret complex financial data and provide actionable recommendations to drive your business forward.

Comprehensive accounting services provide the foundation for financial success in businesses of all sizes. These services offer more than just number-crunching; they deliver time and cost savings, improved decision-making capabilities, and access to valuable financial expertise. Professional accounting support transforms raw financial data into actionable insights, enabling businesses to navigate complex financial landscapes with confidence.

Every business faces unique financial challenges, which necessitates tailored accounting solutions. A generic approach fails to address the specific needs of modern businesses in today’s dynamic environment. My CPA Advisory and Accounting Partners understands the transformative power of comprehensive accounting services and offers personalized financial solutions to drive business growth.

Professional accounting services empower businesses to take control of their financial future. With the right accounting partner, companies can navigate financial complexities with ease, allowing them to focus on core business activities and expansion. Don’t let financial intricacies hinder your business growth; embrace the power of professional accounting services today.

Privacy Policy | Terms & Conditions | Powered by Cajabra